Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 07, 2019

Weekly Pricing Pulse: Trade actions offset any positives

Commodity markets were primed for a modest rally last week on the event of a US interest rate cut. Instead, commodity prices, as measured by our Materials Price Index (MPI), fell 1.5% as markets reacted negatively to the threat that the US would impose a 10% tariff on $300 billion of goods imported from China as of September 1.

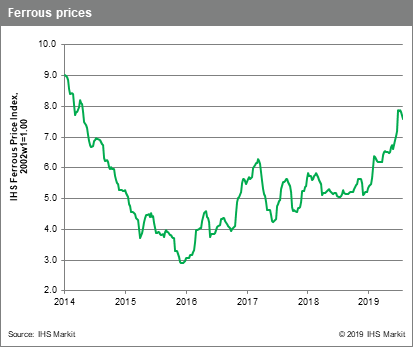

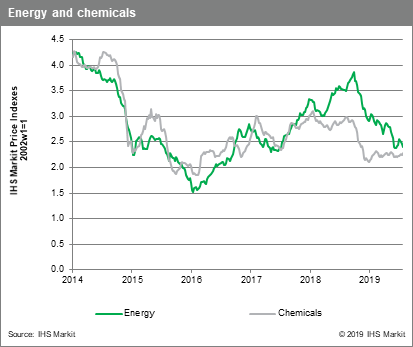

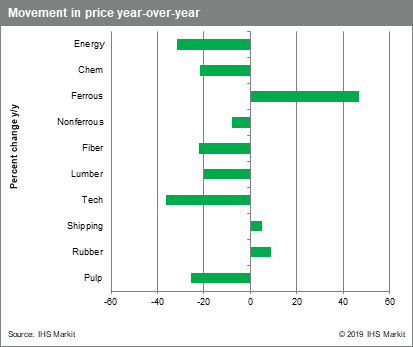

Trade issues were the driver of falling prices last week. Energy prices, down 17.5% in 2019 on coal and gas price weakness, fell 2.1% mainly due to a 9% fall in the Australian thermal coal price. Oil prices retreated on Friday on trade and demand concerns, dropping 7%, although prices for the week eased only fractionally. Ferrous prices fell 3.7% as iron ore prices suffered a long overdue correction. Ore prices will continue to fall as steel markets reset to better supply and prospects for softer demand. Non-ferrous metals, fiber, pulp and rubber prices all fell on trade concerns, dropping between 1.6-5.6%. Chemicals prices moved against the general trend in markets, rising 2.0%. The increase was driven mainly by the US ethylene market, which has shown severe volatility in recent weeks as it tries to move off multi-year lows. Freight rates rose strongly again, moving up 5.2%. However, trade worries and a cooling steel market in China will soon create softness in bulk freight demand.

The positive news from last week, such as the July PMI results, (which showed manufacturing stabilizing outside of Europe), the US interest rate cut, and a solid if unspectacular July US employment report, was undone by the President's tariff threat. Currencies immediately plunged vs. US dollar with bond rates and equity and commodity prices also sliding. China has since retaliated, allowing the Renminbi to fall below the long held RMB7/USD level and by once again halting purchases of US agricultural products. Elsewhere, a British by-election loss by the government, highlights the UK government's fragility going into Brexit negotiations. This combination of factors - unsettled currency markets, the prospect of a broad and prolonged US-China trade war and the looming Brexit deadline, promises volatility in commodity markets into the fourth quarter.

n.b. This week's commentary and data refer to the enhanced global MPI. For a summary of the specifications for the revised index please contact William May.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-trade-actions-offset-any-positives.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-trade-actions-offset-any-positives.html&text=Weekly+Pricing+Pulse%3a+Trade+actions+offset+any+positives+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-trade-actions-offset-any-positives.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Trade actions offset any positives | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-trade-actions-offset-any-positives.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Trade+actions+offset+any+positives+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-trade-actions-offset-any-positives.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}