Buying the right renewable energy certificates in India

The Renewable Energy Certificates Regulations, 2022, came into effect on Dec. 6, 2022, in India, aiming to restructure the local renewable energy certificate (REC) mechanism. The new regulations introduce the concept of REC multipliers by technology, increase the validity of RECs to perpetuity until sold and, most vitally, remove the floor and the ceiling price for REC trading.

Historically, the trading happened within a regulated band of a ceiling and a floor price as determined from time to time by the Central Electricity Regulatory Commission (CERC). The ceiling price of a solar REC came down from $215/MWh in 2010-12 to under $30/MWh in 2017-21. While the traded price has come down by more than 90%, from about $121/MWh in 2011 to about $13/MWh in 2023. Similarly, the REC price of non-solar, which started at a lower cap of $19/MWh, has also come down by about 30%, to $13/MWh, during the same period.

The demand for green energy attributes is increasing with higher RPO and voluntary sustainability targets. However, the local REC market remains constrained owing to high market and regulatory uncertainty and the new regulations fails to address the demand-supply gap. Two of the major reasons for lower demand for RECs are the states' RPO targets being lower than federal targets and the second reason is the chronic noncompliance of those targets. The majority (80%) of the states RPO targets were on an average 30% lower than the federal RPO target of 19% for the fiscal year (FY) 2021. A similar trend is expected to continue despite a new and higher RPO trajectory, with a 43.3% target by FY 2030. Similarly, only a handful of states fulfill their RPO through purchase of either renewable electricity or certificates.

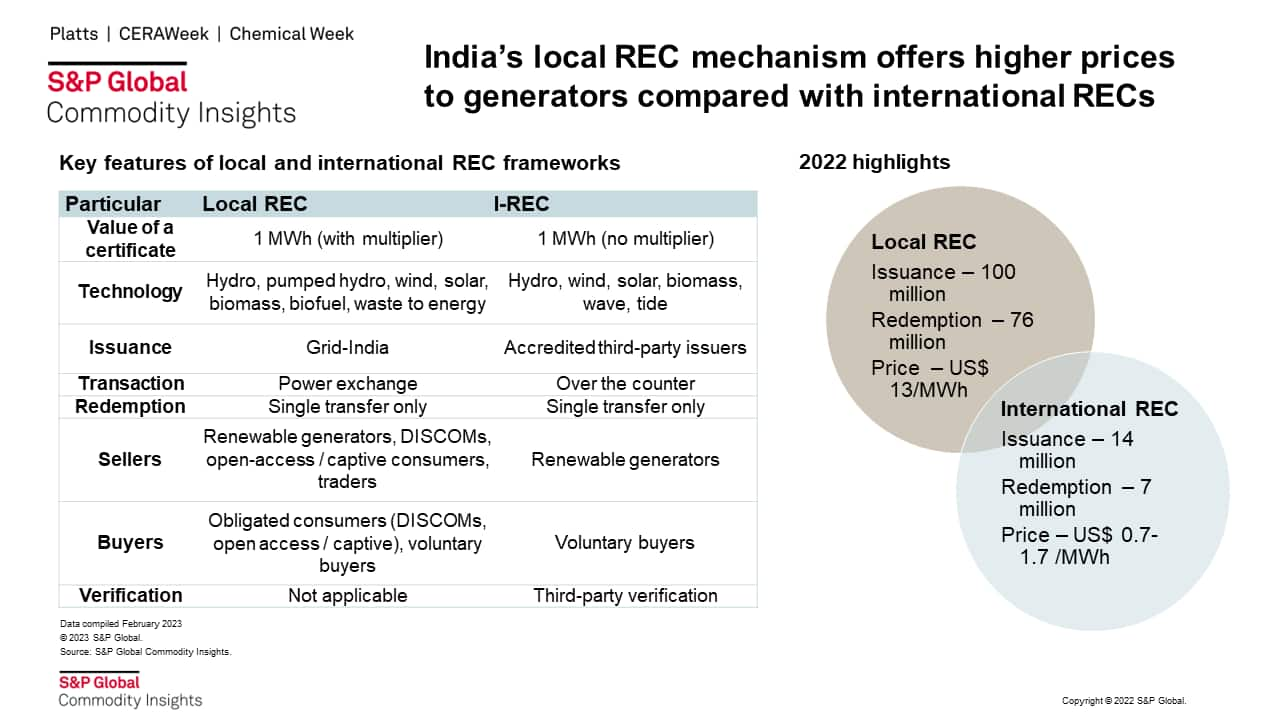

As the local REC market maneuvers the ebbs and tides of regulatory uncertainty, renewable generators are looking for alternate market-based mechanisms. While the local REC market caters to the obligated consumers that have policy obligations to purchase renewables, the international renewable energy certificate (I-REC) mechanism is directed toward the voluntary market. The I-REC framework enables these corporations to purchase green attributes that are unique, trackable, reliable, and cost competitive. Besides, the new regulations allow for Over the Counter (OTC) trading of RECs and is expected to boost the corporate demand for RECs to meet the sustainability goals.

As the I-REC prices are significantly lower than the local REC prices, it could deter renewable generators in India from registering with the international mechanism and trade locally in voluntary market. The price of I-RECs that originated from India ranged between $0.7/MWh and $1.7/MWh during 2022, whereas local RECs are priced about 10 times the value of I-RECs in India, at about $13/MWh. The I-REC market is currently only attractive to generate additional revenue for projects and is expected to remain a short-term solution for India until the market matures and introduces financial instruments in the electricity market.

Local REC premiums need to adjust to market price signals. Solar photovoltaic (PV) and onshore wind generators will no longer require a premium to be commercially attractive or viable, as the levelized market capture price for these technologies will be higher than the cost. On the other hand, hydro, biomass, and battery storage projects may extract a premium of $14-$40/MWh in 2023 and decline to $10-$20/MWh in 2030.

However, the future of the REC market could also be mired with uncertainty as India plans to introduce a carbon market, potentially absorbing the REC market with competition from other emission reduction solutions.

Learn more about our research into Asia-Pacific energy and the clean energy procurement market.

Ankita Chauhan, senior research analyst on the Asia Pacific Gas, Power, and Climate Solutions team, covers research and analysis for the South Asian power and renewable markets, including India, Pakistan, Bangladesh, and Sri Lanka.

Posted on 1 May 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.