Algeria's 2019 Hydrocarbons Law Two Years On

Introduction

Algeria's Law No. 19-13 of 11 December 2019 had the primary goal of

spurring investment in the hydrocarbon sector. In the years leading

up to 2019, Algeria had not been able to attract significant

hydrocarbon investment because prospective contractors did not see

the country's oil and gas regulatory and fiscal framework as

sufficiently attractive. At first glance, the new law seems to have

created a more structured petroleum framework and a more favourable

tax regime for investors. Since the ratification of the law, the

government has passed several decrees (about 40 to date) clarifying

points that were not completely defined in the new law. However,

despite a general improvement for contractors, for example

concerning royalty and Petroleum Revenue Tax (IRH), the result is

not yet clear because, inter alia, a model Production Sharing

Contract (PSC) and a model Risk Service Contract (RSC) are not yet

available.

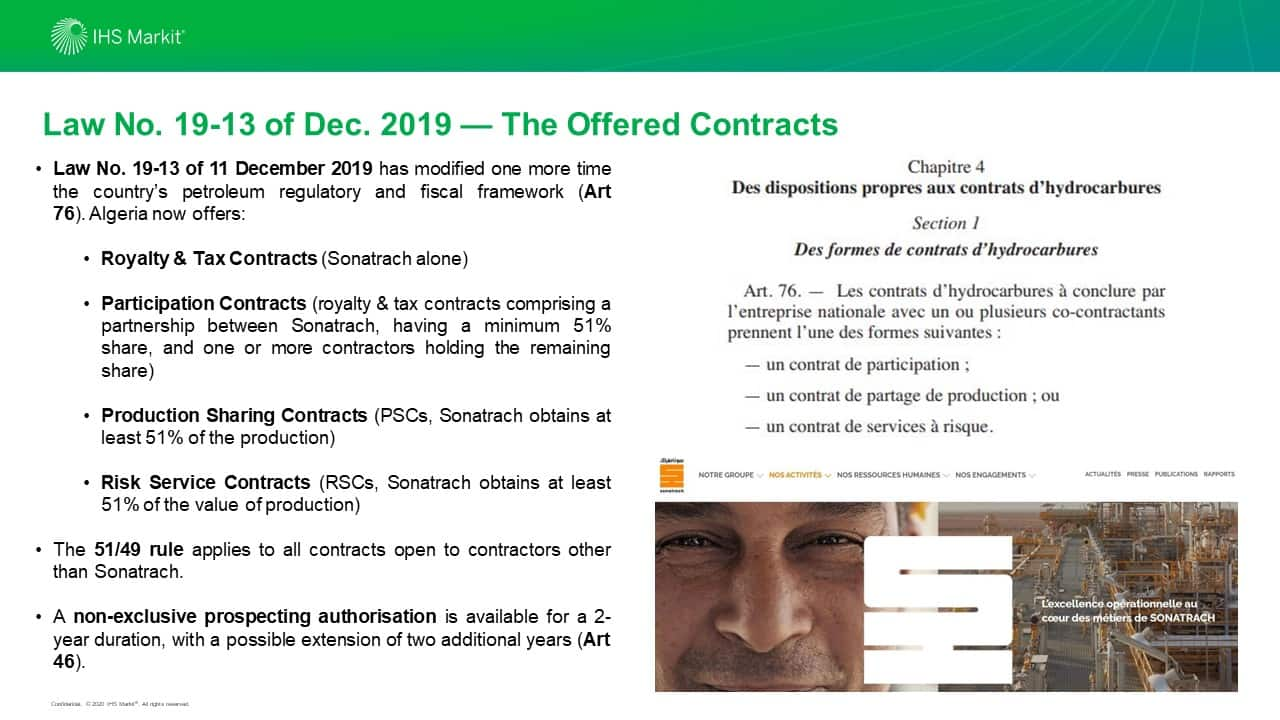

The Contracts Offered

Law No. 19-13 reintroduced PSCs and RSCs in Algeria after they had

not been available to prospective investors as "new contracts"

