Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 17, 2023

World trade vehicle outlook — trends and forecast

We have seen a period of intense changes in the automotive market in recent years. World production and exports have been growing dynamically — a situation that is combined with major changes in the export structure and the development of new technologies. The growing importance of sustainability has contributed to a surge in the production and export of electric and hybrid vehicles. This trend is forecast to further increase in upcoming years as new policies intended to phase out fossil fuel vehicles are being introduced worldwide, especially in major economies. At the same time, rapid development of emerging markets has opened automotive companies to new consumers.

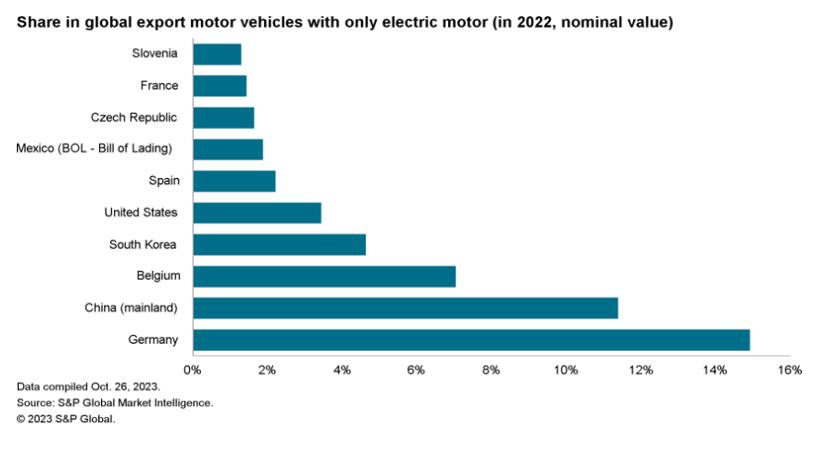

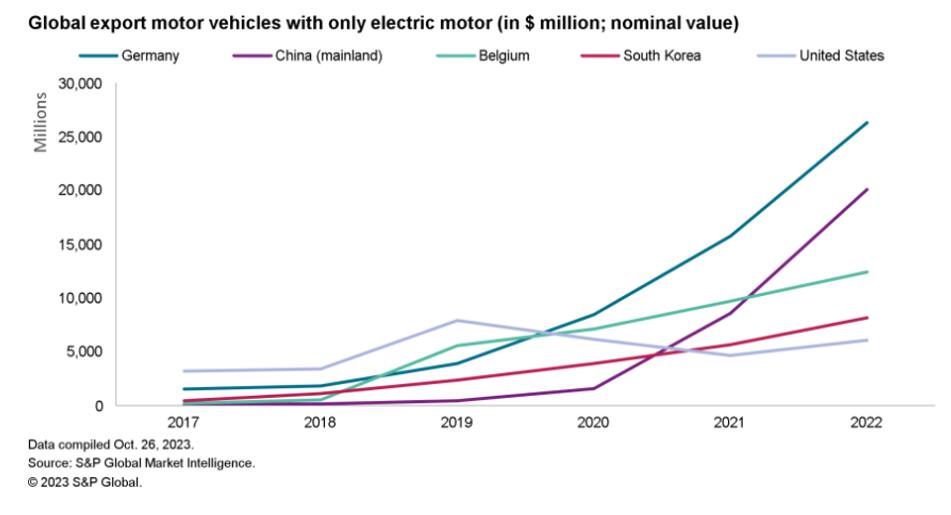

In 2022, the main exporters for electric cars are Germany, followed by mainland China, South Korea and the United States.

Based on our statistics (H6 code; 870380 Motor vehicles with only electric motor, Nesoi), Belgium is one of the main exporters and importers — it seems that this occurrence is influenced by the so-called 'Rotterdam-Antwerp Effect'*, which consists of assigning the export/import of goods to Belgium in trade statistics resulting in incorrect reporting of goods passing through the country's ports. Looking more specifically at the export of electric cars, the main importers from Germany are the United States, the United Kingdom, Norway, the Netherlands, Belgium*, mainland China and Sweden, which accounted for 62.22% of Germany's total electric car exports in 2022.

