A year like no other: How 2022 supercharged the energy transition in the global power sector

In 2022, as concerns mounted around high energy prices and fuel shortages in power markets worldwide, many said that the Russia-Ukraine war had finally revealed an underlying conflict between energy security and the energy transition. However, analysis of official supply, demand, and price data from the world's largest power markets disputes this simple narrative that pits energy security against the energy transition.

This perspective is discussed in the S&P Global report "A year like no other: How 2022 supercharged the energy transition in the global power sector."

The Russia-Ukraine war impacted global power generation in 2022, but so did extreme weather, China's "zero-COVID" policy, and nuclear outages

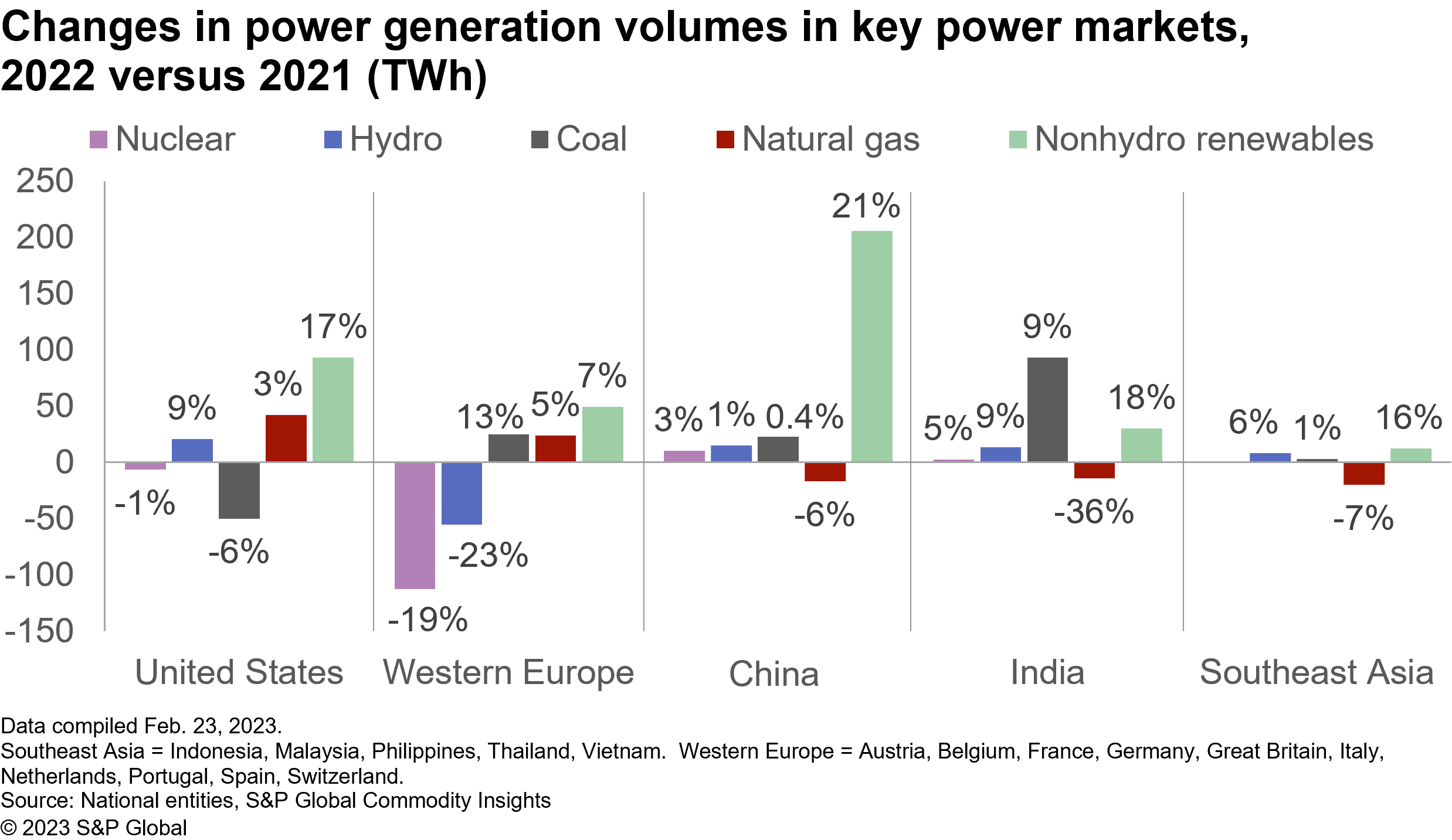

Last year, following Russia's invasion of Ukraine, coal use in Europe rose by 13% relative to 2021, reversing what had been a long-standing decline. However, the rise occurred largely because of substantial nuclear outages (nuclear output declined 19%) and severe droughts (hydro output declined 23%). This is shown clearly in Figure 1.

Figure 1:

Worldwide, fossil fuel use increased most in India, where coal-fired generation rose 93 TWh in 2022, or 9% year on year. However, India is only loosely connected to the war and the global fuel crisis. Instead, summer heat compounded the effect of a remarkable 7% growth in GDP to rapidly increase domestic power demand.

In China, coal-fired power generation growth was the slowest in almost a decade, owing mostly to "zero-COVID" lockdown measures. In other words, a much greater increase in global coal generation and CO2 emissions was avoided because of Chinese domestic policies unrelated to energy security.

Lastly, the United States did raise the global power sector's dependence on natural gas, but the country has abundant domestic resources that already limit its energy security risks. Interestingly, Europe's use of gas also increased despite very high prices and a mild winter.

In summary, fossil fuel generation and CO2 emissions rose last year because of a myriad of often unrelated factors, energy security concerns were just one of them. It is rather on the demand side that the war's impact is most unambiguous, with sizable power demand destruction in Europe.

Yet, amidst all of last year's distinctive events, one consistent theme appears across power markets worldwide: the strong growth in nonhydro renewable energy.

As energy security concerns grew last year, the move toward clean energy accelerated

In the global power sector, substantial growth in renewables was the overarching theme of 2022. The expanding role of wind and solar technologies was evident across global generation levels, new build trends, new policy initiatives, and investment flows.

