Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 10, 2019

Weekly Pricing Pulse: Trade uncertainty piles on

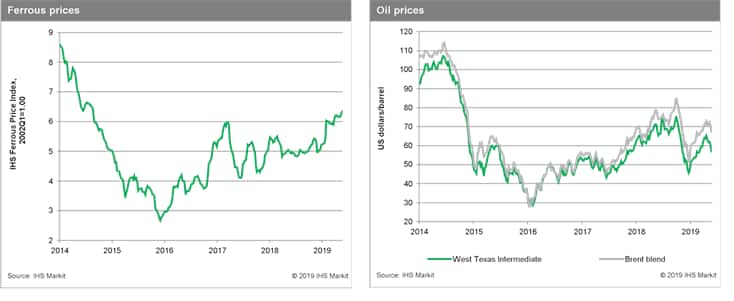

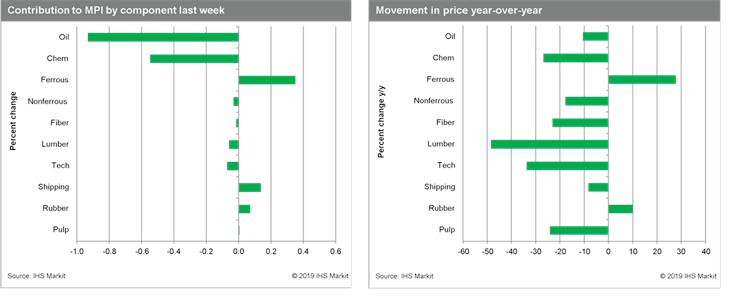

Another week of negative trade news weighed on commodity prices with weaker sentiment sending prices for oil, chemicals, and nonferrous metals lower. Our broader composite Material Price Index (MPI) fell 1.1%, its fourth decline in the past five weeks. The MPI has stayed roughly flat since mid-February.

Oil prices were the biggest mover in the MPI last week. Brent crude slid from $68/barrel on Monday to $62/barrel on Friday, May 31. Despite OPEC restraining production and reduced exports from Iran and Venezuela, the market remains well supplied with demand proving to be tepid. Trade policy continues to weigh on demand. Nonferrous metals prices fell 0.5%, the ninth decline in the last ten weeks, with copper, a bellwether for the base metals complex, falling to its lowest level since July 2017. Chemicals prices slid 2.9% on falling input costs and soft demand. Iron ore continues to push against the general trend in commodity markets, rising to almost $99/metric ton last week, its highest price since June 2014.

While the breakdown in US-China

negotiations has been roiling markets for the past month, it was

President Trump's threat to place new tariffs on Mexican imports

and Prime Minister May's resignation that were the catalysts for

last week's retreat in commodity, equity and bond markets.

President Trump's threat to invoke the International Emergency

Economic Powers Act to impose tariffs on Mexican imports was

particularly destabilizing because only hours before Mexican

President Obrador had announced that he would submit the new

US-Mexico-Canada trade agreement (the USMCA) to the Mexican Senate

for ratification.

While the breakdown in US-China

negotiations has been roiling markets for the past month, it was

President Trump's threat to place new tariffs on Mexican imports

and Prime Minister May's resignation that were the catalysts for

last week's retreat in commodity, equity and bond markets.

President Trump's threat to invoke the International Emergency

Economic Powers Act to impose tariffs on Mexican imports was

particularly destabilizing because only hours before Mexican

President Obrador had announced that he would submit the new

US-Mexico-Canada trade agreement (the USMCA) to the Mexican Senate

for ratification.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-trade-uncertainty-piles-on.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-trade-uncertainty-piles-on.html&text=Weekly+Pricing+Pulse%3a+Trade+uncertainty+piles+on+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-trade-uncertainty-piles-on.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Trade uncertainty piles on | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-trade-uncertainty-piles-on.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Trade+uncertainty+piles+on+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-trade-uncertainty-piles-on.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}