Gorgon 1 Project development : What effect does a Carbon Tax have on the project’s development economic viability?

Colombia is one of the 71 nations that updated its Nationally Determined Contributions (NDC). This reinforces its commitment to urgent climate action. Although Colombia is responsible for only 0.4% of global emissions, according to the World Bank data of 2019, its NDC was one of the most ambitious of the Latin America/Caribbean region and more aligned with the country's objective to achieve carbon neutrality before 2050. In addition, the announcement by Colombia's government indicates that it will address land-based Greenhouse Gas (GHG) emissions from agriculture and make progress towards clean energy.

The purpose of this article is to evaluate the effects of the implementation of a carbon tax in the Colombian fiscal regime as a good instrument of controlling global climate change and reducing domestic and regional air pollution, using the Gorgon 1 project as a working example.

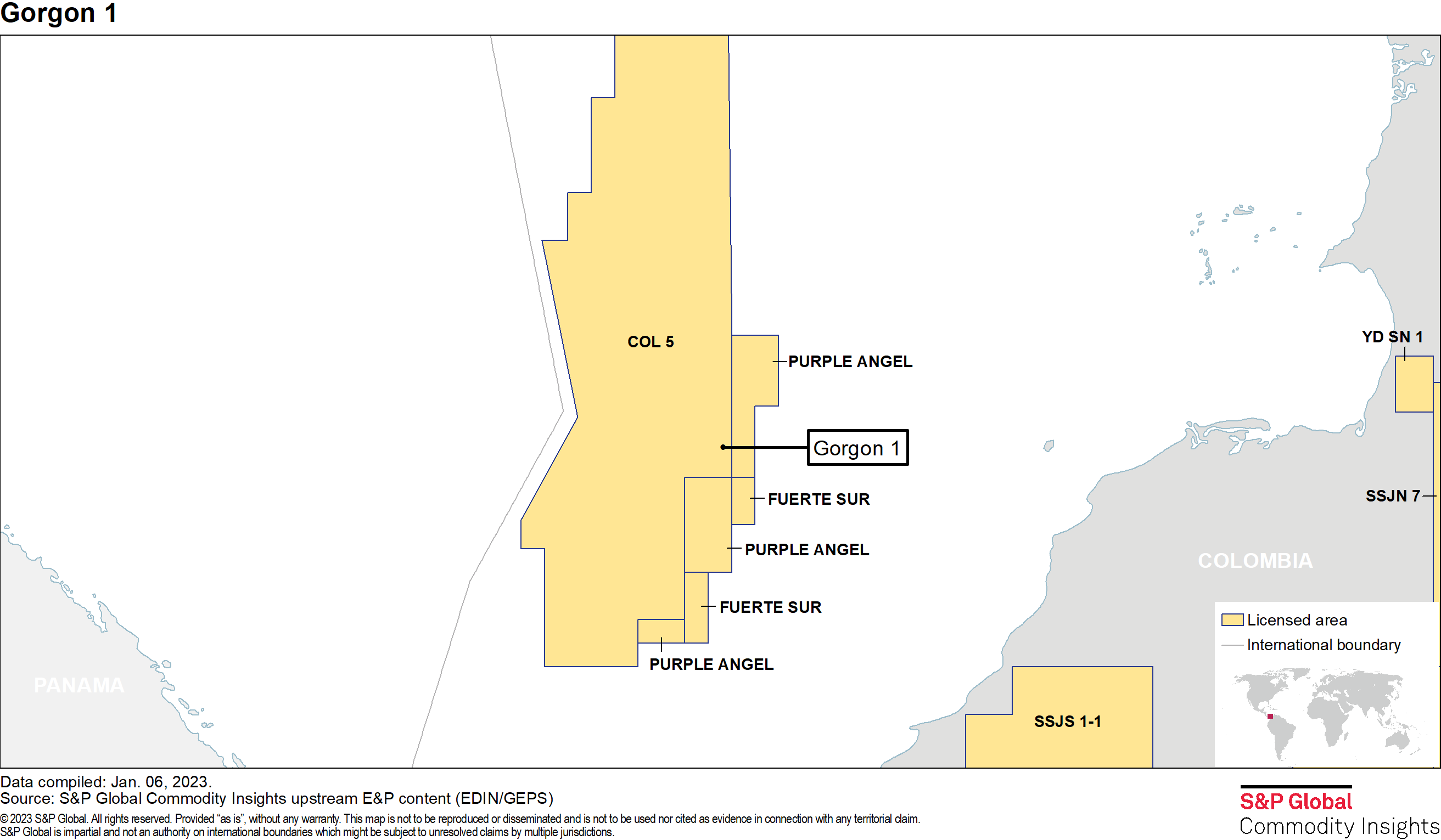

The Gorgon field is a conventional gas producer, that was discovered in 2017. It lies approximately 68 km away from northern Colombia in the Colombian Caribbean Deep Water Purple Angel block. And has preliminary in-place volumes of 6,000 billion cubic feet of gas (Bcf) Shell, who is the current operator of the project, currently holds a half-share in the Purple Angel block after acquiring its 50% from Ecopetrol S.A. in 2020.

