Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 27, 2023

Neptune and Triton: Potential for subsea oil production on the Russian shelf

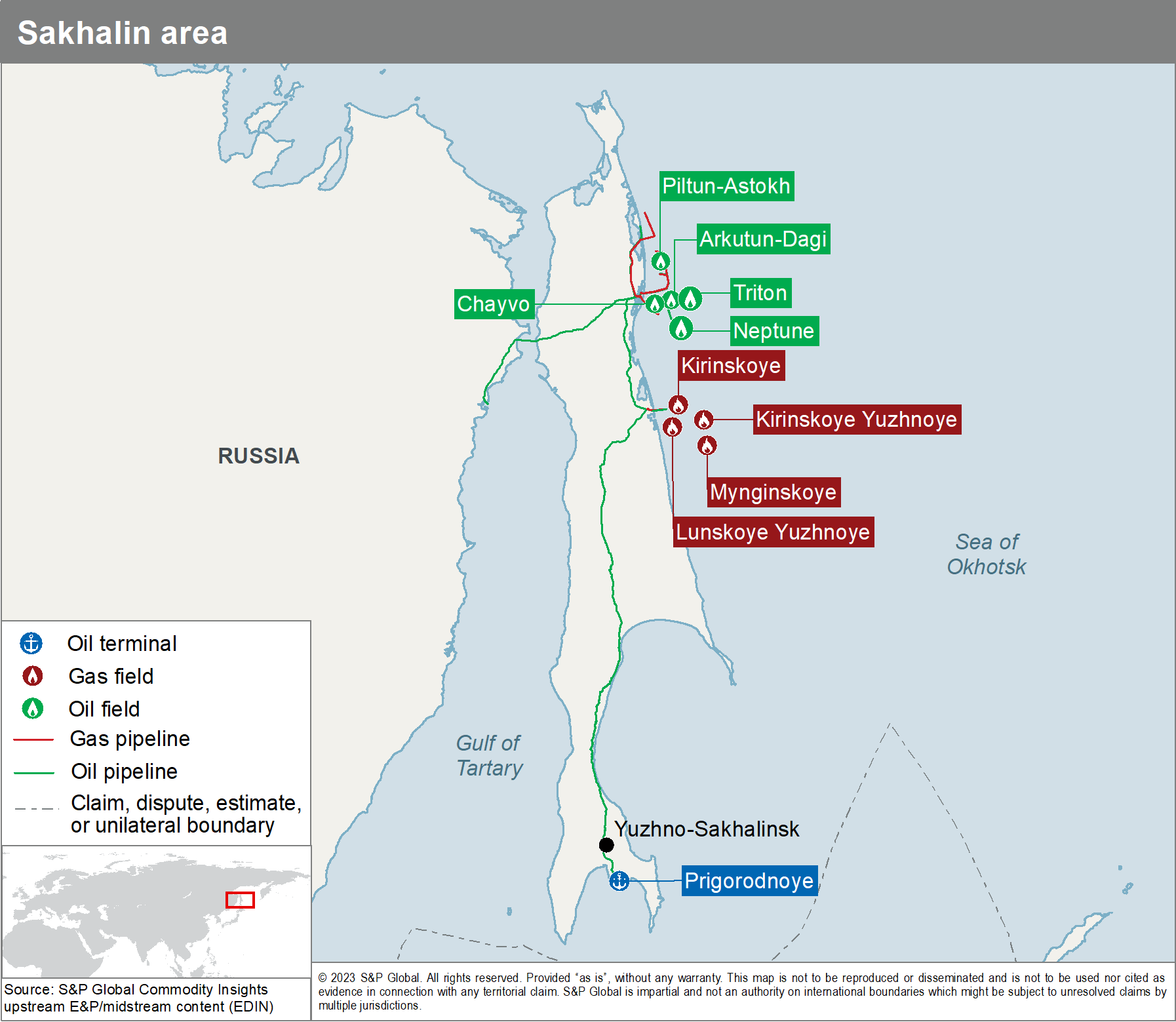

The Ayashsky licensed area in the Sea of Okhotsk is located in the offshore Sakhalin Island. It is located approximately 55 km east of the Sakhalin coastline and contains the Neptune and Triton discoveries in a water depth of around 60-80 m (Figure 1). The total in-place resources of the two fields exceeded 3,665 million barrels of oil. This may eventually play a significant part in raising Russian oil production. Gazprom Neft said that commercial oil production at Neptune and Triton could begin in the 2030 to 2033 timeframe, however, there remains uncertainty in what technology and methods will be used to bring the fields into commercial production.

