Asia Pacific Regional Integrated Energy Research Highlights: Q1 2023

In the first quarter of 2023, 21 new insight papers have been published in the S&P Global Commodity Insights Asia Pacific Integrated service, apart from the regularly updated reports. This research highlight summarized the key impact papers and provided an overview of the market signposts in Q1. Links to a select set of reports are provided below.

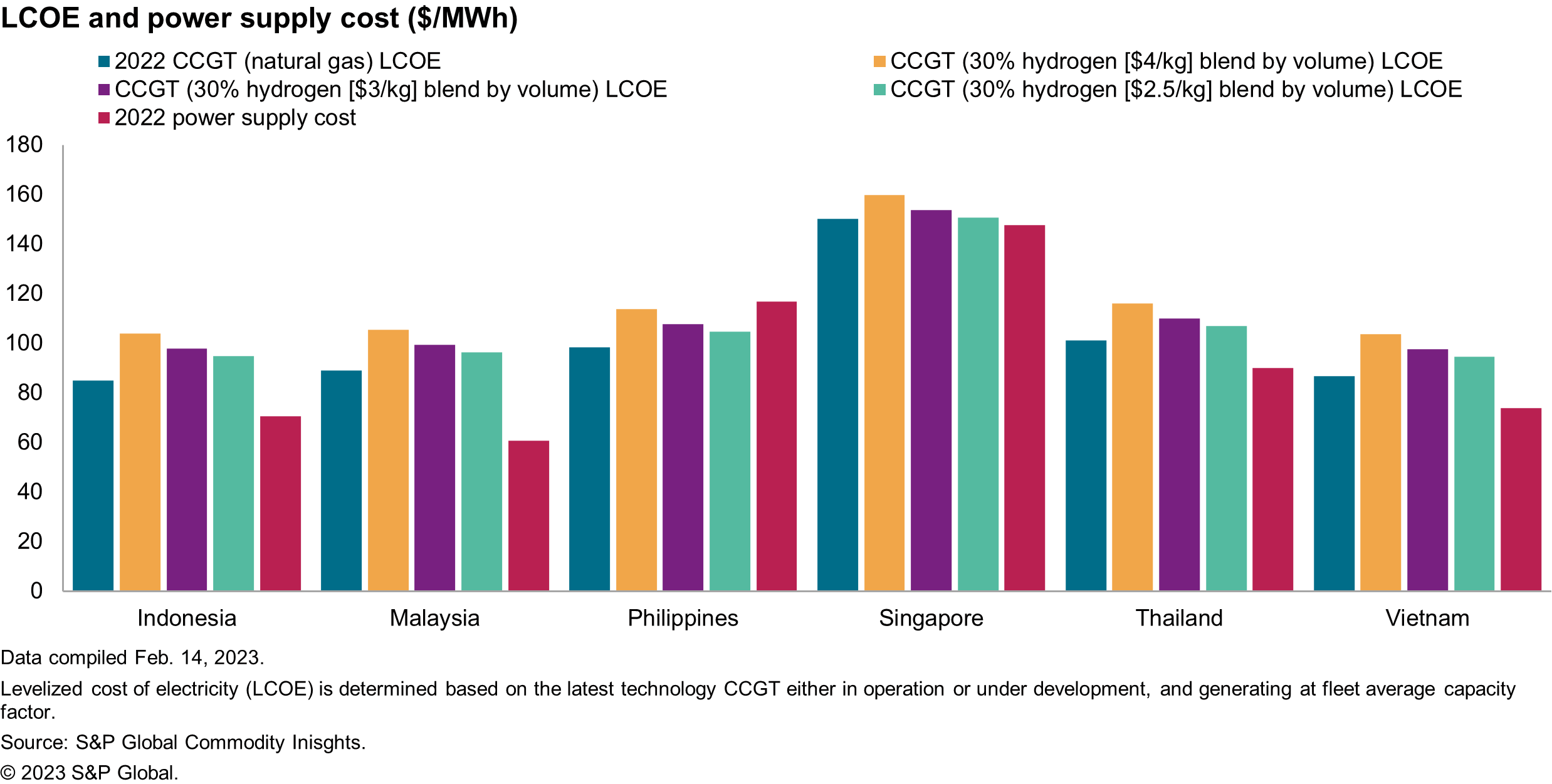

The graphic of the quarter is selected from Post-coal-to-gas switch, what's the next fuel option for Southeast Asia? showing the levelized cost of electricity of combined cycle gas turbine (CCGT) using natural gas and hydrogen blends versus the power supply cost.

Post-coal-to-gas switch, what's the next fuel option for Southeast Asia?

Southeast Asian governments have been revising their power development plans to reduce the reliance on coal and switching to gas and renewables. Gas-fired generation capacity is estimated to grow by 30%, to 130 GW, by 2030. Although a switch from coal to gas will reduce emissions, natural gas-fired generation is not a zero-carbon source. This opens up the opportunity for renewable hydrogen, which is zero-carbon to fuel gas turbines. But will this be an economical option in a region where affordability is a paramount concern? Instead of importing, could domestic hydrogen production be the solution?

