Nature-based solutions can play a role offsetting emissions in the short term but technology-based solutions are critical to achieve long-term decarbonization targets

To adhere to a 1.5°C pathway, massive deployment of solutions to reduce and remove emissions will be required. Emissions reduction technologies will be the main pathway to meet net zero targets, but these technologies alone will not be enough. CO2 removal (CDR)—achieved through negative emission solutions that either capture or remove CO2 from the atmosphere and permanently store it—will be essential to balance remaining emissions from heavy-emitting-sectors that are difficult to reduce. There are two types:

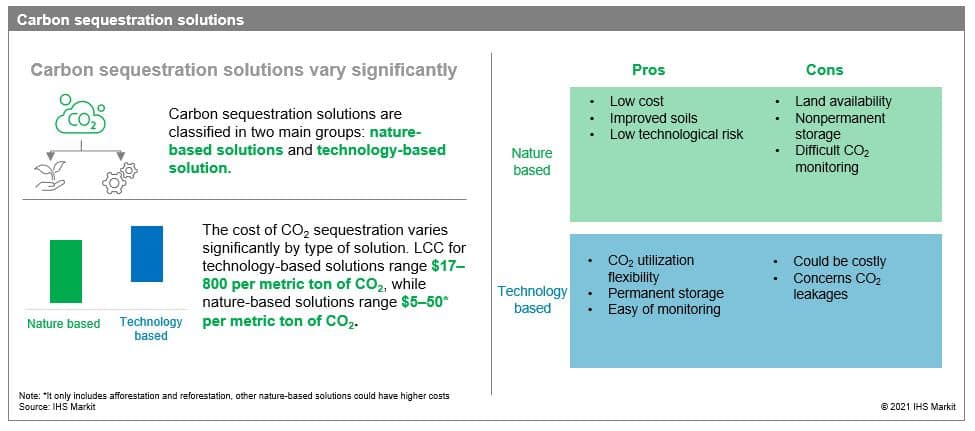

- Nature-based solutions (NBS): Activities that aim to protect, manage, enhance, and restore nature to address challenges and include re/afforestation, soil carbon sequestration and biochar. Some NBS are used as carbon credits in corporate climate strategies.

- Technology-based solutions provide permanent removal and artificial carbon sequestration of CO2. Examples include: Carbon capture, utilization, and storage (CCUS), direct air capture (DAC) and bioenergy with carbon capture and storage (BECCS).

Despite their relevance in the net zero race, the prioritization of these solutions will depend on the attractiveness and maturity of each solution, i.e. project type, time frame, and region specific. Furthermore, each solution has strengths and setbacks. While technology-based solutions are easy to monitor, their cost is still the main drawback for implementing these solutions at large scale. NBS, on the other hand, provide low-cost CO2 removal and no technological risk but are hard to monitor and permanence of carbon sequestration is still uncertain.

Due to their far-reaching impact, NBS credits are more widely used than technology-based solutions. However, they should only be used to offset emissions that cannot be avoided, while easy-to-abate emissions are better addressed being avoided directly or reduced using technology-based solutions.