Figure 1: Location of the Neptune and Triton Fields off the coast of Sakhalin Island with the Sakhalin II infrastructure and Prigorodnoye oil terminal.

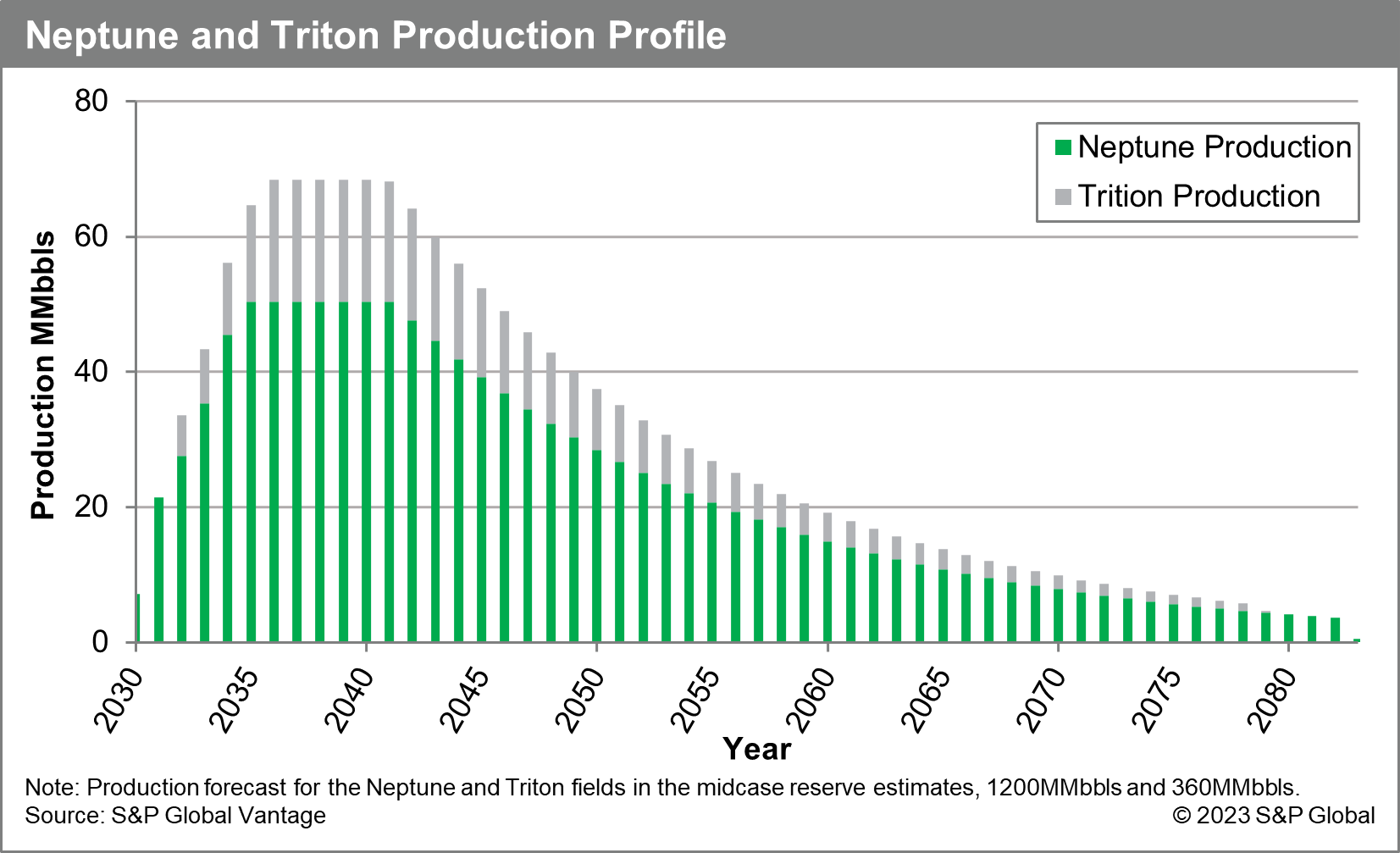

Neptune was the most important discovery of Gazprom Neft in 2017. The company estimated 3P resources of the Neptune discovery at 3,000 MMbbl in place and 1,200 MMbbl of recoverable. Oil production is expected to start in 2030 and could peak in 2035 at around 50 MMbbls/y with Triton coming online around 2033 to boost output to near 70 MMbbls/y from the two projects (Figure 2). To assess the commercial viability of the Neptune field, several scenarios have been run to allow a detailed analysis of the project's economics. Resources used vary from 750 MMbbls to 1,500 MMbbls of recoverable oil across two different development concepts. 3 separate oil price scenarios are used at $53/bbl, $81/bbl and $110/bbl. These are prices from the start of the project in 2030 that are inflated at 2% year on year.

Figure 2: Neptune and Triton production profile in the midcase resource estimates.

