A Deepwater Dive: Has the PIA unlocked the key to Nigeria’s long-term production stability?

Nigeria's Petroleum Industry Act (PIA) 2021, seeks to provide a regulatory, legal, fiscal and governance framework for the Nigerian petroleum industry as well as funding the development of host communities. It was signed into law by President Muhammadu Buhari in August of 2021 and is the boldest attempt to overhaul the country's petroleum sector which alone accounts for over 40% of total GDP and up to 70% of budget revenues.

The new PIA has attempted to improve the country's fiscal attractiveness by altering many facets of the regimes that apply to oil and gas assets. These include:

- Royalty tax (RT) - Two tier (production rate & oil price, previously oil price & water depth) ranging from 5% to 15% for oil and a 5% (export) or 2.5% (domestic) for gas and gas liquids.

- Petroleum Profit Tax - replaced with a Hydrocarbon Tax (HCT), the largest change of the overhaul. A flat rate of 30% is applied on the profit from crude for fields in development or commercial production in onshore or shallow waters. It appears that no HCT for deepwater assets is now applied due to its absence from Sec 267 of the PIA, therefore, this is used for the purposes of this analysis and is IHS Markit's assumption of the PIA.

- Investment Tax allowance - succeeded by a Production allowance depending on water depth (ranges from e.g. shallow waters, USD $8/bbl and 20% of fiscal oil price up to a cumulative max of 100 million barrels (MMbbls).

- Other taxes - Education and Niger Delta Development Ley. These stand at 2% and 3% respectively and have remained the same apart from a few accountancy subtleties.