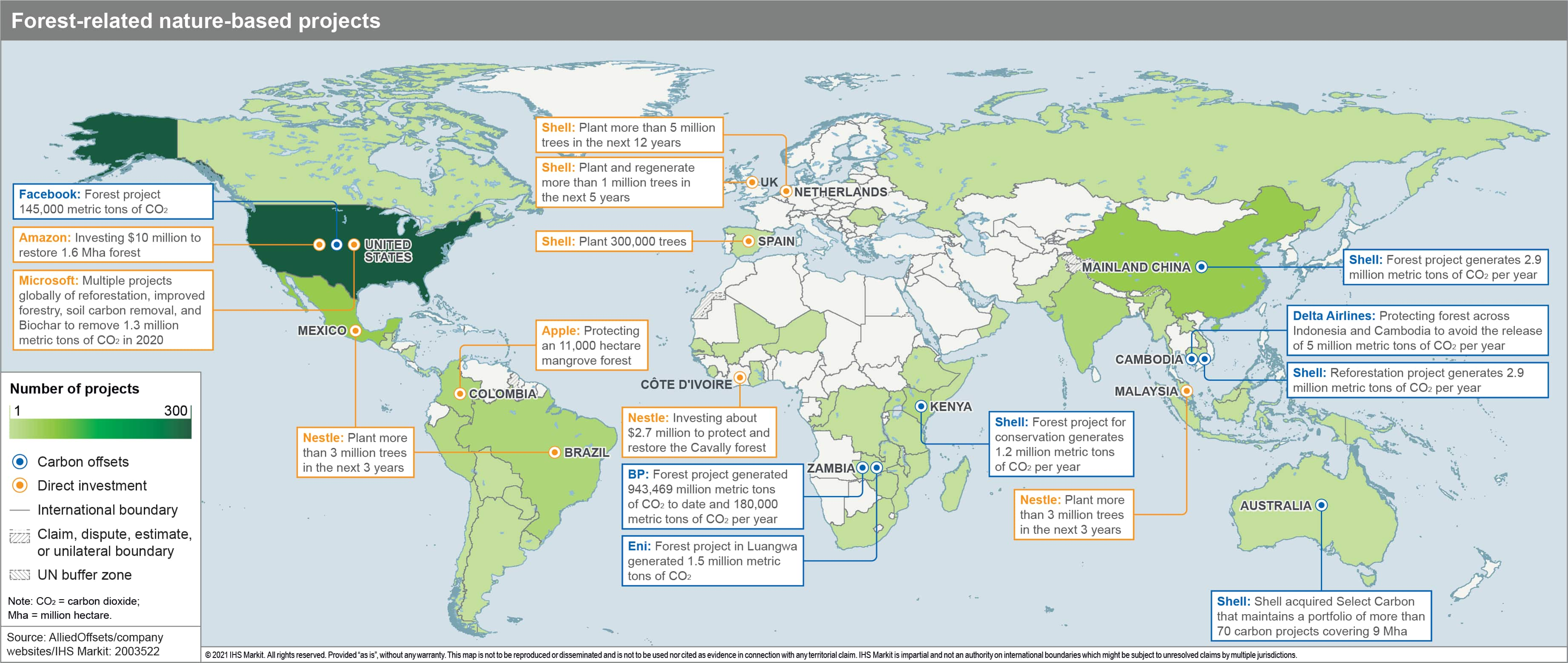

NBS credits have become a key component of meeting net zero targets for many companies, particularly those operating in sectors with hard-to-abate emissions. Giants like Facebook, Delta Airlines, Eni, and BP are investing in afforestation and reforestation projects worldwide through the purchasing of offsets (i.e. third party dedicated entities) to compensate emissions elsewhere in their value chains through the voluntary carbon market (VCM). Other companies like Total and Shell have established dedicated entities for direct investment in NBS including afforestation and reforestation, in fact Total's has publicized plans to invest $100 million annually in these solutions.

Among NBS, two have distinct advantages relative to other methods, being both fully mature and cost-effective. These are afforestation, i.e. planting trees on lands that were originally grasslands or shrublands, and reforestation, i.e. planting trees on lands that used to be forest but were converted to another use. IHS Markit analysis shows that for agriculture, forestry, and land-use (AFOLU) projects, of which reforestation and afforestation are the most common, a metric ton of sequestered carbon is valued at an average of around $4/tCO2e but can reach up to $50/tCO2e, with costs increasing as potential for sequestration decreases with less land availability. These numbers are significantly lower if compared to technology-based solutions ranging from $17/tCO2 to $180/tCO2 (up to $800/tCO2 if DAC is included). With this cost difference, it is not a surprise that some corporations are favoring short-term nature-based solutions over technology-based solutions to align with their corporate targets and accelerate their transition to net zero targets while optimizing investment/making out more for their money.

The trend to favor nature-based in the short term will only gain steam as more companies commit to net zero targets, especially among those with hard-to-abate emissions. Voluntary carbon markets are an area of particular interest as the COP26 UN climate conference develops. Article 6 of the Paris agreement set out broad strokes that permitted the potential use of cross-border offsets in meeting Nationally Determined Contributions to achieve the net zero goals envisioned by the Paris agreement, but individual countries have shied away from designing programs without more specific guidance on which offsets would "count" under Article 6. AFOLU offsets were part of the clean development mechanism (CDM) market under the Kyoto protocol, and holders of those offsets are pressing COP26 attendees to grandfather in those credits to any Article 6 agreement as well.

A widespread application of NBS is not exempt from controversy. Although NBS credits are attractive to corporations with aggressive climate targets required to show immediate results, concerns remain over a heavy dependency on these solutions that focus on offsetting emissions instead of reducing or avoiding them. For some critics, a ton of CO2 compensated replaces the need to reduce emissions in line with science, a concept that has been coined as greenwashing. Moreover, accounting for emissions from afforestation and reforestation projects is challenged by the absence of universally accepted standards or oversight and the potential for double counting, as well as issues of actual sequestration capacity and project permanence including physical risks (i.e. natural disasters as fires, earthquakes, etc.) and the implications they would have over offset contracts. There are also additional questions related to how forestry projects linked to carbon credits should be managed over time, the quality of the reductions as well as concerns over lifecycle emissions, and some past cases of fraud that impacted industry reputation. COP26 will be crucial to reduce uncertainty around these topics and provide a policy and legal roadmap for these solutions.

Overall, NBS enable companies to positively contribute to climate action via the generation of co-benefits for adaptation, biodiversity, and other sustainable development objectives. As critical tools to deliver global climate goals, they will likely play a relevant role in the VCM in the short-term due primarily to their lower cost. However, as offsets prices increase, given higher market demand, technology-based projects will become a more permanent and attractive solution in the long-term - as policy support and project economics improve - with less uncertainty around emission reduction accounting, permanence, and monitoring. As companies keep developing their net zero strategies, they should rely on offsets for their residual emissions and continue advancing technology-based solutions to reduce emissions as their focus.

Companies should keep in mind that when NBS credits occur outside the value chain, they should not be captured as a company's decarbonization strategy nor as a mitigation outcome. In other words, NBS credits do not represent a company's GHG reduction. By doing so companies may undermine their efforts to accelerate the adoption of technology-based solutions. If NBS investments occur within the supply chain, they should be credited as part of the abatement efforts following adequate GHG emissions methods. The companies that follow these foundations will lead the way and act as reference point for other corporate actors.

Clients are welcome to contact us with questions and anyone else can schedule time with our experts (as short as one hour) to discuss our insights, via our new Experts platform.

For more information about our Global Clean Energy Technology service and access to sample insights, request free access to our Climate and Sustainability Hub here.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.