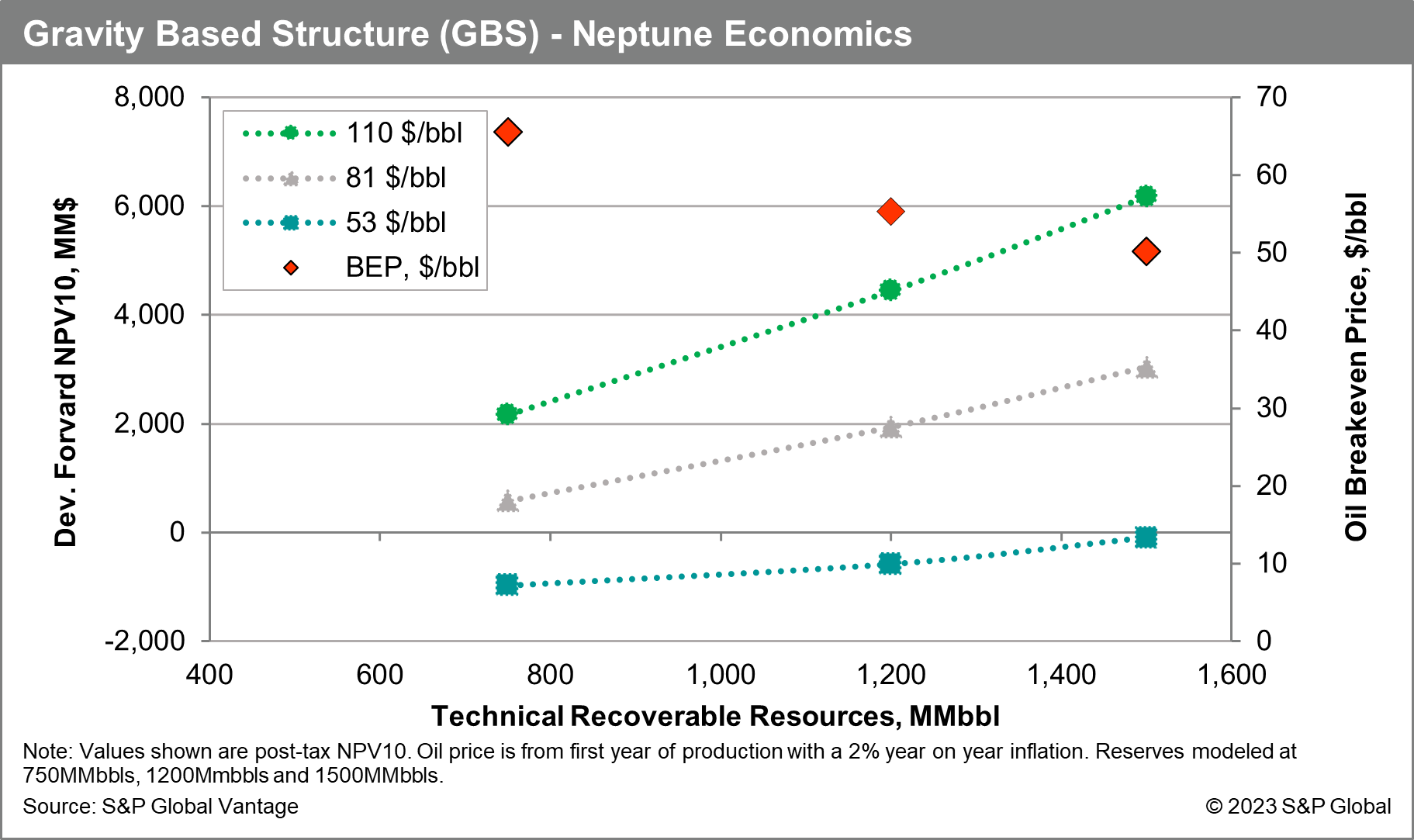

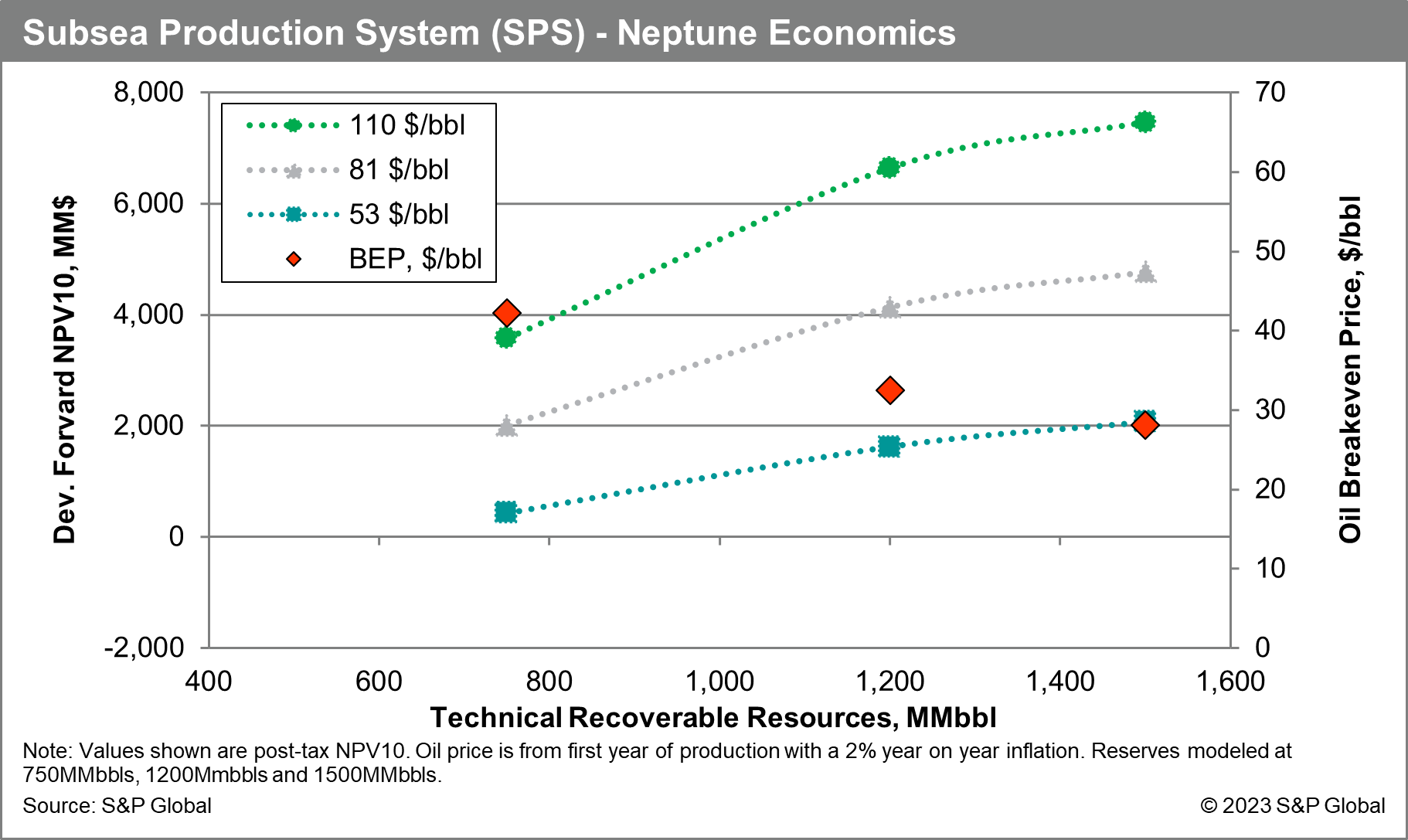

The first development scenario at the Neptune field is the use of a gravity-based platform with storage. From the gravity-based structure (GBS), offshore loading to tankers is assumed as the preferred method of export. A development concept similar to what is in use at the Prirazlomnoye field, Gazprom Neft's largest operated offshore producing oil field. Secondly, the possibility of using an underwater production complex instead of a gravity platform for the first time in Russia is also being considered by Gazprom Neft. This technology can significantly reduce costs for field development as it allows hydrocarbon extraction in the most difficult climate conditions, even under ice, without the construction of platforms and other surface structure. When operating an SPS (subsea production system), there are no emissions into the atmosphere or noise exposure. Moreover, it ensures less dependence on existing infrastructure and will allow for boosting production for the first 5-7 years. The subsea production system has already been successfully used for gas production at the Kirinskoye field. For the onshore processing facilities construction, Russian technologies were mainly used. Russian companies have designed and manufactured complex technological equipment to ensure the uninterrupted operation of the SPS. Considering the sanctions imposed on Russia, this is especially important for Gazprom Neft, which can benefit from the technology and local supply chain while implementing the Neptune and Triton projects.

