COVID-19 has not slowed down the energy transition in Southeast Asia

The COVID-19 pandemic continues to present a significant challenge to the power market in Southeast Asian nations in the fourth quarter of 2020. However, despite causing substantial disruptions to industry and decreasing overall power demand, it has not slowed down the energy transition towards a more sustainable and greener system.

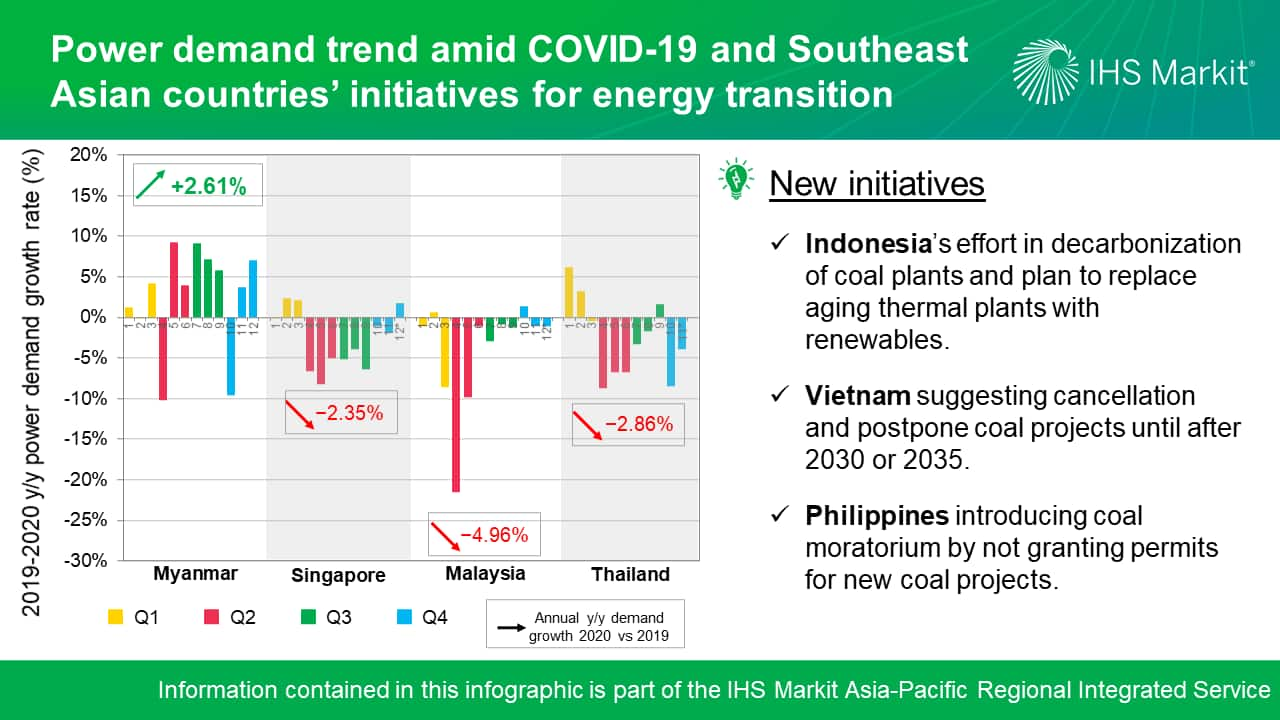

Based on the published power market data, a fluctuated trend of power demand was observed in major Southeast Asian countries by the fourth quarter of 2020. The following figure illustrates the 2019-20 year-on-year (y/y) monthly power demand growth rate in Myanmar, Singapore, Malaysia, and Thailand. The overall power demand grew in Myanmar, with a y/y increment of up to 7.0%. However, the y/y power demand dropped between 8.5% and 1.0% in Singapore, Malaysia, and Thailand.

