China’s LNG demand rebound has started, but will it accelerate?

China's LNG demand growth has resumed since March 2023. According to S&P Global Waterborne data, Chinese LNG imports rose 16% year over year in March 2023, breaking the long streak of continuous decline since January 2022. Will this growth accelerate for the rest of 2023?

Multiple factors contributed to the healthy growth in March.

First, the low-base effect. March 2022 LNG imports were down 17% year over year, compared with an 11% decline in January-February 2022.

Second, market sentiment following the lifting of the "zero-COVID" policy. February 2023 LNG imports were mostly procured during December 2022-January 2023 when the "zero-COVID" policy just ended and the market was still worried about infection rate and the impact on economic growth. By the end of January and early February 2023, this concern gradually faded away as the first wave of COVID-19 infection seemingly passed rather quickly, prompting LNG importers to take advantage of falling prices to restock with March cargoes.

Third, low pipeline imports — Central Asian pipeline exports to China were particularly weak during the 2022/23 winter season. In fact, Uzbekistan volumes stopped altogether in the first quarter of 2023 to address the country's own surging domestic winter gas demand. As a result, more LNG imports were needed to fill some of the gap in March.

Finally, the last month to use TPA slots. This is a new factor in China's gas market, with the national pipeline company, China Oil and Gas Pipeline Network Corp (PipeChina), taking over seven LNG receiving terminals from the three national oil companies (NOCs) and granting more TPA to these terminals in recent years. March is the end of the annual gas year for TPA slots at PipeChina's terminals. Third parties have delayed using their slots throughout the 2022/23 gas year owing to a combination of weak domestic demand and high spot prices. These companies, especially second-tier LNG importers without their own terminals, procured cargoes for March 2023 deliveries to utilize slots they already committed. Otherwise, they not only will forfeit the deposit but also could be marked as unreliable shippers for future rounds of TPA slots.

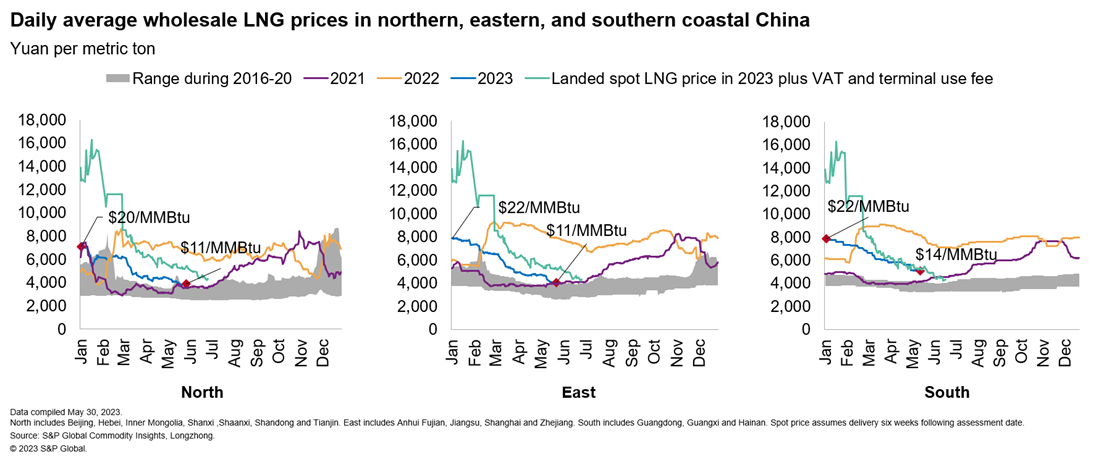

Figure 1

But market sentiment remains bearish. LNG import growth remained relatively healthy but decelerated to 14% in April and 12% in May based on preliminary data. During the first five months of 2023, spot cargoes still sold into the domestic market at a loss (see Figure 1). Spot prices have been declining, but so have trucked LNG prices in the domestic market. In fact, the lack of spot demand from China contributed to the low spot price environment for summer deliveries. China's economic recovery will still be under pressure from the real estate market downturn and weak export demand. More crucially, current policy priorities are economic growth stability and energy supply security. The coal-to-gas policy, the key driver behind Chinese gas demand growth in recent years, is no longer a top priority, given the higher cost of natural gas compared with alternatives.