since the ratification of Law No. 05-07 of 28 April 2005 Concerning

Hydrocarbons (Algeria's previous hydrocarbons law as amended in

2006 and 2013). Under Law No. 05-07, prospective contractors could

only enter into royalty/tax partnership agreements with Sonatrach,

Algeria's national oil company. By law, Sonatrach had to have not

less than 51% in the partnership. Law No. 19-13's opening of the

legal regime to more types of petroleum contracts has many

similarities with the opening of the regime to PSCs and RSCs by Law

No. 86-14 of 19 August 1986. That law was the first radical

modification of Algeria's petroleum framework after the February

1971 100% gas nationalization and 51% oil

nationalization—following the nationalization, the only

available contracts were participation agreements, with Sonatrach

holding at least 51% of the participation.

The diagram below summarises the contract types now available in

the wake of Law No. 19-13.

The fiscal framework introduced by Law No. 19-13 is based on the

fiscal impositions listed in the diagram below.

Specific Improvements

Despite that all the types of petroleum contracts now available

maintain the 51%-49% rule in favour of Sonatrach, in general terms,

Law No.19-13 has improved the petroleum fiscal framework for

prospective contractors in four different ways:

- Royalty under Law No. 05-07 as amended, was cumbersome as it was linked to various rates—from 5.5% to 23%—based on daily production and four zones into which Algeria's territory was divided (Zones A, B, C, and D). For unconventional petroleum and areas underexplored, with complex geology, and/or with no infrastructure, the rate was 5%. Law No. 19-13 has a single 10% royalty rate (5% if reduced for areas having complex geology, requiring complex extraction techniques, and/or having high development costs compromising the profitability of a project).

- Petroleum Revenue Tax (IRH), called under Law No. 05-07 "taxe sur le revenue pétrolier, TRP," (after the amendment introduced to Law No. 05-07 by Law No. 13-01 of 20 February 2013) was set for conventional petroleum at a rate from 20% to 70% based on an R Factor linked to three scenarios (1st scenario: plateau production < 50,000 boe, 2nd scenario: plateau production ≥ 50,000 boe, and 3rd scenario: areas underexplored, having complex geology, and/or with no infrastructure). For unconventional petroleum, the rate was from 10% to 40% (without the three scenarios). Law No. 19-13 has an IRH rate from 10% to 50%, also based on an R Factor (from 10% to 20% if reduced for areas having complex geology, requiring complex extraction techniques, and/or having high development costs compromising the profitability of a project).

- Corporate Income Tax (IR), called under Law No. 05-07 "impôt complémentaire sur le revenue, ICR," (after the amendment introduced to Law No. 05-07 by Law No. 13-01) was set at a rate from 19% (R2 < 1) to 80% (R2 ≥ 1) based on an R Factor linked to the three above-mentioned scenarios (fixed 30% rate for the 2nd scenario) for conventional and unconventional petroleum. Law No. 19-13 has an IR rate of 30%.

- Law No. 19-13, which has reintroduced PSCs and RSCs, does not mention any windfall tax ("taxe sur les profits exceptionnels, TEP"), which was introduced by Ordinance No. 06-10 of 29 July 2006 for contracts signed on the basis of Law No. 86-14 of 19 August 1986. For those contracts, the windfall tax applies when the oil price is higher than USD 30 per barrel and has rates between 5% and 50%.

Conclusion

It appears that Law No. 19-13 has improved Algeria's regulatory and

fiscal framework in favour of prospective contractors. However,

without a model PSC and a model RSC, it is difficult to accurately

gauge the attractiveness of the two new regimes. Generally,

evaluating the legal-fiscal terms in isolation, in other words,

examining only the separate fiscal components, one by one, is not

the optimum method for determining the overall state take in a

petroleum framework. The industry is eagerly awaiting the model

contracts to complete the picture.

A longer, more detailed, version of this piece will soon be available to our subscribers.

Screen upstream opportunities and above-ground risk with PEPS from IHS Markit - Learn More.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.