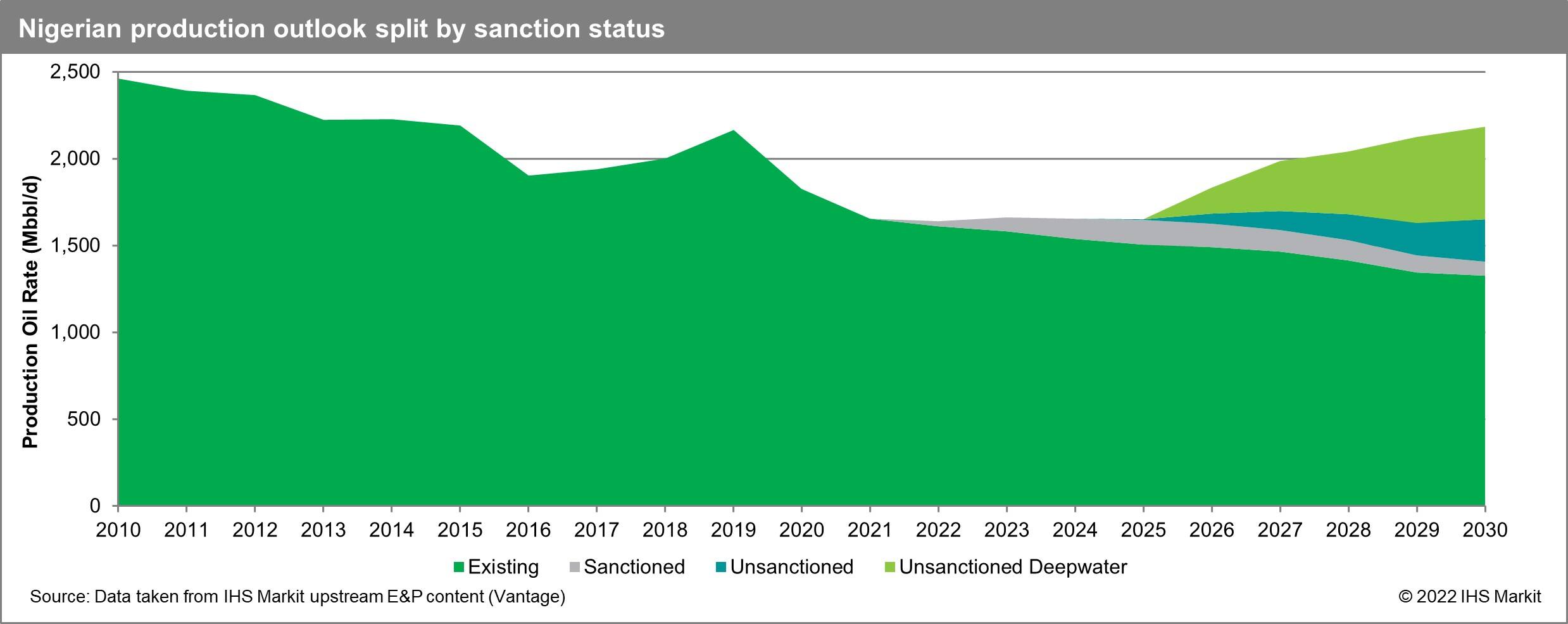

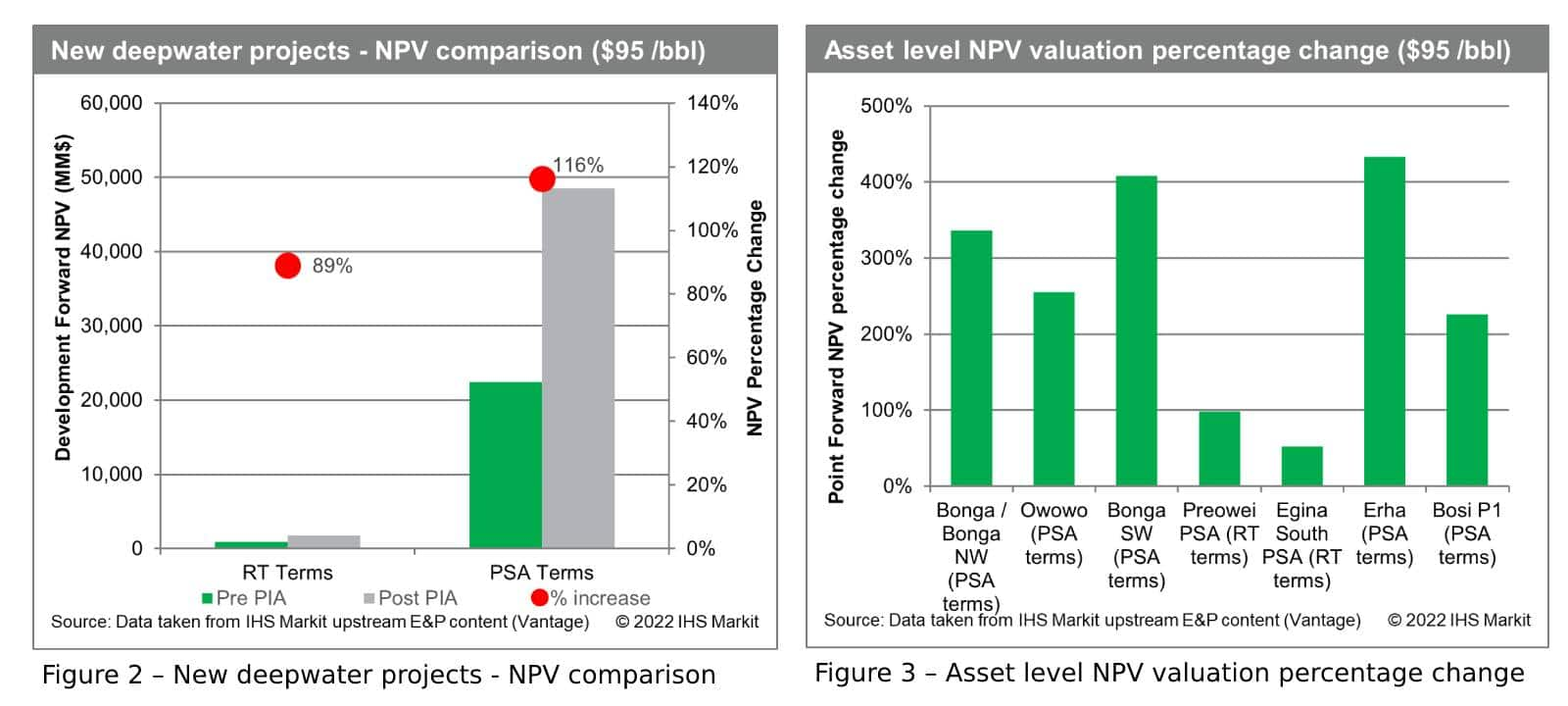

One area of particular interest and that is crucial in preventing Nigerian production from declining is the sanctioning and timely construction of new deepwater projects such as Bonga Southwest and Owowo. Starkly highlighted in figure 1 is the reality of the importance of unsanctioned projects, but especially deepwater projects to Nigeria's production growth and ultimately, stability. The deepwater projects that are due to start up between 2025 and 2030 are estimated to hold recoverable resources, of 2.3 Bbbl. Figure 1 illustrates that without the sanctioning and commissioning of currently unsanctioned projects, Nigeria's overall production will likely decrease from the end of the decade and reveals that it's the deepwater projects that can provide this extra production required to offset the expected production decrease. Therefore, unsanctioned deepwater projects are seen as the prime target area for fiscal and regulatory improvement which, as figures 2 and 3 represent is thought to have occurred if the assets convert to the new PIA fiscal terms (cases run at $95 /bbl & 10% discount rate).

Those deepwater projects on legacy RT terms upon conversion will see their combined NPV increase by 89%, even though in terms of the overall value of all new deepwater projects it's still a small number due to only two developments being under those terms - portions of Egina South and Preowei, where for example an NPV increase is seen of close to 100% for Preowei taking its NPV to over $MM 1,500. Deepwater assets on PSA terms are set to see a combined total NPV increase of 116% with some assets seeing increases of over 300% in the case of the producing Bonga/Bonga North and over 200% in the case of the Owowo development taking its NPV to over $MM 3,500. This is positive news for the projects and their operators and has initiated some of them and other joint venture (JV) partners to release news that these changes have stimulated progression towards a possible final investment decision (FID). An example being Preowei, where operator TotalEnergies announced that it is to accelerate the development with a possible early conversion to the PIA terms (thought to have occurred in August 2022) due to the new fiscal structure which contains tax advantages. These being the 0% HCT and the new incremental production-based royalty which went from a set 10% for water depths of greater than 200m to either 5% for less than 50,000 bpd or 7.5% for greater than this. Shell's Bonga / Bonga North expansion and Bonga Southwest developments, both under PSA terms, are also thought to have progressed as the partners acknowledge the benefit the new terms will bring to their valuations , over 400% to around $MM 3,000 in the case of Bonga SW, though hurdles remain.