Decarbonization after the scheduled coal-to-gas switch will incorporate the use of hydrogen to allow continued use of thermal power plants. Fossil fuel generation will remain a sizable part of the region's generation mix, contributing to just less than 50% of total generation by 2050. This will result in emissions remaining quite substantial, owing to the growing power demand, and gives rise to the need to adopt lower-carbon fuel. Many countries in the region intend to tap on hydrogen as a fuel for power generation, to allow continued use of existing and currently under construction power plants, with some upgrades/retrofits required to allow for the blending of either hydrogen or ammonia, instead of requiring entirely new builds or the early retirement or a change of role for a substantial amount of capacity, which may give rise to supply security concerns.

Hydrogen will be a relatively more expensive fuel, with prices estimated at $40/MMBtu compared with coal or gas, and is a costly option for power generation for the region. This is equivalent to about four times the 2022 average delivered gas price in Southeast Asia, and even with cost declines, the delivered cost of renewable hydrogen is forecast to reach $3.5/kg ($27/MMBtu) by 2040. This high cost of imported green hydrogen will be detrimental to the adoption into the region's generation fuel mix, where the current levelized cost of electricity for a combined-cycle gas turbine utilizing natural gas as a fuel is already higher than the average power supply cost. Therefore, the adoption of hydrogen, even at a 30% blend by volume, appears untenable as it will drive up the power supply cost further and will raise affordability concerns.

Hydrogen blending is expected in the region, albeit still in small proportions. Across Southeast Asia, S&P Global Commodity Insights forecasts in its base case outlook that renewable hydrogen generation will reach 2.5% of the total generation by 2050, which translates to 77 TWh, with four countries adopting renewable hydrogen into the fuel mix. There is upside potential, which will be dependent on policy support and decline in cost of renewable hydrogen, which may be contingent on cost reductions in transportation and production, as well as the possibility for domestic production.

Read more in our article, Post-coal-to-gas switch, what's the next fuel option for Southeast Asia?

Seizing wind investment potential in Southeast Asia

Vietnam and the Philippines have been gaining traction among offshore wind developers and investors. Technical potential for offshore wind resources is estimated at 600 GW and 178 GW, respectively, and policies are being formulated to facilitate project development. However, both markets are nowhere close to reaching a commercial stage—no single de facto offshore wind project is in full operation yet, the permitting process in many parts of the development stage remains obscure, and mobilizing resources from the international capital market remains limited. Developers need to be wary of various challenges in permitting, supply chain, and financing when crafting a go-to-market strategy.

Vietnam and the Philippines have raised their ambition for offshore wind, capitalizing on their vast resource potential. According to the latest draft version of Power Development Plan VIII (PDP8), Vietnam aims to achieve up to 7 GW of offshore wind capacity by 2030, up from 6 GW in PDP7 (onshore and offshore wind combined). While there is no explicit offshore wind capacity target set for the Philippines, the Department of Energy (DOE) raised the wind capacity target for 2040 from 12 GW to 17 GW in the latest National Renewable Energy Program. Nevertheless, detailed implementation plans and coherent near-term targets will be needed to give a clear policy signal to market participants.

International developers are actively seeking a partnership with Vietnamese firms, with two-thirds of offshore wind project pipelines jointly owned by international and local companies. European companies are particularly active, making up 52% of total attributable capacity of offshore wind projects in a preconstruction stage. Localization is also becoming prevalent in building supply chain, as Vietnamese firms could offer their knowledge on regulatory environments and provide access to necessary infrastructure, building on their experience in various shipbuilding and oil and gas projects.

The new tariff proposed by Vietnam Electricity (EVN) will make most transitional wind projects unprofitable. The proposed tariff at 7.9 cents/kWh will reduce post-tax equity internal rate of return (IRR) to 5-9%, down from 11-15% under the previous feed-in tariff (FIT), making the profitability of transitional wind projects not commensurate with a hurdle rate by many developers. Companies will need to put cost optimization as a priority, as tariffs become less attractive and a planned transition to the tender will only give more cost pressure.

Risk mitigation in financial structuring is required to unlock low-cost international capital. Vietnam needs massive financing for offshore wind, which could not be provided by local lenders alone. Credit enhancement mechanism such as sponsor support or export credit agency (ECA)-backed financing will be needed to attract international lenders.

Read more in our recent article, Seizing wind investment potential in Southeast Asia

The road is long in Singapore's hydrogen journey

Singapore's first National Hydrogen Strategy outlines ambitions on using hydrogen to achieve a net-zero target. Before large-scale hydrogen can be deployed, a supply chain needs to be built for this nascent sector. Furthermore, new facilities ranging from import infrastructure to distribution pipelines and the overhaul of end-user industrial equipment will be necessary.

