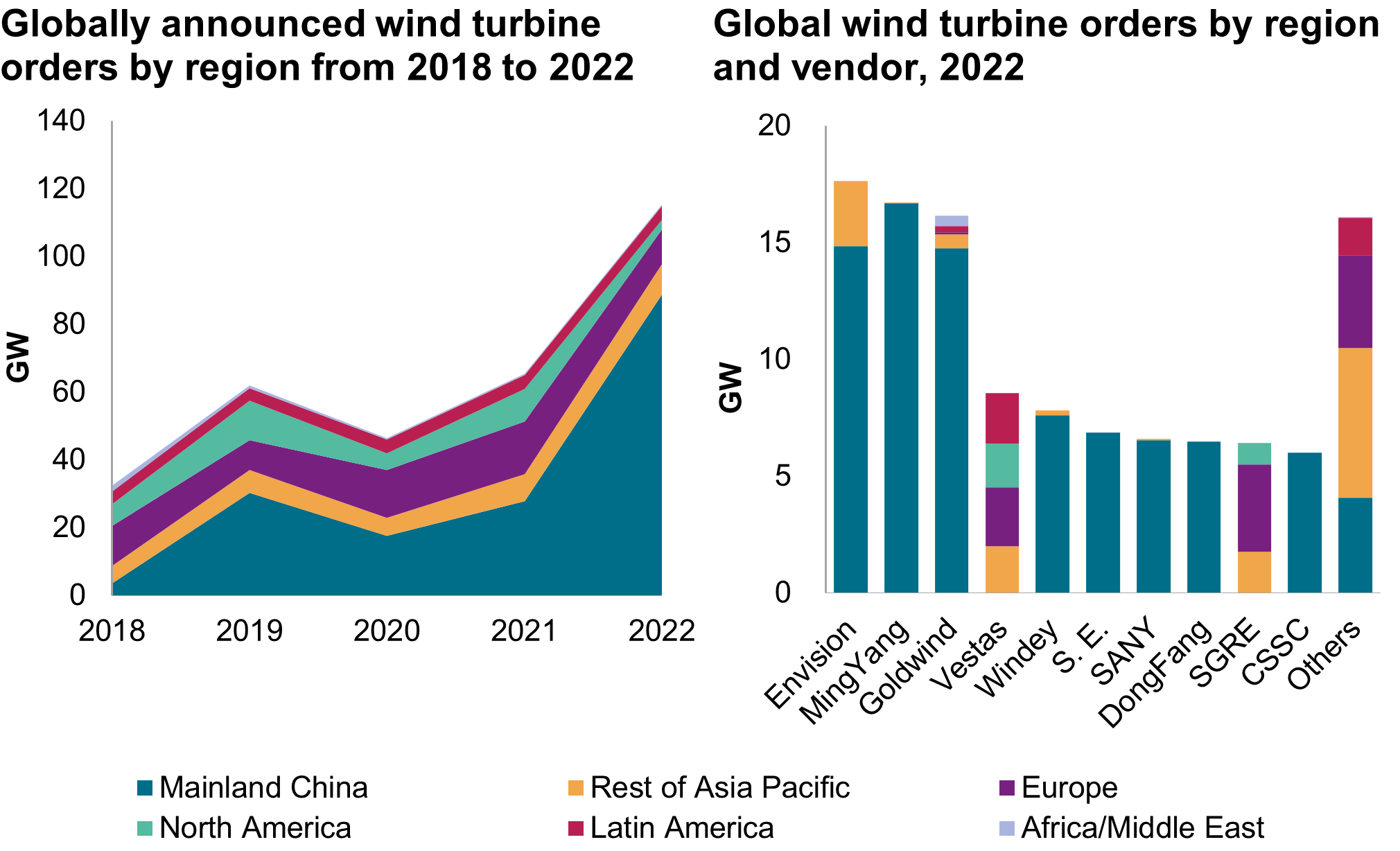

Record high wind turbine order intake exceeding 115 GW was recorded globally in 2022

In 2022, S&P Global tracked wind turbine orders exceeding 115 GW globally across 40 markets to be supplied by 23 manufacturers. Order volumes reached a record high, circa 75% higher than 2021, despite headwinds including lingering effects of the pandemic, Russia's invasion of Ukraine, high input costs, and other supply chain uncertainties.

Onshore wind accounted for over 70% of the total order intake, growing by 50% year-on-year. There was also a nearly threefold increase in offshore orders compared to 2021, excluding 8 GW that was secured through non-firm conditional agreements.

Contracting activity more than tripled in mainland China, accounting for nearly 80% of the global total. This was driven by the Chinese government's 1,200 GW wind and solar target by 2030, and a nearly 20% drop in onshore and offshore turbine selling prices by domestic manufacturers last year.

In contrast, cost pressures and supply chain issues resulted in order intake in Europe and North America falling by 33% and 71% respectively year-on-year, while remaining flat in Latin America, Africa, and the Middle East.

Chinese turbine makers took eight of the top ten spots last year, with the three largest OEMs - Goldwind, Envision, and MingYang - securing 50 GW in orders, over 50% share in their home market. Nevertheless, the four major western turbine makers - Vestas, Siemens Gamesa, Nordex, and GE - saw order intake collectively contract by 44% year on year as they hiked average turbine selling prices by up to 20% throughout 2022.

The widening turbine price gap between Chinese and western vendors have started to impact orderbooks of the latter. While western OEMs have announced no orders from mainland China since 2020, Chinese turbine makers nearly tripled overseas order intake year on year to 4.5 GW in 2022, almost entirely for onshore. Chinese suppliers made inroads into price sensitive markets including in India, Africa, Middle East and Central Asia while western players retained their dominance in mature markets including in Europe and North America.

The trend towards larger turbines continued last year. The average rated capacity of ordered onshore wind turbines globally was 4.9 MW up by 14% year-on-year. For offshore, rated capacity was 10 MW, down 12% year-on-year due to a surge in orders for 7 - 8 MW turbines in mainland China in 2022 and despite that nearly all new projects in western markets ordered turbines rated at 14 MW and above.

S&P Global Commodity Insights closely tracks wind turbine orders globally and publishes data and key insights in its Global Announced Wind Turbine Order Tracker report on a half-yearly basis. For more information on recorded orders, and our onshore and offshore wind coverage as part of the Clean Energy Technology service please visit our service site here.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.