UK Production – Where does it go from here?

Introduction

There are many factors which could determine how the future of hydrocarbon production in the UK will unfold. It is likely that the UK's hydrocarbon production will not continue beyond 2050, likely due to natural decline in output and net zero emission targets set for 2050. If this target is to be achieved, hydrocarbon production will need to be heavily reduced and offset. However, in the short to medium term, the UK's large energy consumption and recently heightened energy security risks necessitate that E&P activities must continue for at least the next 30 years. Though the amount of production and consumption during this time will decay, the future rate of decline can still be influenced.

Production Forecast by Maturity Status

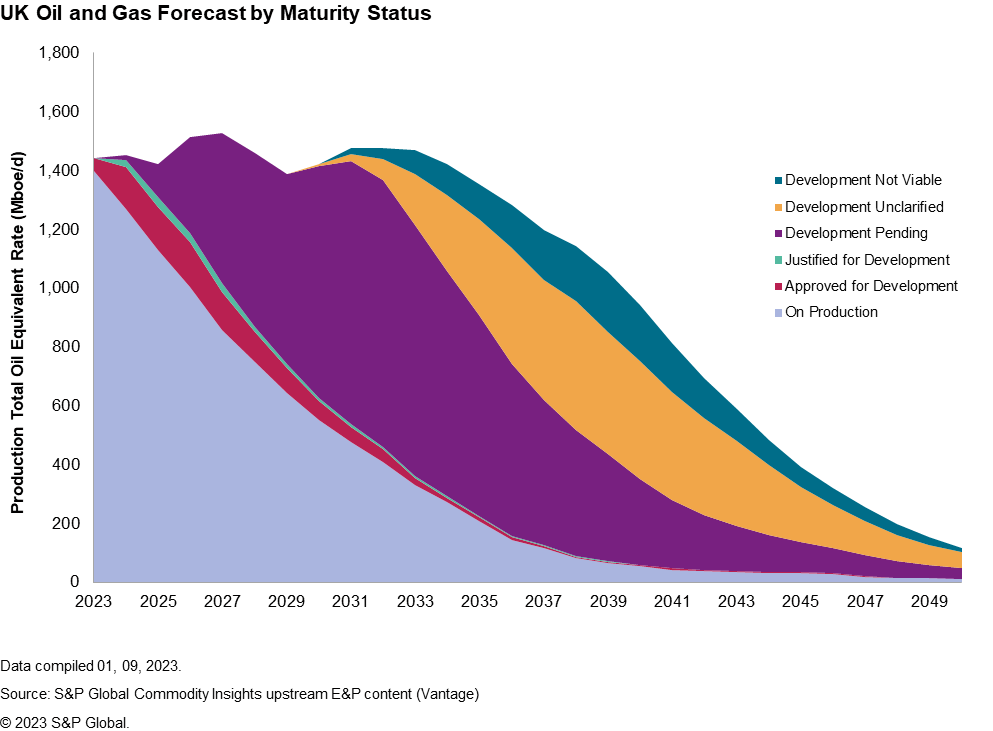

The production forecast for the UK can be broken down by project maturity status. Each status aims to represent a project's level of risk, highlighting potential barriers to first production. From 'On Production' having the lowest risk, down to 'Development Not Viable' highlighting projects which have the highest risk. These statuses are based on the definitions set out by the Society of Petroleum Engineers (SPE) and Petroleum Resources Management System (PRMS).

Figure 1: The UK's oil and gas production forecast split by maturity status, representing proportions of risked production.

Figure 1 provides a forecast for the UK's oil and gas output based on these maturity statuses. The graph highlights the importance of future projects in maintaining the UK's production. Projects classed as, On Production, will not be sufficient in stemming the UK's natural hydrocarbon output decline. The combined production from reserves, represented by the top three maturity status' (On Production, Approved for Development and Justified for Development) will rapidly decline post 2024, and halve by 2029. Therefore, the UK is heavily reliant on contingent resources to stem its decline.

The 'Development Pending' maturity class has the largest potential production volumes associated with it. Projects which fall under this category have a moderate/high degree of associated risk attributed to them and therefore are often contingent on certain events being approved. This maturity status category can be affected by changes in fiscal and environmental policies, which could see projects progress, delayed, or even abandoned.

A project example which falls within the Development Pending category is the Equinor-owned Rosebank development, located 140 km from the Shetland Islands in the UKCS, Faroes-Shetland Trough. For Rosebank, a Final Investment Decision, would move the project into the lower-risk category of Justified for Development, though this decision could be negatively influenced by strong environmental opposition received within the last few months.

A visible production hump is forecasted between 2026 and 2030. This ramp-up in production can be attributed to contingent resources from a handful of large fields, modelled as coming onstream during the period. The largest of these projects by volume are Rosebank, Cambo and Clair South (Phase 3). These larger developments are likely to be in a "now or never" development scenario, where operators could be able to justify these developments regardless of fiscal instability, given the current high commodity price and the energy security crisis which has triggered the government's intention to increase domestic production. Beyond 2030, changes in policy and the inevitable shift towards lower emission energy sources, will add increasing risk and may disfavour capital and emission-intensive projects.

Though a ramp-up is noticeable from 2026, it is short-lived, with production more likely to hold a plateau until 2030, resuming a declining trend beyond this. The peak of this ramp-up is forecast to hit just over 1,500 Mboe/d in 2027. At a historic level, this increase is almost insignificant, with production rates more than triple this during peak output from the UK between 1999-2000. However, any extra production in the near term is important to help sustain the UK through the energy transition and bolster the country's energy security. The forecast in Figure 1 suggests that relatively stable production could be achieved in the UK for at least the next 5 years, assuming new projects are consistently brought onstream in line with announced production start-up dates.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.