In shipping, Singapore is exploring several hydrogen carriers, among which liquefied hydrogen is likely to be the most expensive. The high cost of liquefaction, transport and storage infrastructure for liquefied hydrogen forms the bulk of our cost outlook for this carrier form. Meanwhile, while the ammonia global supply chain is well-established, the high cost of extracting hydrogen from ammonia will be a key obstacle in Singapore's hydrogen transition. It is still uncertain which carrier mode will dominate global trade and this uncertainty will slow hydrogen adoption.

Finally, access to financing with support from the government will be necessary to attract capital required for this transition. Markets around the world are considering various support mechanisms in the form of tax reliefs, grants or even subsidies. While Singapore has a carbon tax in place, further support will be necessary to improve the commercial viability of these low-carbon projects.

China's LNG imports: Marginal supply in domestic market, key mover in global trade

In 2022, China played an instrumental part in balancing the global market as it recorded a 16 million-metric-ton (MMt) decline in LNG imports, freeing up more volumes for Europe. A key question is how much Chinese LNG demand will return this year and beyond and what it means for the global balance.

In 2023, China will not regain the title of the largest LNG importer despite growth. A muted economic rebound following the lifting of the zero-COVID policy—due to the real estate market downturn and weak export demand—and rising coal and renewable availability will keep Chinese gas demand growth at 7%. Domestic production growth, the planned ramp-up of Russian pipeline supply, and high spot prices will limit incremental LNG imports to 5 MMt, mostly from term contracts.

China will continue to be a swing factor in global trade. Gas, LNG imports, and spot LNG serve as the last energy supply options, at their peaks only accounting for 9%, 3%, and less than 1%, respectively, of China's energy demand. On the other hand, China accounts for a large chunk of global LNG trade—21% of global LNG demand at the peak in 2021. This contrast will not change significantly in the future.

China will not, however, replace Europe as the LNG market of last resort. Compared with Europe, China has less flexible supply options, limited storage capacity, and a much lower coal-to-gas switching point. Furthermore, domestic gas price regulations and the role of the national oil companies mean that some spot purchases at high prices can still be procured for supply security and sold into the domestic market at an average cost.

South Korea's new electricity plan confirms government nuclear ambitions, but implementation will not be easy

On 12 January 2023, the government of South Korea unveiled the country's 10th Basic Plan for Electricity Supply and Demand, the first to be released under the administration of President Yoon Seok-yeol. A key component of his energy policy is a reversal of the previous administration's plans to phase out nuclear power generation, and this has been reflected in the updated plan.

Nuclear power is projected in the plan to account for 32.4% of electricity generation in 2030 and 34.6% in 2036, underpinned by extending the life span of 12 reactors beyond their original 40-year lifetime and building two additional nuclear reactors closer to 2036. However, the government's bets on boosting nuclear power generation as a key pillar to meet South Korea's 2030 nationally determined contribution (NDC) commitment will be contingent on accelerating massive new infrastructure build and streamlining the permitting process.

South Korea's ambition for nuclear energy could bring significant benefits to the economy, hit hard by high import fuel prices, but implantation will not be easy. South Korea's highly divided stance on nuclear energy from the two main political parties indicates that any nuclear restart or new-build plan after Yoon's term expires in 2027 will be highly uncertain.

The actual operating capacity of nuclear power plants will be much lower than the stated capacity in the plan. The new government aims to accelerate the evaluation process for lifetime extensions, but nuclear reactors in South Korea have been required to stay idle for a few years after reaching the end of their original 40-year lifetime owing to the lengthy and complicated process needed to resume operations.

The sluggish pace of expanding the grid network and building hydrogen import infrastructure points to a need for higher LNG demand than in the plan. In the short term, South Korea's prolonged transmission lines on the east coast will likely limit output from new coal-fired power plants until 2026. The country's aim to boost the use of hydrogen for cofiring in gas generators may face barriers in infrastructure and regulations, calling for higher LNG consumption than in the plan if not successful.

Additional Insights and Strategic Reports published in first quarter 2023

- How the smaller South Asian countries fared in energy and power last year and what to watch out for in 2023

- Priority areas and enablers of net-zero transition in India's Long-Term Low Emission Development Strategy

- India's power sector prepares for another hot summer in 2023

- India prepares national carbon market under Energy Conservation (Amendment) Act to deliver on NDC goal; future carbon price rise limited by plans to increase supply

- Asia Pacific renewable corporate power purchase agreement—Fourth quarter 2022

- A year after China's accelerated power price reform: Will 2022's high prices continue in 2023?

- Malaysia's MRP price mechanism suggests limited exposure to the spot LNG market

- Seizing offshore wind investment potential in Vietnam

- China power long-term outlook update: Accelerating green energy transition

Learn more about our Asia-Pacific energy research.

Logan Reese, associate director on the Asia Pacific Gas, Power, and Climate Solutions team, covers the gas, power, and renewables markets in Australia, focusing on market fundamentals, power and renewable developments, and policy developments.

Ankita Chauhan, senior research analyst on the Asia Pacific Gas, Power, and Climate Solutions team, covers research and analysis for the South Asian power and renewable markets, including India, Pakistan, Bangladesh, and Sri Lanka.

Posted on 1 May 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.