North American Crude Oil Markets Short-Term Outlook - October 2021

Dampened US supply reactivity is leading the international oil market to a new, higher price band

United States (US) E&Ps are set to register their strongest free cash flow results in years

Strongest free cash flow is expected to be registered by US E&Ps thanks to surging oil and gas prices and restrained spending. We continue to expect these producers to exert spending restraint through the end of the year as they focus on repairing balance sheets and delivering robust cash returns to investors.

By 2022, we believe the pathway to volumetric growth will emerge, as West Texas Intermediate (WTI) prices averaging in the $70s should allow producers to deliver both meaningful returns of capital to shareholders and boost spending to support volume growth. Base decline rates have also materially decelerated given the decline in new well additions in 2020-21 compared with previous years; this will make growth easier next year.

We are projecting US crude oil production to increase by 700,000 b/d in both 2022 and 2023. We have left our 2022 US supply outlook unchanged (+700,000 b/d) despite our upward revision to WTI prices of roughly $15/bbl in fourth quarter 2021 and $11/bbl in 2022.

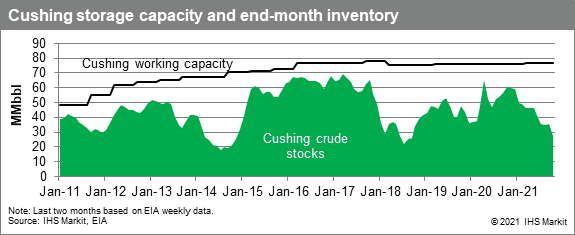

Cushing inventories likely headed toward tank bottoms

Backwardation in the WTI forward curve has reached the highest level since 2014, both reflecting a tightening crude balance in the US Midcontinent and reducing incentive to store barrels at the Cushing hub. Price differentials will shift to eventually replenish storage levels: we expect Cushing prices to strengthen relative to Midland and Houston to attract barrels from the Permian Basin and reduce outflows to the Gulf Coast, where inventories are fuller.

Light, sweet crude supply is tightening in the US Midwest and Midcontinent

PADD 2 and PADD 4 crude oil production is averaging about 400,000 b/d lower this year than in 2020, reducing light, sweet supply to regional refineries. Meanwhile demand for crude in the region has been robust, with PADD 2 refinery throughput at times exceeding 2019 (prepandemic) levels. As a result, inventories are not just low at Cushing—at various hubs throughout PADD 2, they are at levels not seen since 2015.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.