Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 02, 2023

Worldwide factory prices on the rise again in September

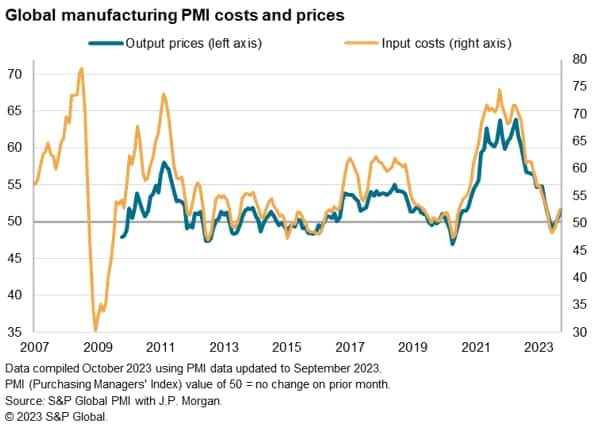

Global manufacturing prices are on the rise again, according to the latest JPMorgan Global Manufacturing Purchasing Managers' Index™ (PMI™) compiled by S&P Global, up for a second month in a row in September. Although the rate of inflation remains subdued by standards seen over the pandemic, the return of growth to industrial prices represents a reversal of one of the major disinflationary forces seen over the past year.

Global factory prices rise as fastest rate in five months

Manufacturers worldwide charged more for their goods on average in September, reporting a second month of rising prices after three months of decline. The uplift in prices, as indicated by the latest PMI surveys compiled by S&P Global and sponsored by JP Morgan, was the largest for five months and driven by a second month of increasing growth in factory costs. Input costs showed the largest rise for six months.

The data therefore suggest that the strong deflationary impact of cooling industrial price growth seen over much of the past year has started to reverse, albeit with the recent degree of price growth running well below the peaks seen during the pandemic.

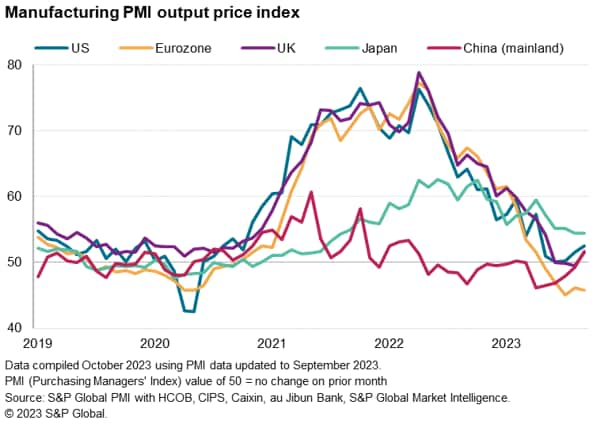

Higher rates of selling price inflation for goods were notably evident in the US, UK and mainland China. While rates of inflation hit five-and four-month highs in the US and UK respectively, the rate of increase in mainland China was the highest for one and a half years. Although by comparison Japan continued to report a relatively stronger rate of price inflation, the pace held steady on August's two-year low. Charges meanwhile continued to fall at a steep rate in the eurozone.

Not just oil

Some of the upward pressure on prices emanated from oil. The price of West Texas Intermediate has risen from around $70 per barrel in July to over $90, a rise of around 30%. Brent Crude has shown a rise of similar magnitude.

However, there are other factors also at play.

First, producers continue to report upward wage pressures, as workers seek to restore real pay growth in the face of high inflation.

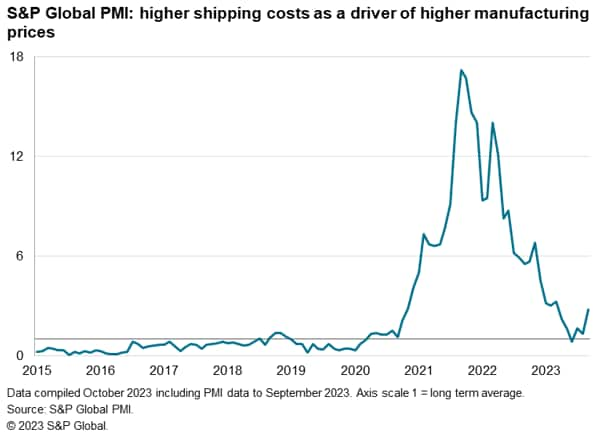

Second, reports of higher shipping rates are on the rise again, reflecting a likely bottoming out of the logistics market. Although far below the levels seen during the pandemic, reports of upward price pressure from the cost of shipping raw materials and finished goods are now back to their highest since March, having hit a post-pandemic low in June.

Supply chain deflation moderates

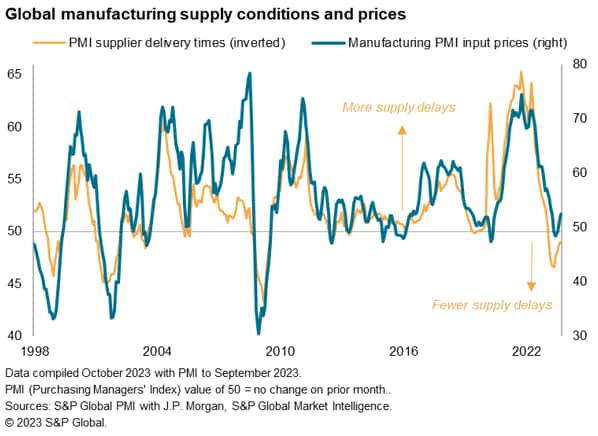

Third, the deflationary impact of the improvement in supply chain conditions has started to reverse.

Prices for many goods had risen sharply during the pandemic as demand outstripped supply, the latter widely constrained by lockdowns, illnesses and unprecedented component shortages. However, although worldwide supplier delivery times continued to improve at a rate not seen since the global financial crisis, the latest data point to the improvement in September being the least marked since February. These supply chain developments suggest that supplier pricing power is beginning to find some support, helping suppliers extract higher prices from manufacturers.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-factory-prices-on-the-rise-again-in-september2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-factory-prices-on-the-rise-again-in-september2023.html&text=Worldwide+factory+prices+on+the+rise+again+in+September+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-factory-prices-on-the-rise-again-in-september2023.html","enabled":true},{"name":"email","url":"?subject=Worldwide factory prices on the rise again in September | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-factory-prices-on-the-rise-again-in-september2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Worldwide+factory+prices+on+the+rise+again+in+September+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-factory-prices-on-the-rise-again-in-september2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}