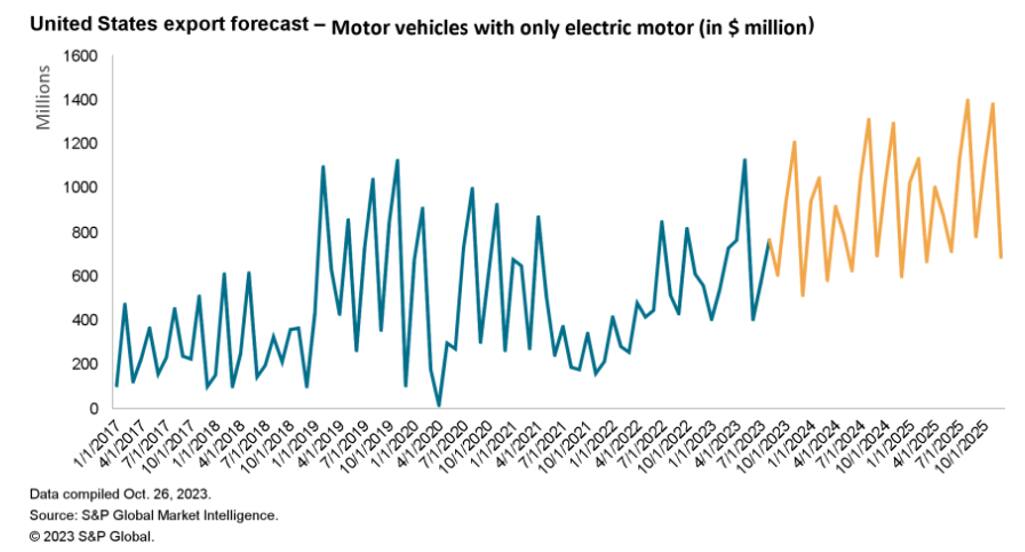

We built a forecast using the SARIMAX model to better illustrate the development of electric car exports. The model was developed based on monthly data available from the Global Trade Atlas (GTA) database (electric cars - H6 code: 870380 Motor vehicles with only electric motor). The main exporters from three continents were selected for the forecast, i.e. mainland China, Germany and the United States.

The United States may have the highest growth dynamics, but the forecast does not fully reflect this. Looking at the expansion into European markets, growing sales of Tesla, one can expect that the United States will increase its exports to other countries. In terms of market value, when it comes to exports of electric cars, Ford Motor Company has been leading in recent months followed by Porsche Automobil Holding SE, General Motors Company, Nissan Motor Co., Ltd. and Bayerische Motoren Werke Aktiengesellschaft. With reference to the European Alternative Fuels Observatory (European Commission), in the first four months of 2023, most electric cars are registered under the Tesla brand. However, looking at the share of producer groups, Volkswagen takes first place, followed by Stellantis, Tesla and BMW, respectively.

