Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 08, 2017

Yemen: Risks to aviation and marine assets

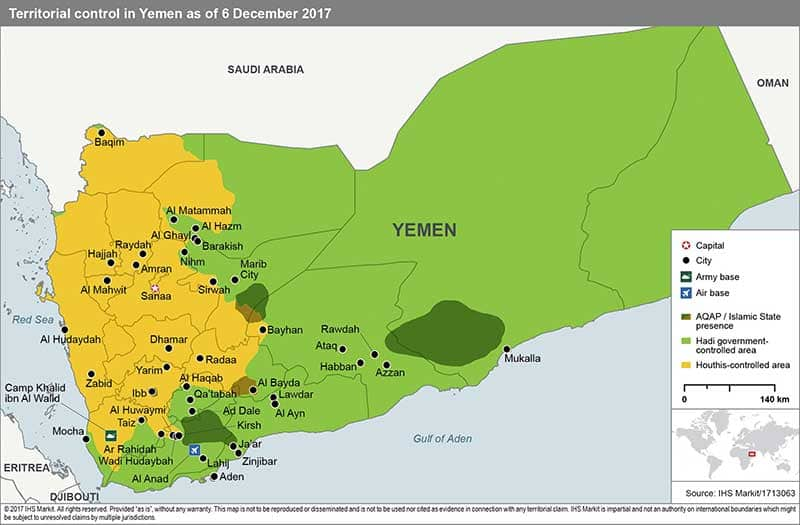

On 7 December, forces nominally supporting the internationally recognised government of President Abdu Rabu Mansour Hadi resumed a stalled offensive to recapture the port city of Hodeidah, on the Yemeni Red Sea coastline.

The coalition-backed offensive along Yemen's Red Sea coastline, Operation Golden Spear, was formally launched on 6 January 2017. Despite sustained coalition airstrikes and fire support from warships offshore, lack of cohesive coalition-backed forces on the ground capable of fire and manoeuvre with close air support, together with the Houthis' heavy use of landmines, ambushes, and coercion of the local population have prevented pro-government forces from making significant headway. The front lines stabilised in May 2017 around Hasy Salim, approximately 120 km south of Hodeidah and 30 km north of Mocha, which itself was captured by coalition forces in February 2017.

The collapse of the Houthi-Saleh alliance in Sanaa, and subsequent killing of the former Yemeni president by Houthi militants on 4 December, has provided the coalition with a new momentum to unite previously fragmented forces with independent commands, with the aim of isolating and besieging the capital. Yemeni vice-president Ali Mohsen al Ahmar has started to mobilise Sunni tribal militias north of Sanaa in preparation for an offensive on the capital from the northeast district of Nihm. On 5 December, Yemeni media reported that his troops had cut the main road connecting Hodeidah to west Sanaa. On 7 December, President Hadi formally announced the resumption of the military operations to capture Hodeidah, under Houthi control since the civil war began in March 2015, and home to Yemen's most active port facilities. Hodeidah port is also the entry point for more than 70% of the country's current food, fuel, and humanitarian aid imports. The Hodeidah offensive is spearheaded by militants from the UAE-backed Southern Resistance Front and joined by pro-government Popular Committees of the Tihama Resistance. These forces have already taken control of al-Khowkha town and Abu Musa al-Shari military camp, marking the first entry of coalition-backed forces into Hodeidah province. On 8 December, the new front line was established on the edges of al-Tuhayat, approximately 70 km south of Hodeidah. Although unconfirmed social media reports claimed that two brigades of pro-Saleh Republican Guards that had defected from the Houthi bloc in Taiz had joined the offensive, IHS Markit has been unable to verify this claim. If true, this would be a positive indicator of weakening Houthi position in Taiz province, and would likely support coalition efforts to expel the Houthi from southwest Yemen.

The situation in Sanaa

Since Saleh's execution, the Houthis have prioritised consolidating their position in Sanaa, arresting and executing tribal sheikhs and General People Congress (GPC) officials loyal to Saleh and dismantling the former president's network. This is likely to harden the position of Saleh's supporters in the capital, and risks intensifying the ongoing fighting between the two sides inside the capital.

The Houthis have also opted for unilateral leadership of the capital, and are likely to aggressively respond to any display of resistance. For example, Houthi militants immediately resorted to using live fire against a demonstration by women calling for the right to bury the former president's body. The Houthi also arrested 80 pro-GPC journalists, blocked access to social networking websites, and reportedly started to interrogate civilians suspected of harbouring pro-Saleh dissidents.

Following Saleh's execution and the Houthi's takeover of the insurgency in north Yemen resisting President Hadi's government and coalition backed forces, the Houthi's militant wing within the movement is likely to become dominant, and seek closer support from Iran and its proxies.

Outlook and implications

The offensive along the Red Sea coastline, coupled with the arrival of Saudi-led coalition military vehicles and supplies from al-Ghayda, Mahra province, indicates that the coalition's priority is to stop weapons smuggling to Houthi insurgents through the Red Sea and Mahra province coastal regions. Specifically advancing on Hodeidah and efforts to besiege Sanaa are intended to isolate the Houthi economically and militarily, build momentum against the Houthi and force them to retreat to their northern mountainous safe havens.

The outcome will largely depend on the tribes south of Sanaa, and military units formerly loyal to Saleh, including the Republican Guard and the Special Forces. In all cases, a speedy advance on the capital by coalition-backed forces is unlikely. Integrating coalition special forces with advancing Yemeni forces and provision of close air support north of Sanaa would be a strong indicator of an imminent operation to capture the city. With respect to Hodeidah, coalition backed forces are unlikely to make a decisive breakthrough without similar deployment and integration of coalition Special Forces with advancing local forces, or major sea-landings in the vicinity of Hodeidah port. An offensive on Hodeidah would probably cause very substantial population displacement and civilian casualties, severe and widespread damage to property and infrastructure, and exacerbate the already severe risk of famine across north Yemen. More likely, the coalition will adopt a slower approach, and continue to restrict commercial and humanitarian traffic at Hodeidah port while pro-government forces attempt to consolidate control in the southwest and advance along the coast line.

Ludovico Carlino, Senior Analyst Country Risk - Middle East and North Africa at IHS Markit

Posted 8 December 2017

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fyemen-risks-to-aviation-and-marine-assets.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fyemen-risks-to-aviation-and-marine-assets.html&text=Yemen%3a+Risks+to+aviation+and+marine+assets","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fyemen-risks-to-aviation-and-marine-assets.html","enabled":true},{"name":"email","url":"?subject=Yemen: Risks to aviation and marine assets&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fyemen-risks-to-aviation-and-marine-assets.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Yemen%3a+Risks+to+aviation+and+marine+assets http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fyemen-risks-to-aviation-and-marine-assets.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}