Myanmar recorded a y/y drop of 9.6% in October, but a growth of 3.7% and 7.0% in November and December 2020. This fluctuation is due to the enforcement of Factory Restriction from 24 Sep to 21 Oct, where manufacturing factories are required to close, in order to curb the spread of COVID-19 pandemic. It was then followed by the General Election and Stay Home Order in November 2020, where people mostly stay at home instead of going out for commercial and recreation activities, resulting in overall less power consumption during weekends. On the contrary, weekday power demand remained high throughout November and December, due to the lift of Factory Restrictions and manufacturing sector rushed to complete their annual orders before the end of 2020.

Singapore's power demand seemed to have recovered in the last quarter of 2020. Total demand declined by 1.0% y/y and 1.8% y/y, respectively, in October and November, but rebound in December with 1.75% y/y growth. The power market trend indicates recovery and growth in the country's economic activities. Furthermore, with the government's approval of COVID-19 vaccine by mid of December, it's likely to boost up the business reopening and contribute to higher power demand in the region.

Malaysia's power demand decline decelerated in the fourth quarter of 2020, with increasing demand of 1.3% y/y in October, and an average decline of 1% y/y was recorded for the next two months. This is due to the surge of new COVID-19 cases that have led to the conditional movement control order (CMCO) being enforced by the government in the later months of last quarter. Of note, essential economic industries are allowed to operate and significantly lessened the impacts of COVID-19 on the power market. The drop in power demand was mostly due to the slowing activities in commercial sectors.

Thailand's power demand seemed to fall more steadily than in the previous quarter, when it declined between 8.5% y/y and 3.9% y/y, by October and November 2020. The country announced a nationwide lockdown for the whole October, causing the power market to crash with a similar contraction rate ever since the April lockdown. From November 2020, the country allowed a full boarder reopening for tourism activities, and, to some extent, relieve the domestic power market from further crashing. December power market data was still unavailable, but they are estimated to be stay below pre-COVID-19 lockdown levels owing to the country's poor economic outlook.

Initiatives taken for thermal power plants clean production

The uncertain economic crisis triggered by the COVID-19 pandemic has driven the transition from fossil fuels to cleaner energy sources to reduce greenhouse gas (GHG) emissions. This move is a strong indication that Southeast Asian nations are working to boost energy market resilience and ensure more sustainable growth.

Indonesia as the biggest thermal power market, has stepped up their decarbonization efforts by approving regulation on the installation of anti-pollution scrubbers to all existing coal-fired power plants as well as replacing all aging thermal plants with renewables. If fully enforced, the scrubbers will be applied to a combined installed capacity of 11GW in Java-Bali, and will replace 13GW of aging thermal plant.

Vietnam on the other hand, has proposed a rapid expansion of renewables and natural gas, suggesting cancellation of seven planned coal projects and postponed six coal projects until after 2030 or 2035, in their recent proposal for eighth Power Development plan (PDP8). Vietnam will only continue to develop 15 coal projects with a combined capacity of 18 GW between now and 2026, which represents 60% of all coal projects listed in the revised PDP 7.

Lately, Philippines' government is introducing a coal moratorium to scrap new coal-fired power projects by not granting permits. The authority also supported the transition from fossil fuel-based technology to cleaner energy sources amid a renewable energy push. However, the government has yet to identify which pre-permit contracts are now at risk.

The power market has been challenged by COVID-19 over the year, and demand plunge is observed for most Southeast Asian countries throughout 2020, with Myanmar being an exception with 2.63% y/y growth. However, the fluctuations in power demand indicate a resilient recovery in Southeast Asian power markets in post COVID-19 era. Additionally, COVID-19 has not slowed down the energy transition in Southeast Asia, where multiple countries made new announcements to oppose further coal capacity expansion, and renewables continued to gain momentum.

Learn more about our Asia-Pacific integrated energy research and analysis.

Choon Gek Khoo is a research analyst with the Climate and Sustainability team at IHS Markit based in Penang, Malaysia.

Cecillia Zheng is an associate director with the Climate and Sustainability team at IHS Markit.

Wang, Ph.D., is a director on the Climate and Sustainability team at IHS Markit, based in Singapore.

Posted 22 January 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.