Asia Pacific Regional Integrated Service Research Highlights: Third quarter 2023

In the third quarter of 2023, 25 new insight papers have been published in the S&P Global Commodity Insights Asia Pacific Integrated service, apart from the regular updated reports. This research highlight summarized the key impact papers and provided an overview the market signposts in Q3. A link to a select set of reports is provided below.

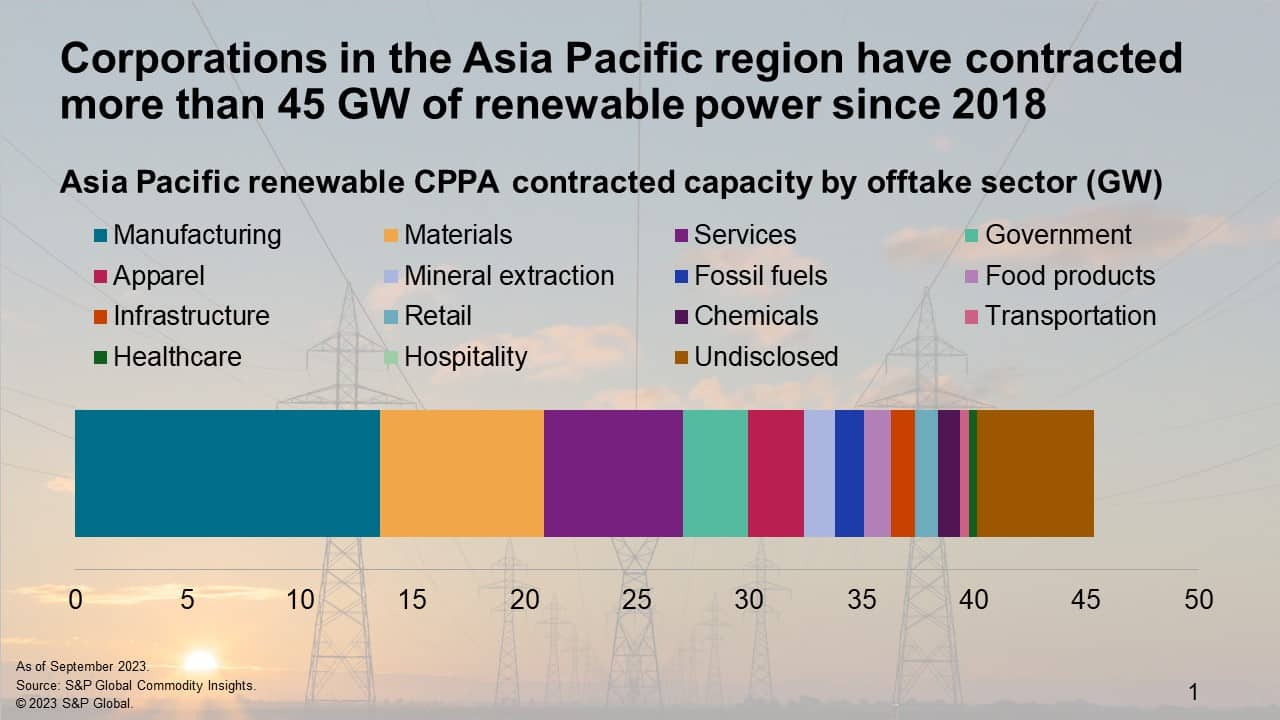

The graphic of the quarter is selected from "Asia Pacific renewable corporate power purchase agreement — Q2 2023", showing the total contracted capacity by offtake sector 2018-Q2 2023.

Asia Pacific renewable corporate power purchase agreement — Q2 2023

The role of corporate power purchase agreements (CPPAs) in facilitating renewable power additions is increasing in the Asia-Pacific region. The second quarter of 2023 recorded a sharp rise in contracted capacity with a 74% increase over the prior quarter, though with a similar number of deals. Within 8 of the 15 markets tracked by S&P Global Commodity Insights, there are 453 deals with total capacity of 8.1 GW signed across Asia-Pacific in second quarter 2023 — bringing the total CPPAs in the region to 3,560 deals and 45.2 GW contracted to date.

