The gas price spike has incentivized Norwegian upstream producers with midstream assets to minimize ethane recovery, but US imports continue

Upstream producers and midstream natural gas liquids (NGL-) operators and asset owners in Norway are reducing ethane recovery from natural gas and have temporarily suspended ethane exports to Sweden and Belgium. Recent high natural gas prices in Europe greatly incentivize ethane rejection to boost natural gas production and natural gas sales in the form of rejected ethane. Norwegian authorities have limited short- term expansions of natural gas production, so ethane rejection is a way to increase natural gas production in the short term to support the current European natural gas supply shortage. Ethane recovery and ethane exports from this producing area are likely to resume once natural gas markets in Europe return to more normal conditions.

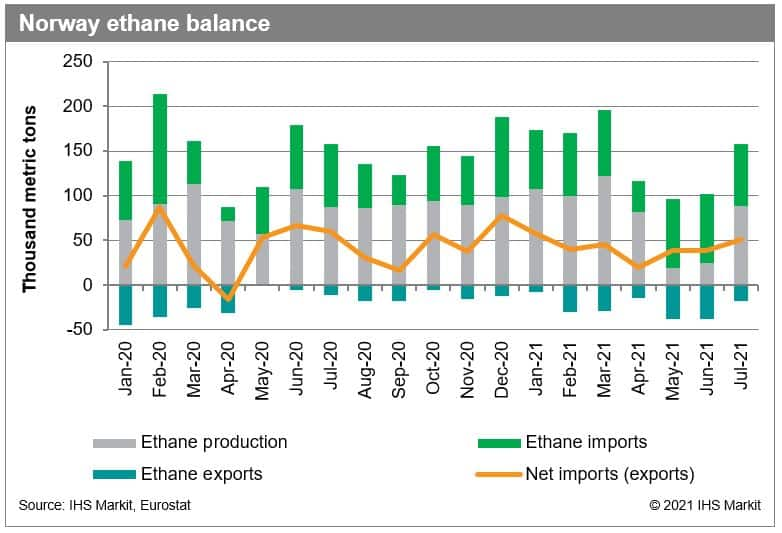

Norway suspends ethane exports

Norway as a country is both an importer and exporter of ethane,

although both production and imports of ethane are much larger than

exports. Ethane is recovered at the Kaarstoe gas processing and NGL

fractionation complex along with propane and butane (LPG) and is

sold domestically and exported. INEOS receives domestic ethane

cargoes at its Rafnes steam cracker and also imports ethane from

the United States. Equinor exports some of the ethane recovered

from Norwegian natural gas production at Kaarstoe.

These activities are separated both geographically and from an infrastructure standpoint; ethane recovered at the NGL fractionators at Kaarstoe for domestic consumption and export is not linked directly to the Rafnes complex. A pipeline project was planned to transport ethane-rich natural gas from Kaarstoe to Rafnes (the Skanled project), but has not been completed. The pipeline was to deliver this ethane-rich gas stream to the Rafnes complex with ethane then extracted and recovered at Rafnes to be used as a petrochemical feedstock. The natural gas stream remaining was planned to be sent on to Denmark and Sweden as a fuel. This project was suspended in 2012 and has not been revived.

Since INEOS began ethane imports to Rafnes in 2016, Norway has been a net importer of ethane in most months. On the export side of the equation, Equinor has ethane supply contracts with both Borealis in Sweden and TotalEnergies in Antwerp, and although volumes are small, exports have mostly been steady month to month (see Figure 1). IHS Markit analysis of recent waterborne ethane liftings from the United States to Norway and receipts and exports of ethane from Norway indicates the export of ethane from Norway fell in September and halted entirely in October.

A summary of the ethane feedstock situation for the two buyers of

Norwegian ethane is as follows. To meet the needs of its steam

cracker at Stenungsund, Sweden, Borealis imports ethane both from

Norway and the United States. Borealis has ethane supply contracts

with shale gas producers in the Marcellus and Utica plays in the

northeastern United States and imports cargoes originating at the

Marcus Hook terminal near Philadelphia, Pennsylvania. IHS Markit

expects Borealis will increase its lifting at Marcus Hook to fill

the gap left by the loss of Norwegian supply.

The other buyer of Norwegian ethane, TotalEnergies, receives ethane

at its petrochemical complex in Antwerp, Belgium. TotalEnergies

does not have any direct access to US ethane supply, and there is

no established market for spot ethane cargoes. In the past, INEOS

has at times used its surplus US ethane terminal and shipping

capacity to sell spot ethane cargoes to other companies, including

several to Borealis during the period before its US supply contract

came into effect in 2020. This is one possible remedy, as is

switching feedstock in Antwerp from ethane to propane or butane.

Borealis also has such flexibility, but current ethylene production

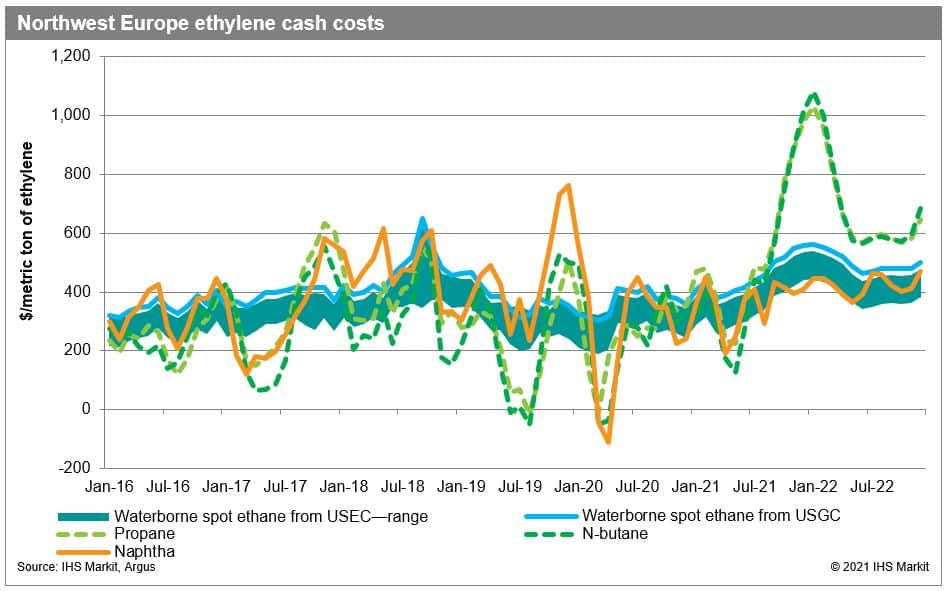

economics make this very unlikely for both companies. Both propane

and butane are widely unfavorable to both US-sourced ethane and

European naphtha on an ethylene cash cost basis (see Figure 2).

In October and November IHS Markit's Waterborne LPG has observed three ethane cargoes from the US to Antwerp. One of these originated at Marcus Hook on one of INEOS' Dragon-class ethane carriers, and the other two came from Morgan's Point on Navigator vessels. INEOS and possibly another buyer with access to US ethane supply and terminal capacity is selling some spot volumes to TotalEnergies to make up the gap left by lower Norwegian output.

Another possibility would be Equinor sending its ships to the

United States to lift ethane cargoes. This would require an

agreement with one of the US terminal capacity holders, which could

be possible given current utilization rates. In 2021, utilization

has been below 80% at all three operational US ethane export

terminals.

Gain greater insight into global and regional ethane and NGL markets with IHS Markit Midstream Oil and NGLs research. Learn more here.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.