Figure 3 displays the economics using the GBS concept. A conservative long term price expectation of $53/bbl at the three different reserve values yields negative post-tax NPV10 for all scenarios with a breakeven around the $65/bbl pricemark. The $81/bbl price gives a more favourable economic outlook for the project, with positive NPV10 in all the resource scenarios, however economics internal rate of return (IRR) is low in the low and mid reserve estimates. At $110/bbl, the project has favourable economics however, the reality of this commodity price is high and unlikely to be sustained for extended periods of time. The three resource scenarios provide break even prices of $65/bbl in the low resource case and $55 in the mid case and $50 in the high case, all notably higher than the Russian average, but considerably lower than development of the Prirazlomnoye field in the Pechora Sea.

Figure 3: Economics representing the development of the Neptune oil field via a Gravity based structure in 3 difference resources and price scenarios.

Figure 4 displays the economics using the Subsea Development System (SDS) in the different resource and price scenarios. The low case $53/bbl instantly yields positive returns even with the lower-end resource estimations from the Neptune field. The mid-case of $81/bbl is significantly more viable with the midcase providing strong positive economics with good IRR values. The breakeven prices for the project are significantly lower that what is seen from the GBS models, with breakeven prices for the Subsea development varying from $30 - $40 per barrel of oil, much closer aligned to projects across Russia, and providing an attractive investment opportunity for Gazprom Neft.

Figure 4: Economics representing the development of the Neptune oil field via a Gravity based structure in 3 difference resource and price scenarios.

It will be more challenging to find commercially viable stand-alone field development concepts for these two oil fields than in the past for the existing Sakhalin-1 and -2 projects. But the Neptune project can be economically feasible in case of implementing a subsea production system and if Gazprom Neft collaborates with other Sakhalin projects to utilise their existing infrastructure. The deployment of a subsea oil production system in Russia is yet to be trailed. Sanctions against Russia and access to western technology could prove significant while developing such technology for this project. However, partnership with companies, especially from China, could provide access to the technology required to develop the Neptune oil field, while also reducing Gazprom Neft's exposure to the project moving forward.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fNeptune-and-Triton-subsea-oil-production.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fNeptune-and-Triton-subsea-oil-production.html&text=Neptune+and+Triton%3a+Potential+for+subsea+oil+production+on+the+Russian+shelf+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fNeptune-and-Triton-subsea-oil-production.html","enabled":true},{"name":"email","url":"?subject=Neptune and Triton: Potential for subsea oil production on the Russian shelf | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fNeptune-and-Triton-subsea-oil-production.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Neptune+and+Triton%3a+Potential+for+subsea+oil+production+on+the+Russian+shelf+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fNeptune-and-Triton-subsea-oil-production.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}