The top three markets in contract capacity in second quarter 2023 are mainland China, India and Taiwan. Mainland China and India recorded only 22 and 53 deals but have seen large-size agreements among them — contracting a total of 3.5 GW and 2.9 GW, respectively. Conversely, Taiwan contracted a total 1.1 GW of capacity but accounted for nearly 70% of the CPPAs in the quarter — an average of less than 1 MW per deal.

Southeast Asia reported only a limited number of deals in this quarter owing to relatively undeveloped CPPA markets in the region — limiting procurement options. Out of the eight Southeast Asian markets, Malaysia and Thailand were the only two markets that made CPPA announcements in this quarter with three deals each and contracting 15 MW and 4 MW, respectively.

The manufacturing sector accounts for 67% of the total contracted capacity in this quarter — totaling at 5.4 GW — its largest capacity contracted in a quarter on record that was led by multiple deals in mainland China and India. The materials sectors added the second-largest volume (like the first quarter) at 1.1 GW of contracted capacity. These sectors are followed by the government, services and chemicals sectors, contracting 315 MW, 292 MW and 139 MW, respectively — capacities similar to the first quarter of 2023.

A total of 107 new corporations entered the CPPA market in this quarter — a similar number to previous quarters. On average, new corporations contracted approximately 17 MW per deal, up from an average of 9 MW per deal from new market entrants in first quarter 2023. Together, they accounted for 107 deals (one deal from each offtaker) and 1.8 GW or 22% of the quarterly contracted capacity. Offtakers that signed a CPPA in one of the previous quarters, represented by the remaining 123 offtakers in second quarter 2023, accounted for 346 deals and 6.3 GW capacity in total.

Third-party access at PipeChina's terminals: 2022 summary and outlook for the rest of 2023

In 2022, weak domestic gas demand and elevated global spot prices reduced China's appetite for LNG and throughput at China Oil and Gas Pipeline Corp.'s (PipeChina) terminals. In the first half of 2023, as China's LNG imports returned to growth, service volumes at PipeChina's LNG terminals increased by 12% year over year.

PipeChina's terminal utilization is expected to rise in 2023 but remain below 2021 levels. China's demand for gas will return to growth but still be limited from weak economic rebound and surging coal and renewable capacity. Continued growth in domestic production and ramping delivery from Russian pipeline imports will constrain LNG import growth.

Chinese non-national oil companies (non-NOCs) will be relatively quiet with third-party access (TPA) at PipeChina's terminals. NOCs need access to receive long-term contracted volumes and ensure winter supply security. Non-NOCs, many of them having their own terminals, may take advantage of lower spot prices during the summer season to import cargoes but the anticipated global price increase in the 2023-24 winter season may keep them out of the market.

PipeChina's current spare capacity can accommodate another 24-25 cargoes per month should LNG demand rise. If China's LNG demand grows faster than anticipated, be it extreme winter weather conditions or lower supply from other sources, PipeChina's LNG receiving capacity can be an accommodating factor.

China's LNG imports surged in June under the impact of extreme weather and declining spot price

In June 2023, China imported 6.3 million metric tons (MMt) of LNG, up 32% year over year and approaching the record for June in 2021. Imports into the southern coast was particularly strong at a 54% year-over-year growth. Declining spot prices and extreme weather conditions — persistent heat waves in Guangdong and a drought in Yunnan — contributed to surging imports.

Strong LNG import growth may not continue assuming normal weather conditions. Economic recovery is relatively muted with policy no longer focusing on coal-to-gas switching. Continued growth in domestic production and ramped-up delivery from Russian pipeline imports will limit the growth of LNG imports.

Spot LNG will remain a premium energy supply source in the domestic market. Current fuel cost differential still favors coal over spot LNG on a short-run marginal cost (SRMC) basis in power generation. In general, to be profitable, The Japan Korea Marker (JKM) needs to fall to $5.6/MMBtu in the regulated wholesale gas market and $8.5-$9.5 in the deregulated market.

