China’s record coal capacity approvals in 2022: Will carbon targets still be met?

China's government approved a record-breaking 86 GW of new coal-fired power capacity in 2022, raising critical questions on whether Beijing had deviated from its energy transition pathway and whether the country's climate goal of peak emissions by 2030 could be met.

However, S&P Global Commodity Insights research shows that the purpose of this new build is fundamentally different from the big wave of coal additions in the mid-2000s. Whereas coal plants historically mainly fulfilled baseload demand, they are increasingly built for flexibility purposes.

To that end, the massive approval wave last year is a reliability measure to manage the combined effect of "peakier" load curves on the demand side, higher share of variable renewables, and more extreme weather events. Coal plants in China will operate fewer hours in the future as renewables meet the bulk of incremental demand - a trend that we have observed among gas-fired power plants in Europe, for example.

Increasing demand for dispatchable, long-duration capacity

Concerns over reliability in China - and globally - increased sharply in 2022 as the Russia-Ukraine war tightened global fuel markets dramatically. In China, a long drought and hot summer worsened the supply tightness as summer demand soared while hydro output dropped. The effect of this can be seen from the spike in the coal plant utilization in summer 2022 when the grid scrambled to find generators that could meet the supply gap.

Meanwhile, these demand center provinces are also regions where residential and commercial demand is growing rapidly, creating more need for flexible generation capacity to meet demand fluctuations from diurnal to seasonal.

Aside from demand impact, the continued large-scale deployment of variable generation resources such as wind and solar are also making it more important to have dispatchable, long-duration resources (current battery storage technologies can generally handle 4-6 hours). In 2022, China installed 125 GW of new wind and solar capacity, accounting for over 40% of global additions - a trend that is expected to continue. While battery storage can fulfill a few hours of flexibility requirements, longer-duration back-up requires other options.

Lack of natural gas

Whereas most parts of the world use natural gas plants to fulfill many flexibility and reliability requirements, the lack of natural gas resources in China and the relatively high price of imported gas - especially during a year of global gas market upheavals as a result of the Russia-Ukraine War - are making it unrealistic for the country to rely heavily on gas.

Currently, China has 115 GW of gas-fired power capacity, or about 4.5% of its total power fleet. In comparison, installed wind capacity is 373 GW and solar capacity is 416 GW (and growing rapidly) - the scale of flexible capacity required cannot be met by the gas fleet.

Coal's new role as flexibility provider in China's power system

As a result of these dynamics mentioned above, policymakers regard coal as the most viable option to ensure generation capacity adequacy and address energy supply security concerns at this stage. While other solutions such as demand response and interprovincial grid connectivity are also being implemented, they are insufficient to meet the flexibility requirements of the grid.

