Assessing the significance of steel to the global wind industry

The rapid growth expected for global wind energy installations over the coming decade and increasing wind turbine sizes will result in wind industry steel consumption doubling this decade. Steel prices have more than doubled in some regions between 2020 and 2021 on account of severe supply chain disruptions, highlighting the potential risk to the wind industry due to the commodity's price volatility.

Our team takes a closer look at the demand for steel by the wind industry, current pricing challenges and the normalization timeframe, potential steel price impacts on wind capital costs and levelized cost of electricity, and future challenges related to steel in for the wind industry.

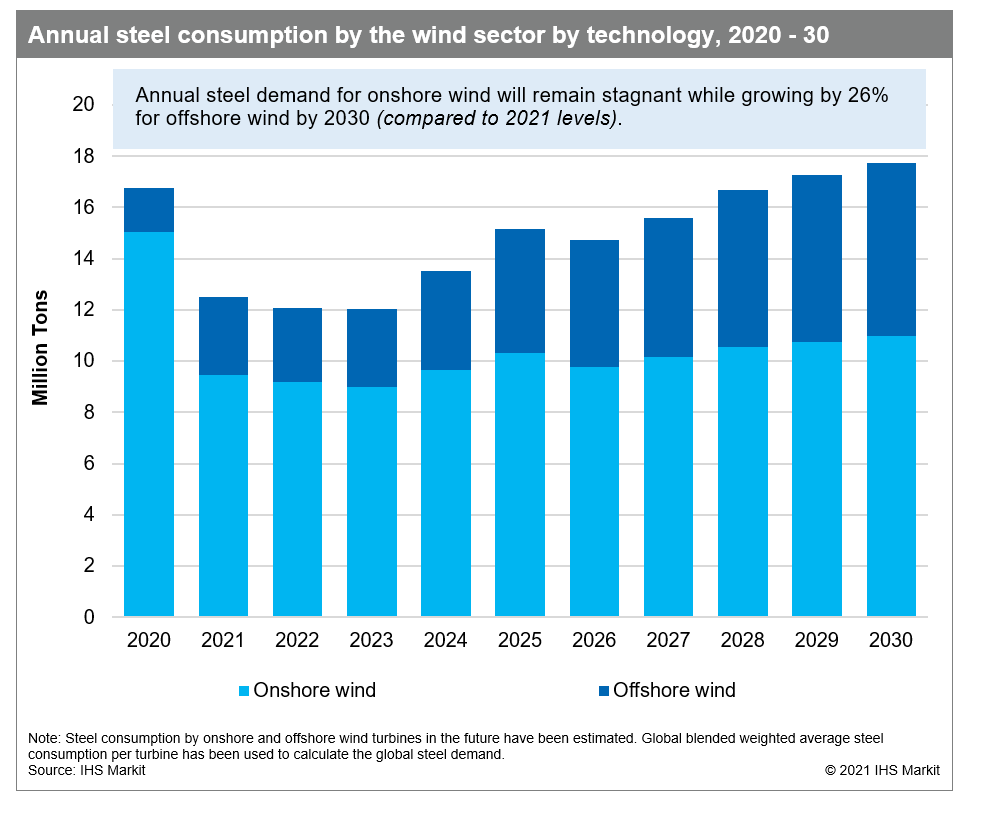

The global wind industries steel consumption is expected to

double this decade reaching 147 MMT between 2021-2030, driven by

forecast global additions of 960 GW. Steel is critical for both

onshore and offshore wind turbines, making up 20% and 90% of

turbine mass for onshore and offshore wind, respectively. Both

onshore and offshore turbine towers are fabricated from steel, and

while onshore wind turbines rely on concrete for their foundations,

offshore wind turbines rely on steel structures such as monopiles

and jackets for their foundations.