In the meantime, there will be more domestic coal and renewable resources available for energy consumption this year. In 2022, over 280 million metric tons per annum of thermal coal mining capacity was added — equivalent to almost 200 Bcm of gas — and will support domestic coal production growth this year and beyond. Another 500 million metric tons per annum of capacity is under construction. About 120 GW of wind and solar capacity was added in 2022 — larger than China's entire existing gas-fired power fleet. Another 165 GW of renewable capacity is scheduled to come online this year.

As a result, we expect Chinese gas demand growth in 2023 to remain in the single digits — 7% in our current outlook instead of the double-digit levels of the recent past.

China's LNG imports are anticipated to grow but will remain well below the 2021 peak levels. Domestic production growth, Central Asian imports recovering after the end of the winter season and the planned ramp-up of Russian pipeline supply along the Power of Siberia 1 pipeline — adding another 7 Bcm year over year — will also limit China's LNG imports demand.

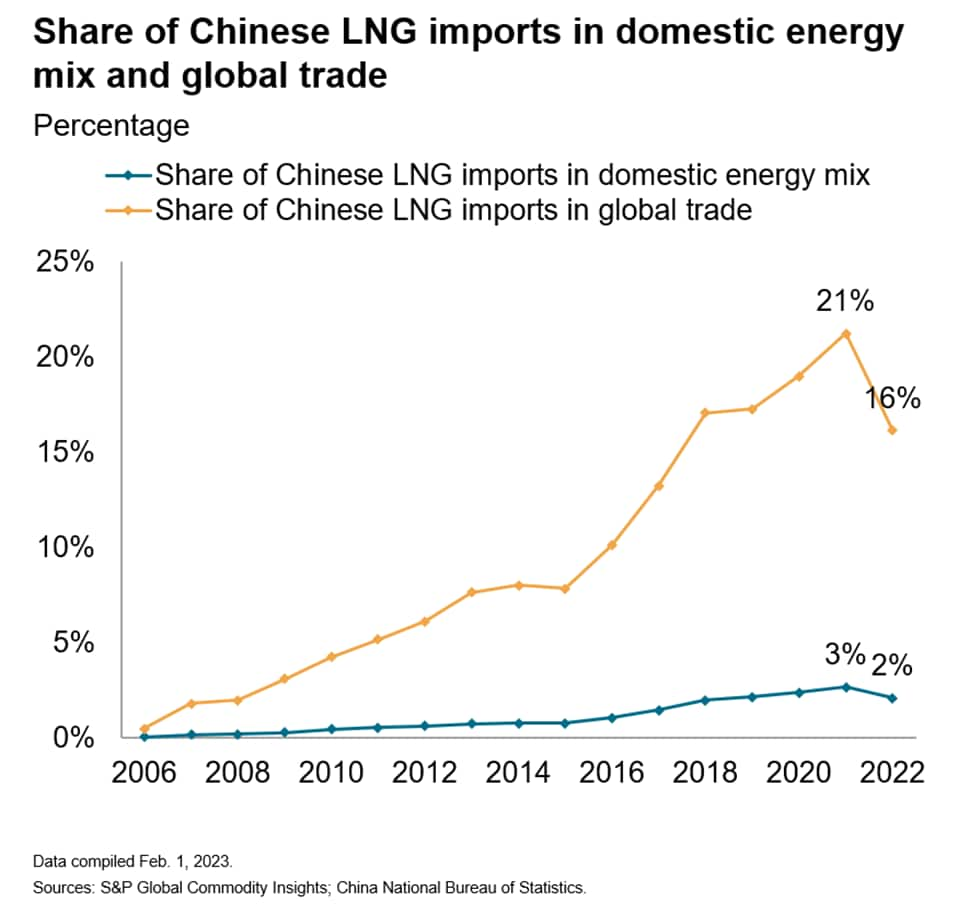

Figure 2

Uncertainty for Chinese LNG demand in 2023 comes from economic growth (particularly industrial activities), spot price levels and government policies. LNG imports may represent only 3% of China's energy consumption and spot LNG purchases much less than 1% of total energy demand, but China's LNG demand and spot purchases could have a significant impact on global trade (see Figure 2). Therefore, changes in China's domestic energy supply demand dynamics will continue to be a critical swing factor in the global LNG trade, given that LNG imports play the role of marginal gas supply and gas plays the role of marginal energy supply in China.

Learn more about our APAC energy research

Jenny Yang is a Senior Director covering Greater China's gas and LNG markets.

Posted 5 June 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.