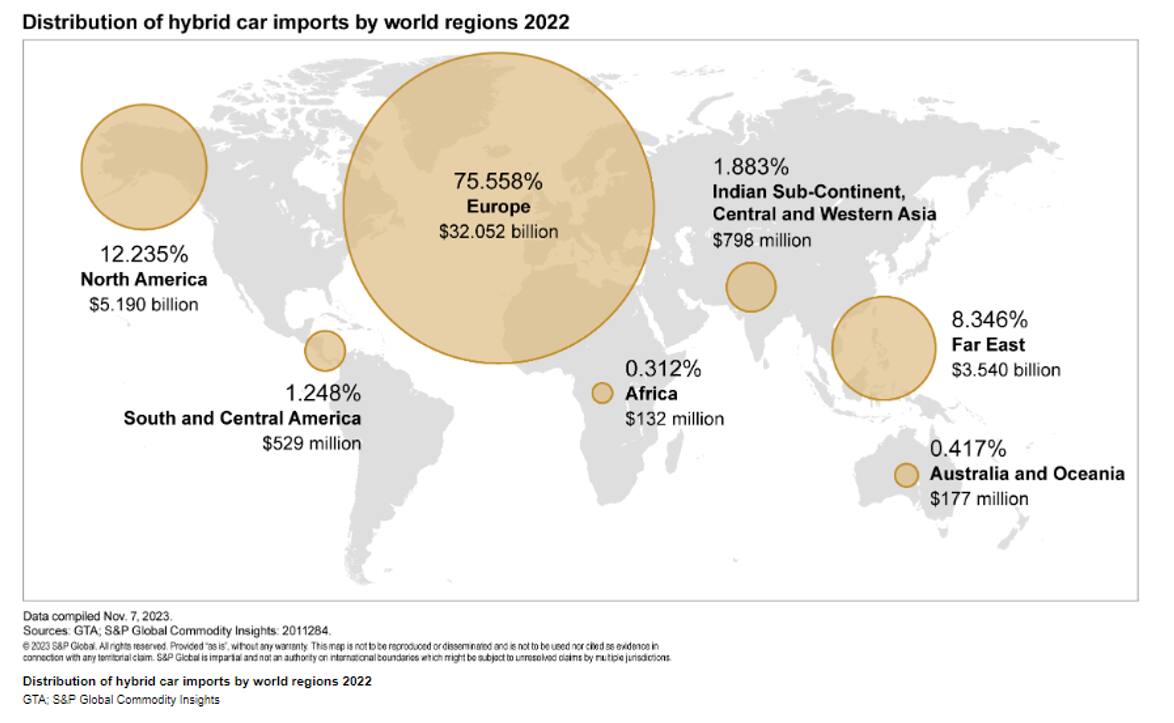

Exports of hybrid vehicles was also marked by constant growth. Between 2017 and 2022, international foreign sales increased from $30 billion to above $93 billion. In 2022, Germany held its position as the primary hybrid vehicles exporter with over a 28% share in global hybrid vehicles export despite the drop of hybrid vehicles production between 2021 and 2022. The other major exporters of hybrid vehicles in 2022 were the United States, followed by Japan and Spain, with the latter two overtaking Sweden, which ranked third among the top exporters in previous years. If we break down German exports into individual countries, we will see that the largest importers of German hybrids in 2022 were France, mainland China, Belgium, the Netherlands and the United Kingdom. For US exports, those countries would be Germany, Belgium, mainland China, Canada and South Korea. At the same time, Japanese exports were mostly directed to the United States, Germany, Canada, the United Kingdom and Norway.

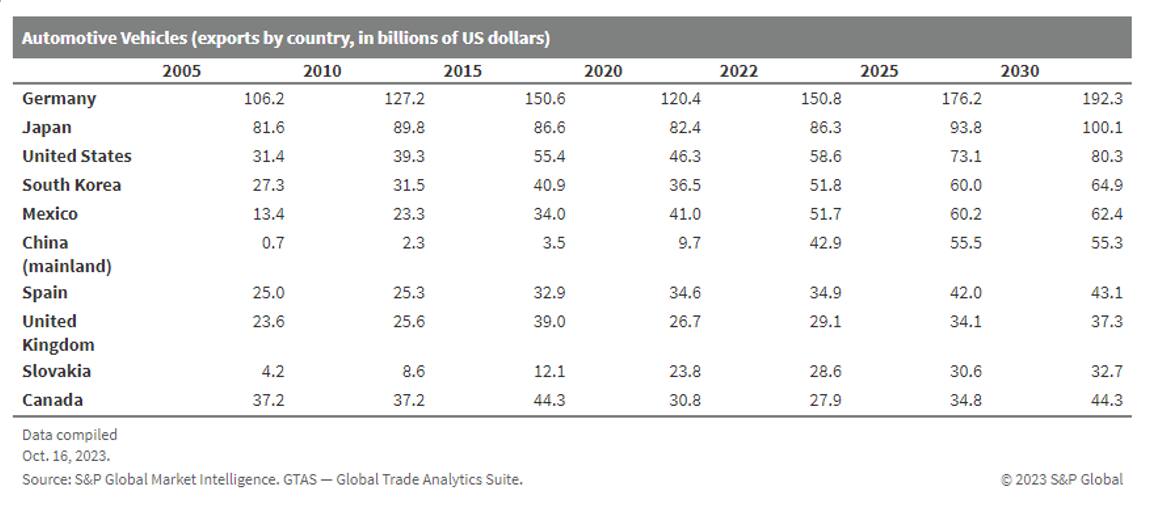

According to the Market Intelligence GTAS Forecasting, if we analyze forecasts for the whole automotive category — motor cars and other motor vehicles designed to transport people — we can see further increases in exports for almost all the major exporters (the exception here is Great Britain, which is expected to see a decline in exports by 2030, and Canada, whose exports will remain nominally almost unchanged). At the same time, no major changes in the structure of global motor vehicles trade will be noted until end of 2020s — with Germany as the biggest exporter controlling 20% of global automotive exports, Japan gradually declining from 11% to 10% and the United States with control over 8% of exports. For import trends, there is no significant change in directions — in 2035, the United States, Germany and the United Kingdom will still be the three biggest car importers, similar to the current situation with the United States responsible for over one-fifth of all car imports in the world.

We expect to observe a further increase in the export of electric and hybrid cars, which will combine the diversification of sales markets and development of new technologies.

This column is based on data from S&P Global Market Intelligence Global Trade Atlas Suite (GTAS) & GTAS Forecasting.

For more details about Global Trade Atlas Suite (GTAS) please visit the product page

For more details about Global Trade Atlas Suite Forecasting please visit the product page

https://www.spglobal.com/marketintelligence/en/mi/products/gtas-forecasting.html

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fwill-people-switch-back-to-horsedrawn-vehicles.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fwill-people-switch-back-to-horsedrawn-vehicles.html&text=World+trade+vehicle+outlook+%e2%80%94+trends+and+forecast++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fwill-people-switch-back-to-horsedrawn-vehicles.html","enabled":true},{"name":"email","url":"?subject=World trade vehicle outlook — trends and forecast | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fwill-people-switch-back-to-horsedrawn-vehicles.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=World+trade+vehicle+outlook+%e2%80%94+trends+and+forecast++%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fwill-people-switch-back-to-horsedrawn-vehicles.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}