Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 12, 2020

Weekly Pricing Pulse: The coronavirus hammers commodities

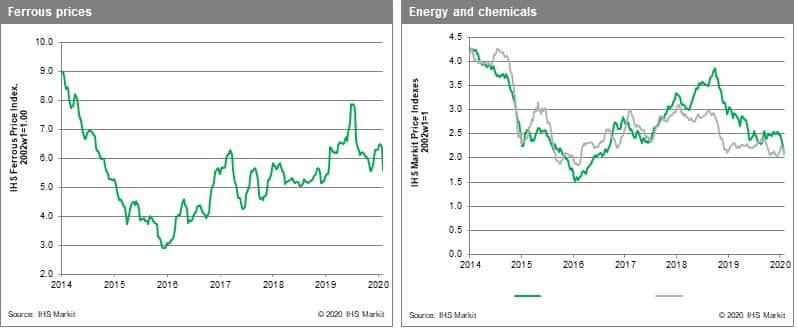

Our Materials Price Index (MPI) dropped a sharp 6.2% last week, declining broadly in a move that saw nine of the index's ten sub-components fall. Last week's decline was also noteworthy for its size in that it was the MPI's fifth largest in its 25-year history. The MPI has retreated roughly 10% in the past three weeks, as markets have become more bearish on the impact of the coronavirus on the Chinese economy.

Within the MPI, the ferrous index saw the largest decline, plunging 10.3% as iron ore prices fell to around $81 /Mt CFR China, down from over $94/Mt as recently as January 27. Steel mills in China are trimming production because of inventory builds tied to logistics bottlenecks. The MPI's energy index fell 6.9% due to a large 15.0% fall in gas prices and a 7.5% drop in oil prices. Chinese oil executives estimate a 25% drop in China's oil demand in February, with OPEC now mulling a March production cut to help stabilize the market. Two of China's largest energy groups have declared "force majeure" on 14 LNG import cargoes, with more such notices expected in the days ahead. Unsurprisingly, Asian gas prices fell 20.8% for the week. Force majeure declarations have also been issued by copper traders in China who are attempting to cancel or delay orders. Non-ferrous prices fell 1.4% last week on top of a much larger 5.6% drop in the previous week's trading. Chemicals prices fell 4.6%, again showing weakness in Asia, but broadly in line with falling oil prices. The lagged effect of weaker oil costs on chemical feedstocks means the market may see more, and possibly larger, declines in coming weeks. DRAM was the only component of the MPI to shake off demand fears, rising 2.3% on the prompt resumption of Chinese chip manufacturing, thus averting any major disruption to the supply chain.

The key question for commodity demand remains the same one posed last week - how long do Chinese factories remain idle? Estimates range widely, but for regions less effected by the coronavirus in the north and west, the outlook for something close to normal production resuming across February seems increasingly likely. Indeed, closer to the epicentre of the outbreak, the Shanghai government claims that up to 70% of manufacturing enterprises have resumed operations in the greater metropolitan area. Better news is that the number of newly confirmed cases outside Hubei province has declined for six consecutive days to 9 February, providing hope that the government's clampdown is containing the virus. If this indeed proves to be the case, markets will calm, with prices potentially recovering some of their recent loses even by the end of February.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-the-coronavirus-hammers-commodities.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-the-coronavirus-hammers-commodities.html&text=Weekly+Pricing+Pulse%3a+The+coronavirus+hammers+commodities+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-the-coronavirus-hammers-commodities.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: The coronavirus hammers commodities | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-the-coronavirus-hammers-commodities.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+The+coronavirus+hammers+commodities+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-the-coronavirus-hammers-commodities.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}