If energy demand is stronger than expected, China may procure spot even at high prices. The national oil companies (NOCs) will purchase some spot cargoes even at high prices to maintain a certain level of supply security, given their ability to absorb expensive costs into their portfolios. On the demand side, gas-fired power generation can swing widely depending on weather conditions as it plays the role of peaker to maintain power system reliability.

Scaling up renewable investments in India: Fighting back funding bottlenecks

Renewable energy is a key pillar to meet India's climate goals, with a target to reach more than 500 GW of capacity by fiscal year (FY) 2032. India needs to more than triple its annual average investments for new renewable builds during the next decade, to more than $35 billion during 2023-32 from about $10 billion in annual average investments historically. Several structural, operational and market constraints need to be addressed to not only scale up the financing but also reduce costs.

Financing will need to come from multiple sources, including commercial banks and nonbanking financing companies along with greater government and developmental bank support, public institutions, and private sector investments. As local banks reach the sectoral limits for financing renewable energy projects, regulatory reforms are required to increase the availability of financing in addition to easing restrictions on overseas financing.

Developer track records, credibility of promoters and offtaker risks are key factors in financing decisions. Large portfolio owners have a higher likelihood of handling market risks better. Strategies include distributing assets across different counterparties, choosing offtakers with better credit scores, adopting a mix of renewable technologies, and using a different vintage of power purchase agreements (PPAs).

Overseas equity investments in the renewable sector will help in bringing return expectations down. High competition among renewable independent power producers (IPPs) to win renewable projects has led to adoption of strategies to lower the cost of capital. Access to international capital markets can be enabled through listing companies in overseas stock exchanges, selling operational assets or stakes in pipeline assets to foreign institutional investors, and pursuing yieldco options.

Entry of public sector companies into green segment will push local investments up. Some of the leading public sector utilities have announced targets of more than 180 GW to be achieved in the next 5-25 years. Estimated investment required will be in the range of $100 billion-$200 billion but will need partnerships with experienced players and timely allocation of funds to capture this opportunity.

Policy certainty will be key toward planning investments. India will also need appropriate carbon pricing to reduce carbon emissions to meet its net-zero goals. Carbon pricing will be an important policy tool to not only mitigate the impact of tightening trade policies around sustainability but also create new avenues for attracting capital toward green investments.

India publishes notification of Carbon Credit Trading Scheme and announces voluntary Green Credit Programme: Strategic considerations and implications

India communicated the finalized framework for its Carbon Credit Trading Scheme (CCTS) for the Indian Carbon Market (ICM) via gazette notification on June 28, 2023. The fundamental structure and framework of the ICM is carried forward from the draft stage. However, there are some significant changes compared with the draft CCTS, such as

- A reduction of powers and enhancement of the membership of the ICM steering committee

- An increase in the powers and purview of the ICM administrator

- Detailed guidance on the compliance market development

- A relegation of the voluntary segment of the ICM to a later stage

S&P Global Commodity Insights expects these policy developments to steer the carbon and cobenefit markets in a positive direction.

- Prioritization of the compliance segment in the CCTS will lead to a focused and orderly market development.

- Adding diversity of interests, expertise and opinion to the steering committee will help in effective discharge of functions.

- Allowing GCP projects to register in the ICM will stimulate credit supply from target sectors.

- The CCTS remains nimble to adapt to any outcomes in climate negotiations that may impact the viability of exporting the ICM's voluntary segment credits.

Additional Insights and Strategic Reports published in third quarter 2023

- South Korea's decarbonization plan with clean ammonia

- Northeast India — An investment destination for the natural gas sector

- Shimane nuclear power reactor in Japan will restart in August 2024

- Thailand moving forward on gas market liberalization

- The bare necessities Vietnam requires for domestic gas security

- Will the updated Green Electricity Certificate mechanism reshape green procurement in China?

- Green hydrogen projects and policy development tracker: South Asia

- South Korea's power sector drops coal for gas in early October 2023; tank top for KOGAS?

Learn more about our Asia-Pacific energy research.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.