Why a ban on US LNG exports would hit consumers, including in the United States, and damage US interests globally

As consumers across the globe face rising gas and power prices, curtailing US LNG exports has been raised as an option to protect US consumers. At a time of extreme stress in gas markets, any mandated disruption to US LNG supply would have a highly destabilizing effect.

Key implications include:

- Disruption to exports would undermine confidence in the United States as a reliable supplier and cause tensions with international allies and companies who have underwritten development of the LNG business over the last decade through long-term binding partnerships and contracts.

- Longer-term damage to the reputation of natural gas and LNG would prolong the reliance on coal in many Asian markets, with negative implications for carbon emissions.

- A loss of confidence in the United States as a reliable source of LNG would hamper development of the next wave of projects, harming domestic investment confidence and thereby risking under-investment and higher prices for US consumers and damaging industrial competitiveness in the medium and longer term.

- At a time of rising tension over Ukraine, a US ban would be a gain for Russia in Europe, resulting in increased reliance on Russian gas, and enabling Russia to say that the United States, not Russia, is the unreliable supplier.

- A ban would be a major hit to the US balance of trade and further stress imbalance in trade with other countries. From January through September 2021, the United States exported LNG worth approximately $17.5 billion.

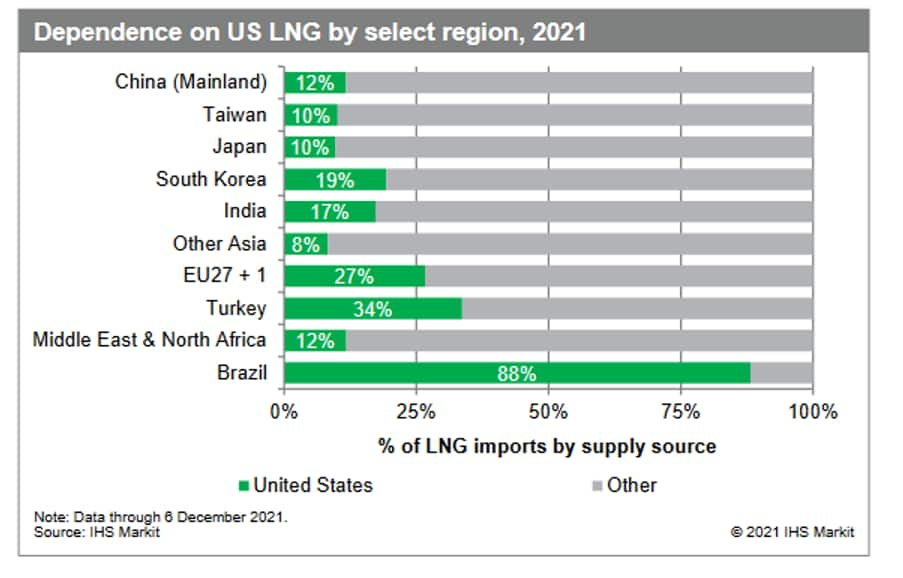

Figure 1: Dependence on US LNG by select region, 2021

See more about our US LNG solutions.

Schedule time with our LNG experts or ask them a question.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.