Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 29, 2018

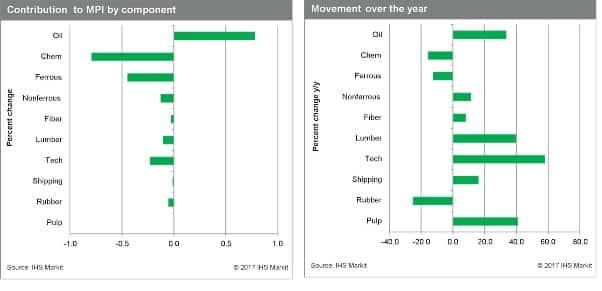

Weekly Pricing Pulse uncertainty depresses commodity prices

Commodities saw a turbulent week, with higher US interest rates andtrade actions by the Trump administration roiling markets, while fundamentals continue to point to softer prices. Our Materials Price Index (MPI) fell 1.0% last week, its seventh retreat in the last eight weeks. The decline was broad-based, with 8 of the MPI's 10 sub-indexes falling, while a 9th stayed flat. Chemicals showed the largest decline, dropping 3.6%, as ample supply continues to depress prices.

Ethylene prices fell strongly for the second straight week, falling 9.1%, as the market continues to deal with oversupply from new capacity. Their drop was the main driver behind the declining chemical price index. On the demand side of the market, underwhelming polyethylene production prevented a drawdown in high supply levels. Ethylene highlights that although volatility is creating weakness in the commodity complex, fundamentals are also part of the reason prices are retreating.

Last week's interest rate hike by the US Federal Reserve (Fed) was widely anticipated and, for the most part, already priced into equity, bond, and commodity markets. What caught markets off-guard was the release of the Fed's latest US forecast and the minutes from the latest Federal Open Market Committee (FOMC) meeting. Together they indicated that interest rates not only may be lifted more quickly, but also to a higher level than previously expected. On trade, the Trump administration's announcement of additional tariffs on Chinese imports under section 301 of the 1974 Trade Act heightened worries about possible reprisals and a full-blown trade war. The bottom line, however, is that actions by the Fed and the administration last week raised uncertainty about the near-term outlook and thereby contributed to volatility, with much of the optimism that markets opened the year with dissipating.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-uncertainty-depresses-commodity-prices.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-uncertainty-depresses-commodity-prices.html&text=Weekly+Pricing+Pulse+uncertainty+depresses+commodity+prices+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-uncertainty-depresses-commodity-prices.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse uncertainty depresses commodity prices | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-uncertainty-depresses-commodity-prices.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse+uncertainty+depresses+commodity+prices+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-uncertainty-depresses-commodity-prices.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}