India’s draft carbon market framework: Building stakeholder confidence

The Ministry of Power (MoP) released a draft on the Carbon Credit Trading Scheme (CCTS) on March 27, 2023, with the aim to establish a framework for the Indian carbon market (ICM). The ICM derives its legislative foundation from the Amendments to the 2001 Energy Conservation Act, adopted by the Indian legislature in December 2022. Prior to this, a more comprehensive draft carbon market policy document was formulated by the Bureau of Energy Efficiency (BEE) in October 2022. This aimed at define the scope design and other operational details of the proposed hybrid (compliance cum voluntary) carbon market[1].

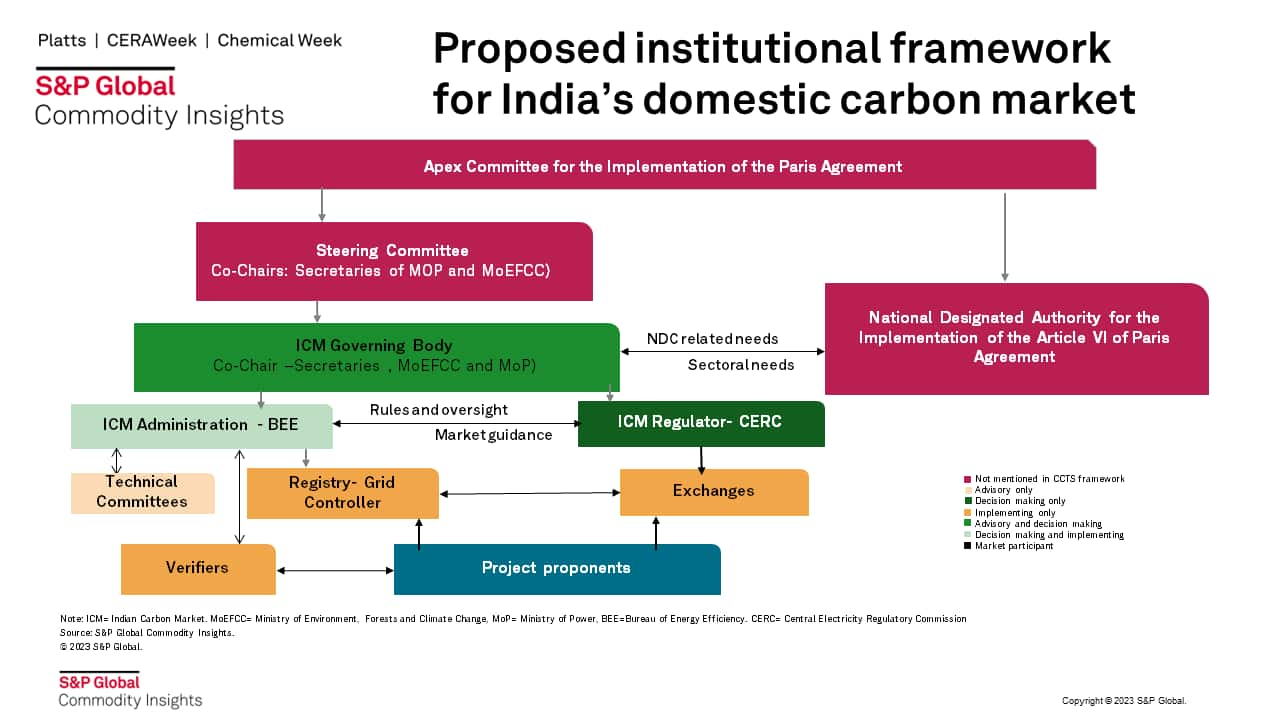

The framework document goes a long way in clarifying the roles and relationships of various actors envisaged, such as the governing body, administrator, regulator, registry, verifiers, exchanges, and technical committees. It proposes to set up a governing body, named the ICM Governing Board (ICMGB) which will be co-chaired by secretaries of the Ministry of Environment, Forests and Climate Change (MoEFCC) and the Ministry of Power (MoP) and include members of several other key ministries that are linked to greenhouse gas (GHG) mitigation aiming to achieve India's nationally determined contributions (NDCs). The ICMGB will play a key role in giving direction to the ICM, framing norms, and providing oversight.

