Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 05, 2020

Worldwide trade shows record collapse in April amid virus lockdowns

- The global manufacturing PMI's export orders index can be used to accurately model worldwide trade flows, and indicated trade slumping at a quarterly rate approaching 15% in April

- A broad-based decline in exports was seen with all countries surveyed reporting lower export volumes

- A renewed slide in demand for exports from China highlights the risk of a second dip in global manufacturing after production lines are restarted

Global manufacturing export orders collapsed at an unprecedented rate in April, according to the latest Purchasing Managers Index data from IHS Markit, as worldwide demand slumped amid the coronavirus disease 2019 (COVID-19) pandemic.

All countries surveyed reported falling export volumes. China, which has reopened production lines ahead of other countries, nevertheless saw output constrained by a renewed slide in export orders, which highlights the risk of persistent weak global demand limiting global manufacturing recoveries even after lockdowns are eased.

Record fall in global trade

The JPMorgan Global Manufacturing PMITM, compiled by IHS Markit from its business surveys in over 30 countries, saw new export orders decline in April to an extent not previously recorded since survey data were first available over 20 years ago.

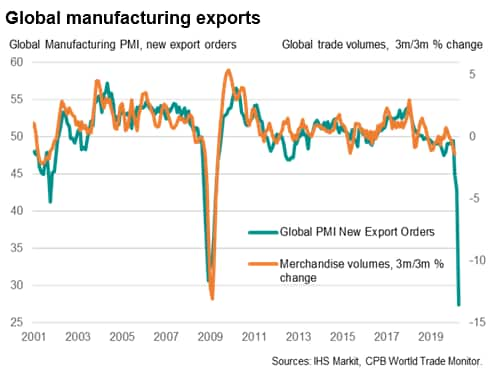

The global PMI's export index is a GDP-weighted measure which has a powerful track record of accurately anticipating changes in world trade flows. The index fell, for example, well before other trade gauges at the start of the global financial crisis (GFC) and was early in indicating a subsequent revival in trade from the GFC.

More recently, the index showed a surge in trade up to early 2018 as global economic growth accelerated, after which the escalating US-China trade war can be seen to have dampened global exports to the extent that exports began falling in September 2018. Note that any index reading below 50 indicates a month-on-month fall in trade volumes. Exports have since remained in decline, but the rate of reduction has accelerated markedly in recent months, the index sliding to a new all-time low of just 27.3 in April, down from 49.5 in January. By comparison, the lowest reading seen during the GFC was 30.6.

PMI-based trade model

To help put the PMI index numbers into context, we compare the survey gauge against the CPB Netherlands Bureau for Economic Policy Analysis World Trade Monitor, which aggregates the latest official trade statistics to provide what is considered a reliable and timely guide to global trade flows.

Month-to-month volatility in the official trade data means the best comparison with the PMI is made looking at the CPB data for the latest three-month period compared to the prior three-month period which, as our chart shows, presents an historical data series which correlates well with the PMI.

The PMI in fact shows its highest correlation (86%) when acting with a lead of one month against this CPB gauge. As the PMI data are also available over two months before the publication of each month's CPB data, the PMI therefore provides highly accurate indications of changing trade at least three months before the official data.

In terms of gauging the initial impact of the coronavirus pandemic, the comparisons suggest that the latest PMI data are indicative of global trade falling at a quarterly rate of just over 13%, or around 50% on an annualised basis.

This estimate is derived from a regression model yielding an adjusted r-square of 0.75 and SE of 1.0 using the global PMI's export index as the sole explanatory variable. (We use the natural log of the PMI index to allow for potential 'non-linearity during times of extreme growth or decline).

Universal downturn

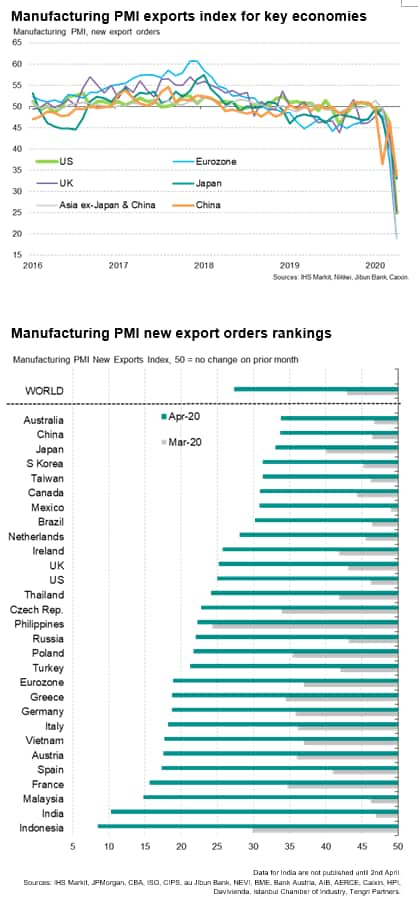

The latest manufacturing PMI survey data were collected between 7th and 24th April, a time when China continued to ease some of the restrictions on social mobility and company closures after lockdowns had been widely imposed in February. However, many other countries saw lockdowns implemented in March persist into April, with very few countries easing any restrictions.

For a second successive month, all countries surveyed reported falling exports, a universal collapse that had not been recorded by the surveys prior to March. Moreover, all saw rates of decline accelerate in April, highlighting the broad-based intensification of the collapse in global trade.

The steepest declines were seen in Indonesia and India, the former even seeing its export orders index slip into single digits.

The mildest export downturn was seen in Australia, in part reflecting some easing in the export decline to China. China was alone in the world in reporting any growth of manufacturing output in April, albeit with production levels still vastly diminished compared to before the virus lockdown.

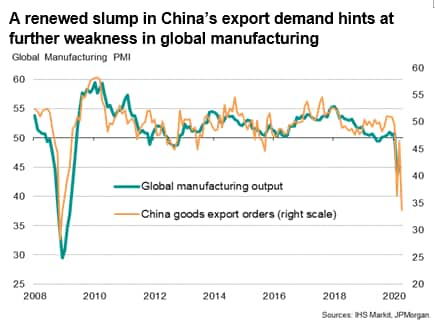

Steeper drop in China's exports bodes ill for global recoveries

China was notable in that, despite seeing only the second-smallest drop in exports of all economies surveyed, the rate of contraction accelerated after a short-lived easing in March. The latest decline was the steepest since the global financial crisis.

This renewed steepening in the rate of loss of China's exports highlights the extent to which global demand for goods has slumped since the onset of the coronavirus outbreak, and is a timely reminder that, while global manufacturing may see an initial rebound after lockdowns are eased and production lines are restarted, albeit even gradually, a lack of demand will limit these recoveries and could well cause a second-dip in production.

For more information contact economics@ihsmarkit.com.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-trade-shows-record-collapse-in-april-amid-virus-lockdowns-May2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-trade-shows-record-collapse-in-april-amid-virus-lockdowns-May2020.html&text=Worldwide+trade+shows+record+collapse+in+April+amid+virus+lockdowns+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-trade-shows-record-collapse-in-april-amid-virus-lockdowns-May2020.html","enabled":true},{"name":"email","url":"?subject=Worldwide trade shows record collapse in April amid virus lockdowns | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-trade-shows-record-collapse-in-april-amid-virus-lockdowns-May2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Worldwide+trade+shows+record+collapse+in+April+amid+virus+lockdowns+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-trade-shows-record-collapse-in-april-amid-virus-lockdowns-May2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}