Figure 1: Annual steel consumption by the wind sector by technology, 2020-30

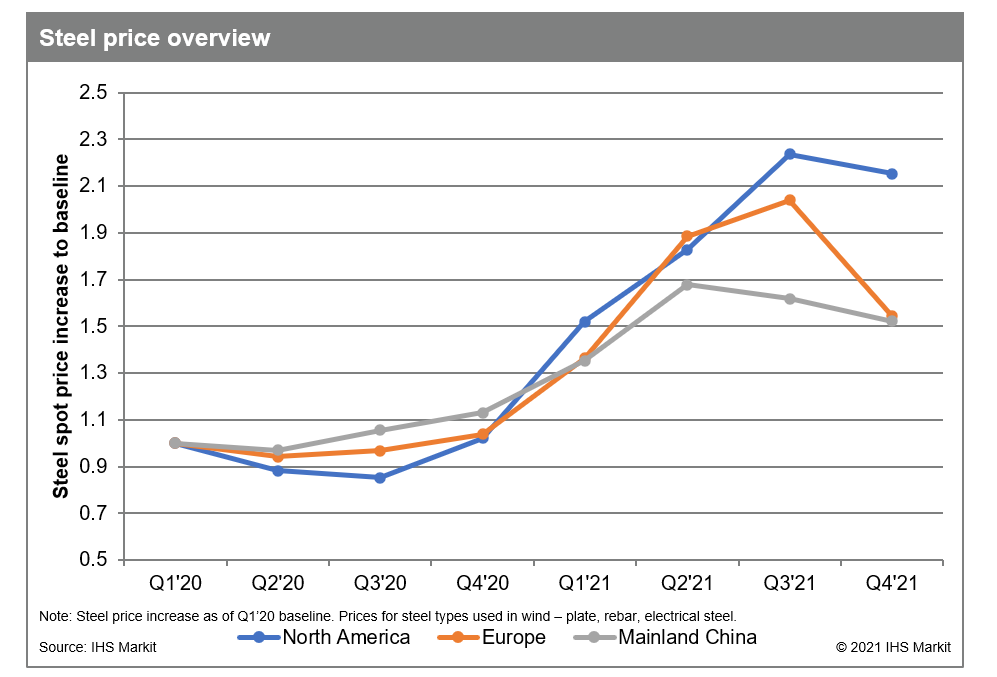

This is important considering average global steel prices almost doubled between 2020 and 2021, reducing wind OEM profit margins and increasing wind project costs, highlighting the risk of steel price volatility causing disruption along the wind industry value chain.

Figure 2: Steel price overview

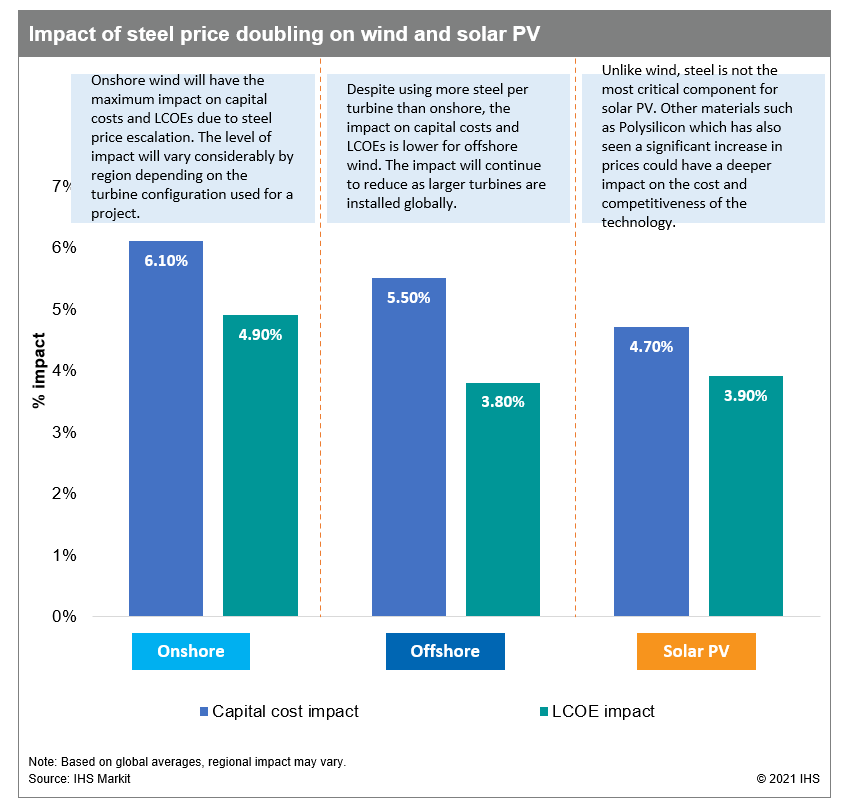

The recent steel price spikes alone could lead to increasing wind project CAPEX and LCOE of 6% and 4.5%, respectively. Onshore wind project CAPEX is most significantly impacted by increasing steel price due to having overall lower project costs compared to offshore wind. Future steel related challenges exist for the wind industry due to increasing implementation of carbon pricing mechanisms, steel industry decarbonization costs along with component fabrications and transport difficulties.

Figure 3: Impact of steel price doubling on wind and solar PV

Learn more about our renewables coverage.

Schedule 1-1 time with our experts, or ask them a complimentary question.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.