Decarbonization – a springboard to post-oil in North Africa?

Decarbonizing entire sectors of the economy is one of the key responses to the threat of climate change. In the oil and gas sector, there is a growing consensus that oil companies can contribute to this decarbonization effort.

Within the energy sector, oil companies can gain a competitive advantage by reducing their carbon footprint. In this article and the accompanying video presentation, members of our GEPS Africa research team discuss the results of their recent study into the potential benefits of decarbonizing hydrocarbon production in North Africa. The full report is available to GEPS customers. View the accompanying video interview:

CO2 emissions in the E&P industry

To tackle global warming, one of the most efficient actions is to reduce or eliminate emissions of CO2 which is a potent greenhouse gas.

A system of emissions scopes was put in place worldwide to standardize reporting, improve transparency and, ultimately, help companies achieve goals by providing metrics and benchmarks.

In a nutshell, here are the three scopes with reference to the E&P industry.

- Scope 1: methane leaks and gas flaring.

- Scope 2: exploration and production wells, central production facilities.

- Scope 3: oil and gas sold to clients.

Scopes 1 and 2 are the most relevant for upstream companies. We chose to investigate scope 2 as it is less publicized than scope 1 but represents around 1/3 of total upstream emissions. The basic idea is to replace the thermal energy sources currently used for scope 2 activities with renewable energy.

First, we defined criteria to select hydrocarbon fields which would most benefit from decarbonization. These criteria are:

- Hydrocarbon type: focus on oil fields since oil well fluids require more energy in handling than gas well fluids.

- Field maturity: mature fields provide more opportunities for emission reduction as the water cut increases with declining oil production.

- Remaining reserves: these should be large enough to justify the cost of power switching.

Based on these criteria, we selected 12 fields as candidates for decarbonization.

The energy model

Next, we created a simplified energy model of an oil field. The model is based on the premise that the main power requirement in conventional oil production is lifting (pumping) the oil from reservoir to surface. In addition to the lifting energy, we took into account two other power requirements. First: water or gas injection to sustain oil production. Second: processing to prepare the oil for shipment to market. The last two power requirements were derived from the first on a pro-rata basis.

The output of the energy model was the basis to determine the size of the renewable power plant.

Concerning the renewable energy to be used, only photovoltaic (PV) was retained for modelling purposes. It is the most evenly distributed and abundant source of renewable energy in the investigated region. We considered geothermal potential, but this is not as well suited since temperature gradients are not high enough in the region to directly produce steam for electricity generation. Regarding the wind potential, it was deemed inefficient as it is too irregular over the region.

Discussion

The result of our investigation is that in North Africa, PV is a realistic option to supply power for oil field operations. Pilot projects completed by Eni in Algeria and Tunisia have demonstrated the feasibility of power switching from thermal to PV.