The economic impact of the carbon tax on the Gorgon 1 project:

Colombia introduced in 2016 a small tax reform as part of a regulatory framework and institutional structure aiming to reduce international emissions. These include a National Climate Change Policy and a National Climate Change System. The main change for the energy sector is the introduction of the carbon tax rate, which stands at a nominal rate of COP 20,500 (~USD 4.53) per tonne of carbon dioxide equivalent (CO2e) (as per Tax reform approved in 2022) and applies to importers as well as domestic producers of fossil fuels.

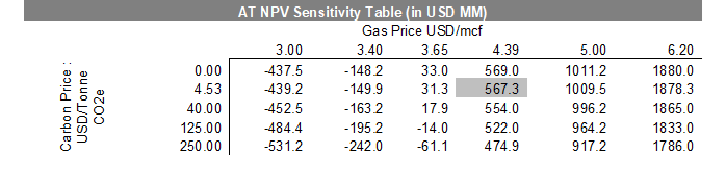

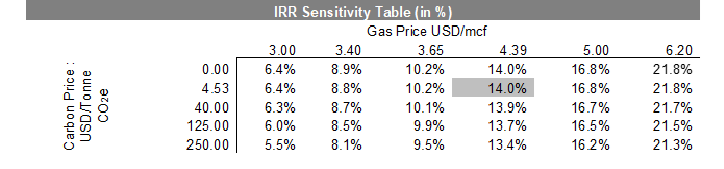

To assess the impact of the introduction of the carbon tax, several project investment metrics are measured, such as the After-tax Net Present Value (AT NPV) @10% nominal discount rate, Nominal Internal rate of return (IRR) and gas/oil Break-even Price (BEP). The economic viability was determined using Vantage Economic Model considering Colombia's Royalty Tax fiscal system, available GHG emission data and assumed upstream carbon emissions of the project (1,175,000 tonne of CO2e).

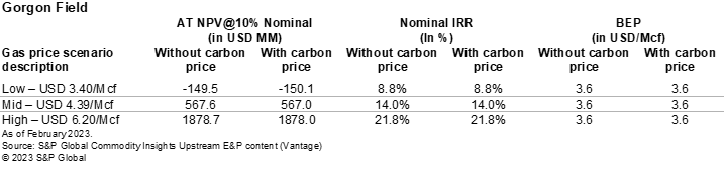

The table below summarizes the AT NPV, IRR and BEP using different price scenarios (USD 3.40/Mcf, USD 4.39/Mcf and USD 6.20/Mcf) and under a post and pre-emissions costs impact scenarios. The post-emissions scenario uses as a base case for the carbon price the current legislation price of USD 4.53 per tonne of CO2e (base 2023), adjusted by 2% inflation.

Positive AT NPVs were at least attainable in the Mid-price scenario, even with the carbon impact consideration, but it was not achievable under a stress scenario price. The post-emissions scenarios shows a minor decrease in the AT NPV (less than USD 1 million), while the IRR has seen less than 0.1% decrease, and the BEP remains the same.

Carbon Cost Sensitivity Analysis:

Looking into different countries in terms of carbon tax legislation and its application to mitigate GHG emissions and move toward energy transition, a sensitivity table analysis using different Carbon Price benchmarks, such as, Shell's Carbon Disclosure Project (CDP) benchmark price of USD 125 per tonne of CO2e, Ecopetrol's Task Force on Climate-Related Financial Disclosures (TCDF) benchmark price of USD 40 per tonne of CO2e and a rate of USD 250 per tonne of CO2e are used.

The Gorgon 1 project sees its AT NPV @10% decrease from USD 567.3 Million to USD 474.9 Million (-16.3%) in the Mid gas price Scenario and when carbon prices increase to USD 250 per tonne of CO2e. The AT NPV is severely impacted when gas prices are under USD 3.65/Mcf, as the Economics results begin to turn the project economically non-viable.

The application of Shell's carbon price can make the AT NPV drop from USD 31.3 Million to USD -14 Million, under a stressed (low) gas price scenario of USD 3.65/Mcf, turning the project not economically viable with these combined factors.

Can carbon pricing be the solution?

The application of the carbon tax in Colombia could be an effective policy tool to address the urgent climate crisis and enhance the country's efforts to transition to a low-carbon economy. This could improve the long-term fiscal outlook by using it to promote substitution of fuel products, and lead to changes in the energy production and consumption structures, encourage energy conservation, and invest in energy efficiency. Also, through the collection of carbon tax revenue, it can influence investment and consumption and promoting renewable energy development by subsidizing environmental protection and technological advancements in energy saving and emissions reduction, while also strengthening the existing effects.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.