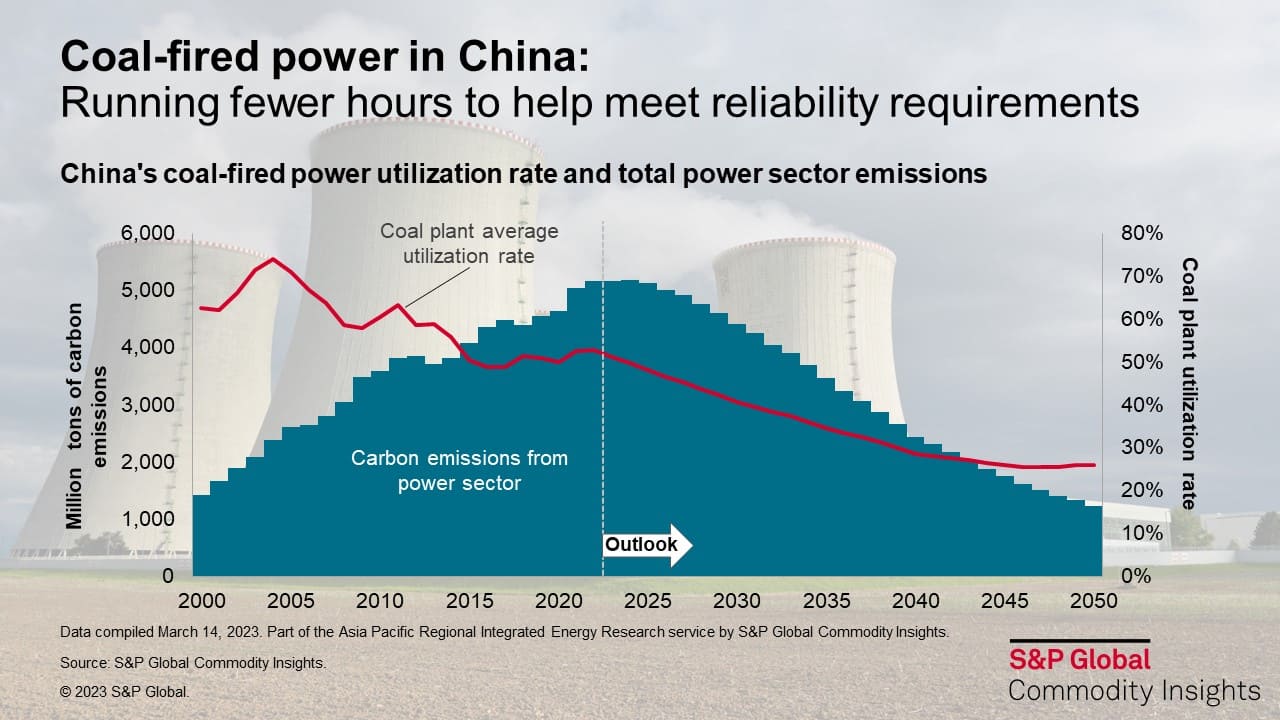

The role of coal-fired power has been evolving over time in China. Two decades ago, when the Chinese economy started booming, most of the electricity demand growth came from baseload industrial customers. Coal provided the bulk of that electricity, and coal plants were running at very high utilization hours, averaging 70% capacity factor during 2002-06. That number has dropped continuously since then as more coal plants start running at mid-merit and even peaking hours. By 2022, the average utilization rate of coal plants in China has dropped to 53%.

To allow more coal plants to play this flexibility role, the Chinese government launched a program a few years ago to mandate "flexibility retrofit" on coal-fired generators, requiring them to be able to cycle up and down in a more flexible manner so that they can meet performance requirements of the grid operators.

Declining capacity factor for coal plants and accelerating coal retirements

S&P Global Commodity Insights analysis shows that the average capacity factor of China's coal plants will continue declining as they become a main source of flexibility and reliability in a grid dominated by variable renewables. By 2050, the average utilization rate of China's coal fleet is expected to drop further to 26%, operating more or less as a peaking capacity.

---------------------------

"The average capacity factor of China's coal plants will

continue declining as they become a main source of flexibility and

reliability in a grid dominated by variable renewables. By 2050,

the average utilization rate of China's coal fleet is expected to

drop further to 26%, operating more or less as a peaking

capacity."

- Bing Han, Senior Research Analyst, S&P Global Commodity

Insights

---------------------------

At the same time, we expect China's coal fleet size to peak around 2030 before coal retirement pace picks up as many of the plants built in the 2000s reach their technical life. We expect cumulative retirements to total 730 GW during 2030-50, enough to power half of the United States today.

The decline in capacity factor and retirements of coal plants means that China's power sector emissions will likely peak as early as 2024, with the majority of incremental power demand met by renewables.

---------------------------

"The decline in capacity factor and retirements of coal

plants means that China's power sector emissions will likely peak

as early as 2024, with the majority of incremental power demand met

by renewables."

- William Chia, Research Analyst, S&P Global Commodity

Insights

---------------------------

Stranded assets?

This raises questions about the coal plants' future profitability and could challenge developers' willingness to proceed even though they have obtained government approval. With continued power market reforms, energy prices in electricity markets in China are under downward pressure as more and more renewables are added. This will challenge these coal plants' economics and financials in the future.

Like in many markets elsewhere in the world, new mechanisms may be needed to allow developers to break even on these new coal investments in order to bring online the needed reserve capacity for reliability requirements. Among ideas under discussion are capacity mechanisms and capacity pricing to pay for these peaking coal plants, but more time is needed to fine-tune exact market rules.

Learn more about our Asia-Pacific energy research.

Choon Kiat William Chia, a research analyst in Greater China power and renewables research for the Gas, Power, and Climate Solutions team, primarily focuses on the China power and renewable market analysis, including long term power supply and demand modeling, hydro power forecast, as well as thermal power fundamental analysis.

Bing Han, a senior research analyst in Greater China power and renewables research for the Gas, Power, and Climate Solutions team, primarily focuses on the China power and renewable market analysis, including supply and demand forecast, power cost and price and energy policies.

Posted 27 April 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.