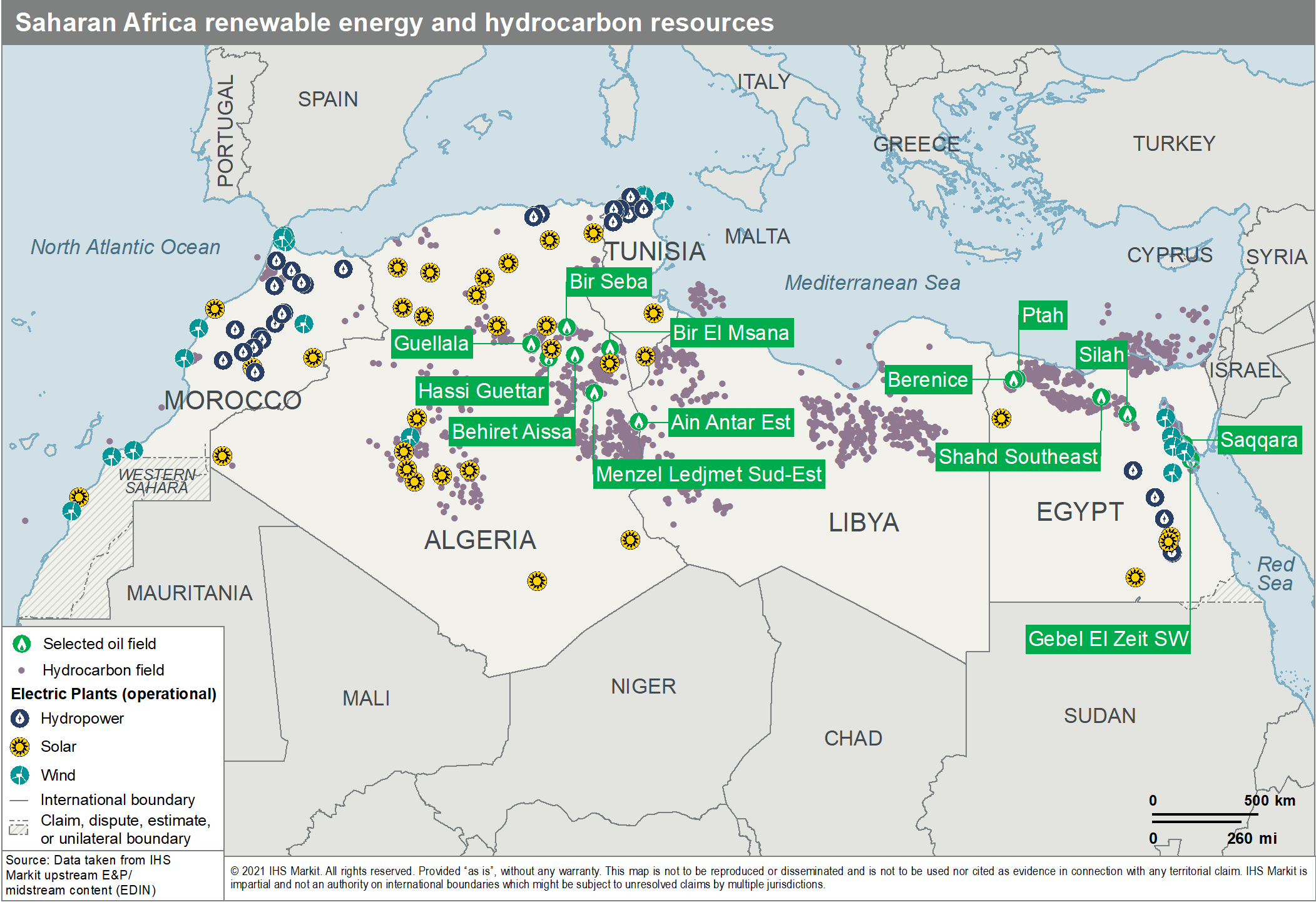

The data used in our investigation are mostly from IHS Markit's georeferenced database. This allows us to easily produce maps. The figure below shows three data layers: first, the fields selected for this investigation, then, all other hydrocarbon fields and finally all operational renewable power plants.

The map shows that the candidates for decarbonization are evenly distributed over the investigated countries. There is not a basin or a geographic zone which is better suited for decarbonization than another. Even offshore fields can be considered.

Remote desert locations at sub-tropical latitudes provide the best places worldwide to deploy PV power plants and it is a great benefit for the North African hydrocarbon industry that the most prolific petroleum basins are in these locations. This is a competitive advantage which should not be underestimated. Low carbon barrels may soon attract a price premium in key markets like the European Union (EU) as the Carbon Border Adjustment Mechanism comes into force.

Outlook

E&P companies can use power switching in their own operations as an initial step. Building on this, these companies can develop a renewables business in its own right to supply power to third parties. The development of large PV power hubs in Saharan Africa such as the pioneering Benban project in Egypt will enable the emergence of large green hydrogen production units. This is another opportunity for which North African E&P companies are ideally positioned. A ready market with exponential growth potential for green hydrogen exists on North Africa's doorstep: the EU.

Conclusion

In conclusion, it can be said that electrification/power switching in North African oil fields will be a key step to secure the existence of the local hydrocarbon industry through the energy transition. In addition, power switching to renewables will enable E&P companies to gain the required expertise to evolve from simply a hydrocarbon provider to an energy provider. With this in mind, starting to install a few solar panels in the middle of nowhere to power a pump or a compressor, is much more important than it seems and goes potentially far beyond scope 2 emissions reduction.

Figure 1: Saharan Africa renewable energy and hydrocarbon resource

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.