China's overseas coal moratorium: Implications for energy transition and electricity reliability in Asia’s emerging markets

China's announcement at the United Nations General Assembly that

it will no longer build any new coal-fired power plants abroad

accelerates the energy transition in Asia's emerging markets but

also raises challenges, according to a new analysis by the IHS

Markit Global Power and Renewables service.

Robust demand growth ahead

In nine key emerging Asian markets[1] that IHS Markit analyzes in the region that receive significant foreign investment in energy projects, electricity demand is expected to grow by 750 TWh during 2020-30, or roughly equivalent to the total demand of France and Spain combined.

Much of the expected electricity demand growth will need to be fulfilled by 24/7 baseload generation due to the high share of industrial customers in these countries relative to mature economies as well as basic electrification of households. This is why coal has been an important power sector fuel in South and Southeast Asia.

Given the low per capita power demand in the region, many of them will not reach levels of developed countries even by 2030, posing continued supply challenge as income levels rise across emerging markets.

Future technology cannot meet current demand

While renewables like wind and solar power can help meet much of that new demand, the intermittent nature of renewables make it harder to fill the baseload generation gap.

IHS Markit estimates that if solar and battery storage were used to meet all of the incremental demand, it would require 70-130 GW of batteries. In comparison, only about 5 GW of battery storage capacity were installed globally in 2020, the highest year on record.

Battery storage technologies are not yet mature enough to be deployed today at such scale to back up wind and solar and meet the immediate demand growth in emerging Asia. While battery storage should be much more mature, scalable and cheaper by 2030, future technology cannot meet current demand.

The role of natural gas

Many regional governments have recognized natural gas as a "bridge" to meet the short-to- medium-term demand challenge with energy transition. Indeed, natural gas-fueled power plants can be built relatively fast and can fulfill baseload capacity requirements while providing flexibility to meet peak demand.

However, most of these markets are facing difficulties to source enough gas supply, mainly due to domestic gas supply constraints and lack of LNG import infrastructures. There are also pricing questions about gas—especially LNG—relative to coal in Asia.

Significant international financial support would be required for natural gas to realize its potential as a 'transitional fuel' in Asia. Most of the countries remain low or lower-middle income. Building out natural gas infrastructure and paying for the electricity relative to coal-fired power would necessitate assistance.

New coal plants still expected to come online in the region

As a result of this supply-demand gap and limited alternatives for baseload generation, IHS Markit expects that a number of new coal plants—mostly those that are already under construction or have secured financing and in advancing planning—will still come online in the next decade.

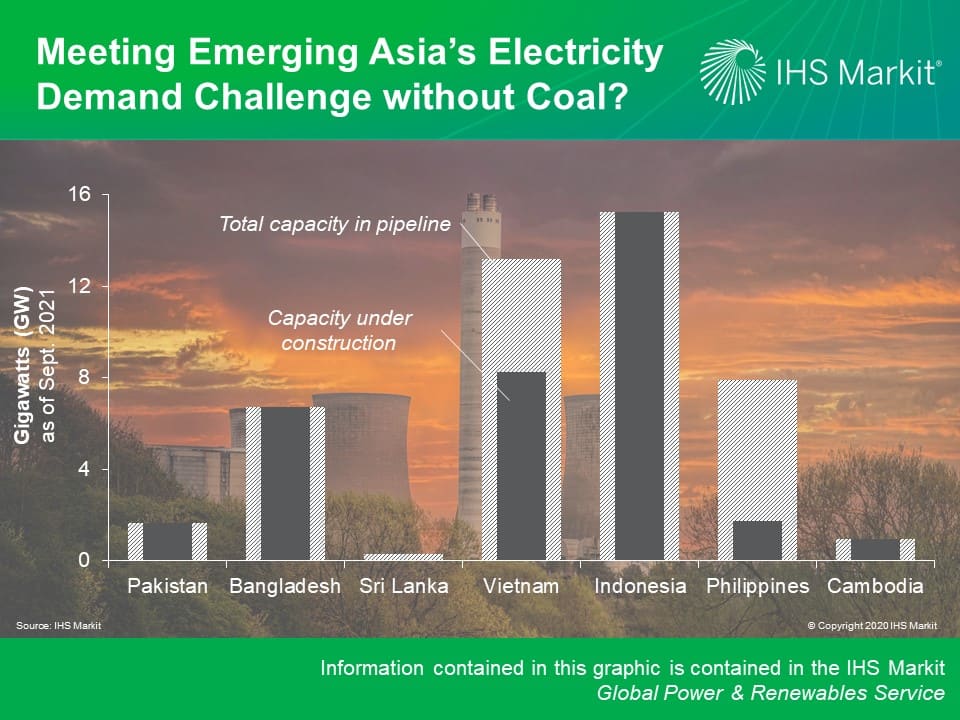

There are roughly 34 GW of coal-fired plants under construction in the region (this figure does not include an additional 32 GW under construction in India), according to the latest IHS Markit data. An additional 24 GW are in fairly advanced planning stages or have closed financing but have yet to begin construction. IHS Markit expects roughly half of them—about 11 GW and almost all in Vietnam and the Philippines will still be brought online.

IHS Markit still expects around 45 GW of new coal-fired power capacity in South and Southeast Asia to enter service over the next decade or so. Were these not to be brought online, such a gap would need to be addressed with other solutions or you risk running into reliability issues and economic disruption in these emerging markets.

Worth noting is that our outlooks also include significant new renewables, hydro, natural gas and battery storage capacity to be built as well - any shortfalls in these technologies would create supply shortfalls as well.

Beyond 2030 IHS Markit expects very few—if any—new coal plants to be built in the region. This means it will be critical for mature battery storage technologies to be developed to grid scale over the next decade to assure long-term supply reliability. Gas-fired power will also be needed to provide baseload and flexibility.

"All of the above" approach

The fact of the matter is that, for South and Southeast Asia markets, investment in power infrastructure must continue to grow for all technologies just to keep up with demand. There is a complex balance between supply reliability and moving towards clean energy for fast-growing regions. Ending the buildout of new coal plants needs to be part of a much bigger discussion.

Learn more about our Asia-Pacific energy research.

Xizhou Zhou is a vice president in the Climate & Sustainability Group at IHS Markit and leads the company's power and renewables practice globally.

Posted on 05 October 2021.

[1] The nine markets include Vietnam, Indonesia, Thailand, Malaysia, Pakistan, Bangladesh, Philippines, Myanmar and Cambodia.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.