BEE will be the ICM administrator and will accredit carbon verifiers (ACVs) responsible for measuring, reporting and verification, and induct technical committees who will provide sectoral guidance on abatement potentials and costs. The registry function will be handled by the Grid Controller of India which will coordinate with market players and exchanges, receiving periodic guidance from the ICM administrator. The regulatory duties will be fulfilled by the Central Electricity Regulatory Commission (CERC), which will be responsible for balancing market power and protecting market integrity. It will also select and govern the carbon trading exchanges.

Our assessment of the framework document reveals certain areas where further enhancements, guidance, and transparency will strengthen the emerging domestic carbon market ecosystem:

- Increasing participation within the governing body and

through experienced knowledge council(s): In its present

form, the governing body has some notable exceptions such as

Agriculture, Industries and Commerce, and Small and Medium

Enterprises. Others such as mining, housing and urban affairs and

transport will also be useful to include in its deliberations.

Similarly, the scope of technical committees could be broadened to

include a knowledge council consisting of market practitioners and

advisory agencies already established in this space.

- Improving coordination with nationally determined

contributions and between the federal and state

governments: The CCTS framework omits the relationship

between the ICM governance board and the Apex Committee for the

Implementation of Paris Agreement (AIPA), as well as the Nationally

Designated Authority for the Implementation of Article VI of the

Paris Agreement (NDAIAPA) which replaces the erstwhile National CDM

Authority of India[2]. While center-state coordination is

critical for the ICM, the role of State Designated Agencies (SDAs)

is also missing in the draft.

- Clarifying norms across and among compliance and

voluntary schemes: The framework does not discuss the

shape and form, the Perform, Achieve and Trade (PAT) and Renewable

Energy Certificates (RECs)— the two existing compliance

systems— will take after the establishment of the ICM. The

norms and agencies responsible to facilitate interactions between

the voluntary and compliance segment are also not clarified.

- Incentivizing foreign purchases for domestic carbon credits: There is but one mention of the role of ICMGB to specify the guidance for sale of carbon credits to international entities. However, any hints or specifics around timelines or phase for registration, criteria for foreign project developers, mandates or incentives for Indian projects registered on international voluntary platforms, and coordination mechanisms with such platforms and exchanges are missing. Foreign participation is key for enhancing liquidity on domestic exchanges and generating demand for Indian credits. Therefore, such norms and responsible agencies must be specified sooner rather than later.

Customers can read the full report here or log on to our Connect platform to view our full range of offerings on India's carbon market and related topics.

Past reports in this series include:

- India finalizes list of Paris Agreement Article 6.2-eligible projects, revises implementation plan for national emissions trading scheme

- India prepares national carbon market under Energy Conservation (Amendment) Act to deliver on NDC goal; future carbon price rise limited by plans to increase supply

- Impact of carbon credit export restrictions on India's global carbon trading revenues

- Webinar: Navigating the trade-offs and implementing the learnings for India's future carbon market

- In the race to global net zero, what are the lessons for India's carbon market?

For more information on this research and its related service offering, please visit the Asia Pacific Regional Integrated Service page.

Mohd. Sahil Ali is a senior sustainability analyst with the Gas, Power, and Climate Solutions group at S&P Global Commodity Insights and covers cross-cutting issues in power and renewables for South Asian markets.

Posted on 30 May 2023

_________________

[1] These entities are included in the BEE's carbon market policy framework document and represented by the red boxes in the above infographic.

[2] A compliance market is one in which emitting entities are mandated by the government to reduce emissions trade in carbon credits with other obligated entities. In a voluntary market, emitting entities trade in carbon credits on their own volition without any government obligations or mandates. A hybrid market includes both compliance and voluntary market elements, with rules of engagement between the two sets of players.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.