These projects should remain an area of particular focus for the government. Indeed, they could become stranded if the terms available are not acceptable to licence holders. However, as the May 2021 renegotiation of the Bonga Southwest PSC terms demonstrated and the subsequent August 2022 renegotiation of a further six blocks including OML 125 & 130, if the government and international oil companies (IOCs) are able to find common ground on such projects, this could raise Nigeria's production outlook, as figure 1 illustrates, towards the end of the decade, which would also likely help to secure the country's output over the longer term.

Figure 1 - Nigerian production outlook split by sanction status

Further important resource large projects that are key to Nigerian production remaining steady are the deepwater producing Agbami field which has also benefitted from the new terms, if implemented, with an NPV increase of around 50% taking it to close to $MM 6,000, the deepwater producing Erha field which would see an NPV increase of over 400% to over $MM 4,000 and the upcoming deepwater Bosi Phase 1 development where an increase of around 225% to over $MM 1,300 has been modelled. These increases are significant and illustrate the intentions of the government moving forward that on its designing of the PIA they have put project partners and fiscal attractiveness at the forefront.

The trajectory of Nigeria's future oil and gas production largely hinges on the PIA and if it is considered to be sufficiently favourable to investors. This is widely unknown as operators and partners have remained generally silent apart from the announcements made by the Preowei and Bonga development JVs. It remains to be seen if Nigeria's boldest attempt to overhaul the country's petroleum sector will work, but it has been a positive step which so far has been commended and should help retain and attract further investment ultimately benefitting the country - providing funds to help further its path towards diversifying its economy and improving gas and electricity infrastructure on its route through the energy transition.

***

Want to learn more on this topic and access similar reports? Try free access to the Upstream Demo Hub to explore selected energy research, analysis, and insights, in one integrated platform.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.