Continued success: European PPA market experiences strong growth in H1 2023

Only nine months into 2023, the European Power Purchase Agreement (PPA) landscape is setting remarkable records. As of August 2023, over 20 GW of PPAs have already been signed, equivalent to an annual energy production of 42 TWh, which is nearly on par with Hungary's annual energy consumption. This surge in activity encompasses a total of 160 deals, almost matching the 180 deals recorded in the entire year of 2022.

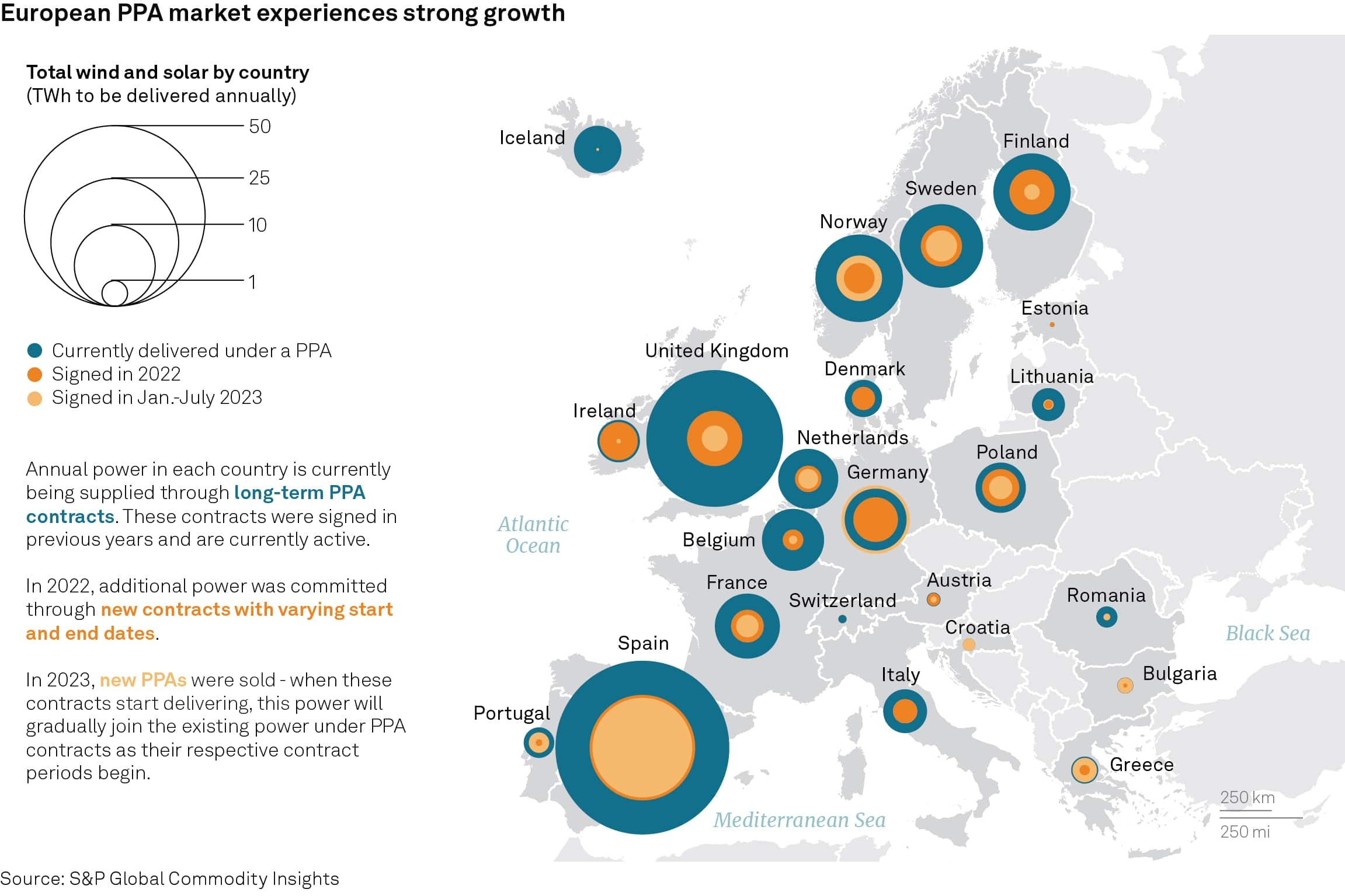

The top five PPA markets currently account for 72% of the total energy supplied through PPA contracts, totaling 92 TWh out of a 131 TWh. Based on deals signed as of August 2023, total annual supply to be delivered under a PPA will rise to 152 TWh by 2024 and 187 TWh by 2026, up from 131 TWh in 2023.

Based on deals signed as of August 2023, 4% of nonresidential demand in EU27+3* will be covered under a corporate PPA deal, up from 2% in 2022. Mature markets such as Spain, Norway and Sweden will reach at least 20% of nonresidential demand supplied through corporate PPAs in 2024.

Spain is once again taking the lead as the largest PPA market, so far in 2023, 8.2 GW have been signed under a contract, accounting for roughly 40% of the total European PPA market volume. In 2023 we estimate that 39 TWh will be delivered under a PPA contract. Based on existing agreements, the total energy supply is expected to reach 48 TWh/y in 2024 and 60 TWh/y by 2026.

Spanish PPA prices are showing early signs of erosion, a hint at the risk that "cannibalization" may become widespread as renewable energy continues to grow.

As the PPA market grows, innovative PPA structures are emerging, particularly in response to the demand for renewable energy production that aligns more closely with actual energy consumption patterns. Corporations already sourcing 100% renewables, such as Google LLC, Mercedes-Benz Group AG, and Dutch Railways, are actively working to match production and consumption on an hourly basis. This is a challenging endeavor due to the intermittent nature of renewable sources but will be crucial in mitigating grid issues. Achieving this goal will require more than just oversizing; it will necessitate the implementation of demand-side management and storage solutions. This kind of achievement usually relies on a utility intermediating between the producer and offtaker since it will be able to deliver the required load from a combination of sources, which will be reflected in the price of the PPA.

Full details can be found here for S&P Global Commodity Insights subscribers, click here. For more information on the Europe Power, Gas, Renewables, Cleantech Analysis service, click here.

*EU27+3 = EU27 + Switzerland, Norway and United Kingdom

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.