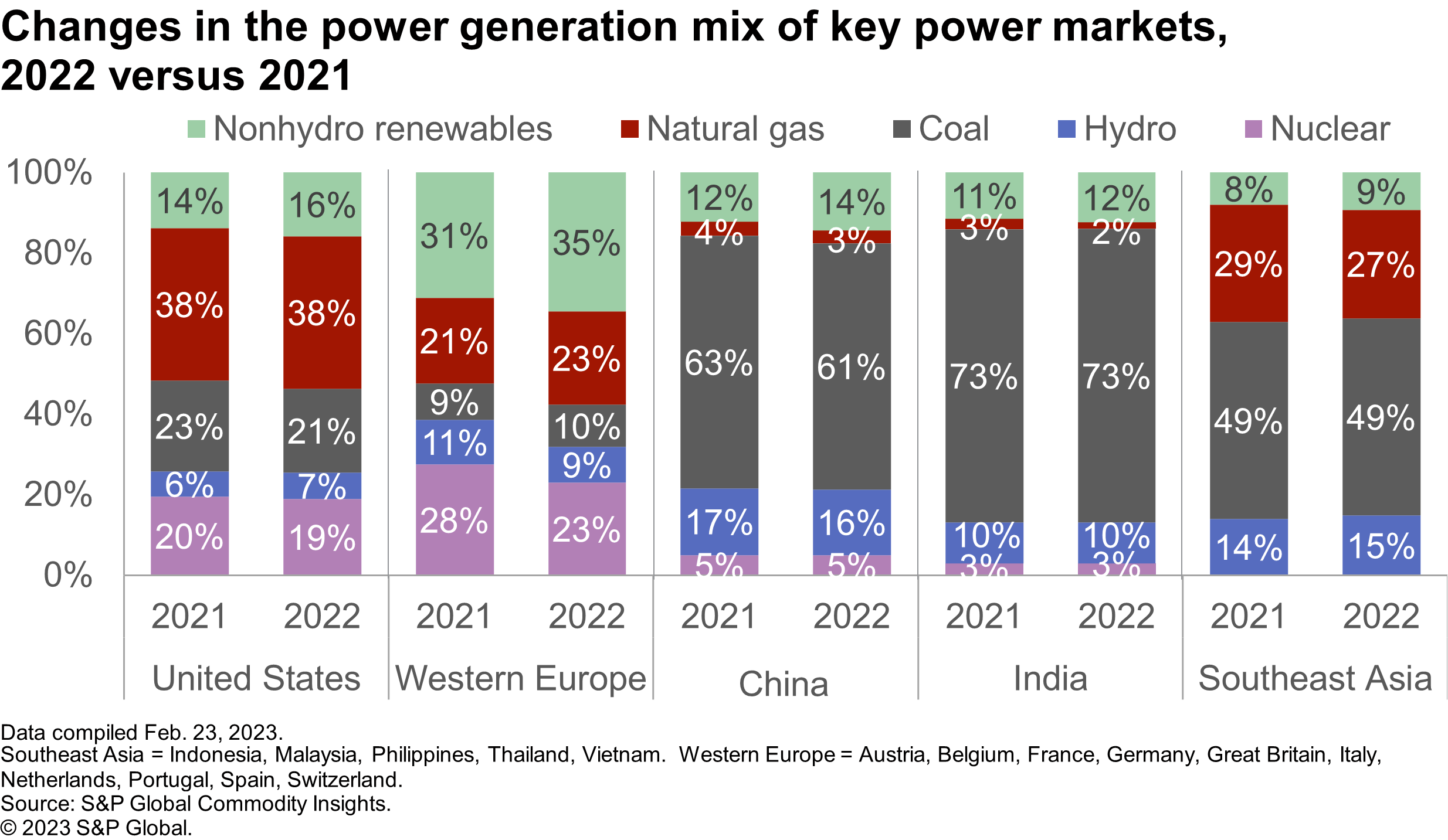

China led the world in boosting renewable generation volumes, with wind and solar power production increasing by 21% in 2022, relative to 2021. India and the United States both saw nonhydro renewables grow by 17% during the year. Renewables continued to increase their share of the generation mix in all major markets (Figure 2).

Figure 2:

2022 was a record year in terms of clean energy additions as well, with an estimated 365 GW added globally. This number surpasses the previous record reached in 2021. Capacity buildouts included 160 GW in China, 72 GW in Europe, and 37 GW in the United States.

On the policy front, since late 2021 landmark climate and energy legislation came into being in China, Europe, and the United States. The magnitude of these initiatives should not be underestimated: the US Inflation Reduction Act brings nearly $400 billion in funding for the energy sector and to combat climate change; Europe's REPowerEU initiative calls for renewables to supply 45% of total energy by 2030; and China's "1+N" package aims to peak the country's carbon emissions by 2030.

Lastly, wind and solar shares within the global pipeline of future projects also rose in 2022, pointing to robust capacity additions for 2023 and the years to come. Importantly this is true including in the Asia Pacific region—the region with the most energy demand growth and most coal-fired power.

In summary, while energy security concerns may at times conflict with the energy transition, last year has mainly underscored that global power markets are on an unstoppable course toward more renewables.

Learn more about our global power and renewables research.

Etienne Gabel, senior director at S&P Global Commodity Insights with the Global Power and Renewables team, specializes in the analysis of market and regulatory developments in power sectors worldwide.

Posted on 22 March 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.