From “missing money” to taxation: The highly political and swinging economics of European power generation

The energy crisis puts the economics of power generation under the spotlight—again. On the back of all-time record-high prices, several power producers announced record profits. The flip side of the coin has been skyrocketing end-user bills and price-driven factory closures. This situation prompted policymakers to introduce new taxes on power generators and ordered a review of the wholesale electricity market design to act against the "unreasonable" profits.

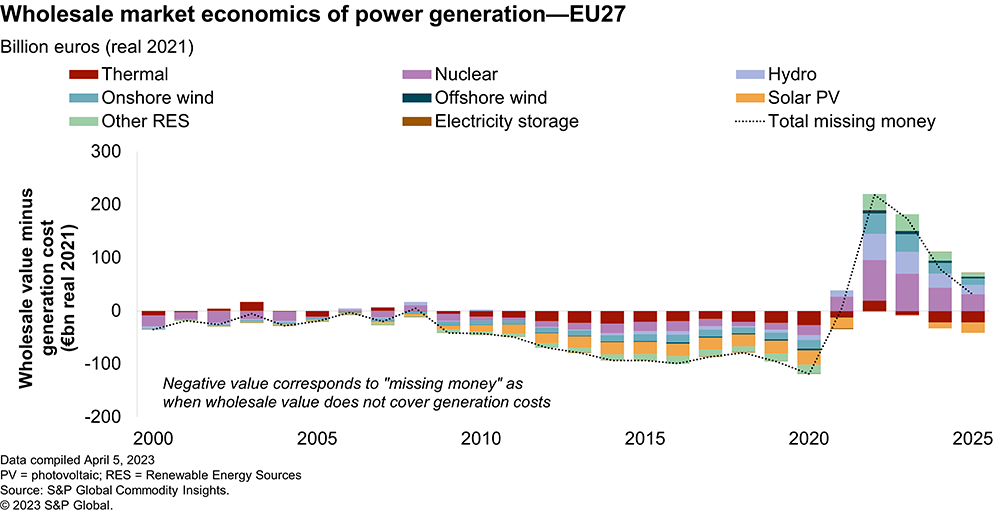

The year 2022 was good for power generation revenues. We estimate that the wholesale value of the 27 European Union member states (EU27) power generation—prior to any hedging and taxation—surpassed total generation costs by €220 billion (real 2021), largely because of record-high power prices. All technologies benefited from the crisis even though not all producers are impacted the same way, depending on their specific contractual and operational characteristics, as shown in the picture below.

Previously, many production technologies were out of money or required subsidies. The current situation represents a reversal in fortune compared with the past decade; during 2010-20 subsidies were handed to renewable newbuilds as the wholesale price was too low to justify any investment. In addition, new remuneration schemes were introduced to reward conventional capacity that would otherwise have closed owing to poor economics, putting security of supply at risk. In the case of renewables, we estimate that two-way support schemes will allow government to save €100 billion during 2022-25, compared with €525 billion of subsidies paid out from 2009 to 2020.

Current profits could be short lived, and "missing money" could return. A decline in gas prices as new gas supplies come in operation, and increasing cannibalization will put pressure on wholesale prices and revenues of generation technologies. A return to a widespread "wholesale missing money" for both conventional and renewable power plants is not out of question. Revenue stacking will be critical for merchant assets. In other words, the wholesale electricity market alone, as it is currently designed, could be insufficient to drive the targeted expansion of renewablesand maintain adequacy. Consequently, additional revenue streams on top of the wholesale market could be required. For renewables, Contracts for Differences (CFDs) or corporate Power Purchase Agreements can provide alternative monetization strategies. Guarantees of Origins could also help plug the revenue gap. For flexible assets, capacity remuneration schemes will grow in relevance. For example, the German government aims at launching several tenders to build hydrogen-ready power plants.

The high sensitivity of policymakers to the revenues of power producers mirrors the fact that the economics of power generation and, more widely, the power market design are at the core of the energy trilemma—i.e., the balance between environmental sustainability, security of supply, and affordability. As such any future reform of the current arrangements will need to cautiously assess its impact on each of these three factors. Any wholesale market reform would need to ensure an adequate level of profitability for power generators, at the risk of under-investments, right at a time when the power sector takes the front stage on the road to a net-zero carbon future. These crucial elements are partly absent from the present discussions, but it is likely they will soon come back on top of the agenda.

Learn more about our European energy research.

Augustin Borelle, Senior Research Analyst on the Gas, Power, and Climate Solutions team, currently focuses on European energy markets and power prices modeling.

Giovanni Giansiracusa, Senior Research Analyst on the Gas, Power, and Climate Solutions team, currently focuses on European power sector modeling.

Sylvain Cognet-Dauphin, Executive Director on the Gas, Power, and Climate Solutions team, is responsible for the fundamental analysis of power markets across Europe to support asset valuation, retainer services, and Multiclient Studies.

Posted on 27 April 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.