Decarbonizing electricity in mining requires 180 TWh / year of clean power

The mining sector has the potential to use up to 180 TWh of additional clean energy from the current levels, according to estimates from S&P Global Clean Energy Technology. The increase would be driven mainly by the mining of energy-intensive metals such as gold, copper, and platinum, as well as iron ore due to its large market size.

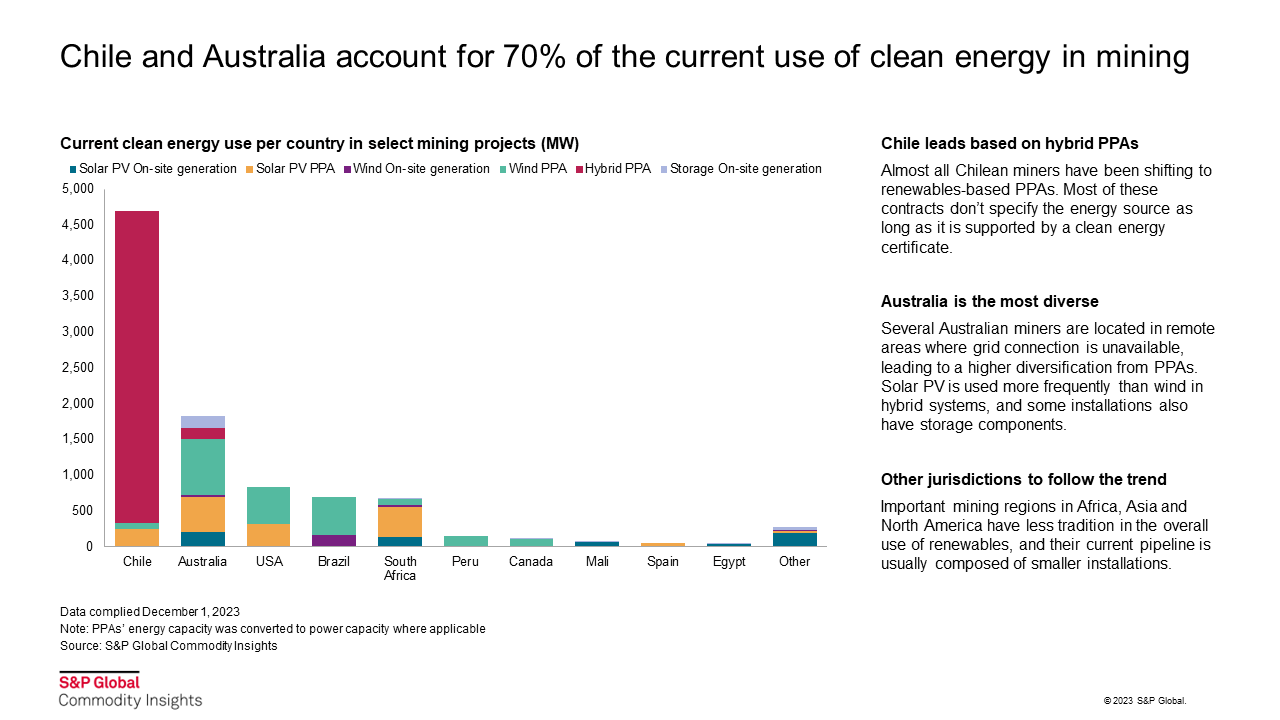

Approximately 32 TWh of renewable PPAs have been signed by mines, with only 1.9 GWh being produced at on-site installations. Australia and Chile account for over half of the current use of clean energy in mining.

Over the past decade, there has been an expansion in the use of renewables for powering mine sites. This has been driven by the falling price of solar and battery storage, as well as increasing scrutiny over miners' emissions. Currently, nine of the top ten publicly listed mining companies have set scope 1 and 2 net-zero goals for 2050.

The energy demand at mine sites comes from four distinct categories: exploration and extraction, material handling, beneficiation and drying, firing and smelting.

- Exploration includes powering the drills to break the rocks' surface and diggers that pull the rubble away.

- Material handling is the process of moving rubble to a place where they can be processed. If a mine is deep underground, continuous transport systems such as conveyors are often used as traditional vehicles can be too time-consuming. Vehicles are used once the rubble is out of the mine, and more mines are turning to the use of battery-electric-vehicles.

- Beneficiation is the process of crushing and grinding the rocks into smaller pieces. For metal mines, this takes up a larger amount of energy.

- Smelting the rocks requires high heat to extract the desired material.

Overall, the first three processes can be replaced with electricity fairly easily, but smelting is difficult due to the high temperature required.

There is no "one size fits all" solution for miners, although the best strategy to decarbonize energy consumption depends on many factors, such as the local regulation, wind and solar availability, grid connectivity, type of operation, and energy intensity of the extracted minerals.

There is potential for significant growth in the use of renewables in mining. PPAs are currently dominant, but growth in the off-grid market can be faster as remote mines are lured by the cost reduction of renewable technology in the past decade. The volatility of the price of fossil fuels is also a challenge for many miners.

The types of solutions vary by country. In Australia, there are a significant number of mines in remote locations, especially gold mines in Western Australia. Gold is the most energy-intensive (and electricity-intensive) material among the conventional mined commodities. The abundant sun irradiance during the day and wind at night make Australia a key growth market for the future. In Chile, however, nearly all mines are grid connected, and so can source power with through offtake agreements with developers or independent power producers (IPPs). Chilean miners were early adopters of clean energy, and now most companies have already signed PPAs, so there is not much room for further expansion.

In the off-grid space, the cost advantage of hybrid installations (those that include renewables) has been widening over pure fossil fuels-based systems, but the share of renewables is limited by the 24/7 baseload energy profile of mines, which requires high-reliability sources. Even a combination of solar, wind and storage can generally only generate a maximum of 80% of a mines' electricity whilst remaining profitable. In addition to this, the drying, firing and smelting part of the mining process is extremely difficult to decarbonize as it requires high temperatures. A final issue for renewables is the fact that mine life uncertainty drives 5-to-10-year electricity contracts. Whilst diesel generators are modular and mobile, it is expensive and completely impractical to deconstruct and reconstruct a solar or wind farm. Relocatable solar and storage solutions are starting to appear, though.

Despite the difficulties described above, the falling price of solar and batteries, the emerging space of electric vehicles for mining, and the growing pressure on mining companies to decarbonize will continue to drive the use of renewable energy at mines.

Learn more about the cleantech trends to look out for in 2024.

Joe Steveni is a research analyst based in London on the S&P Global Commodity Insights Clean Energy Technology team, covering solar photovoltaics in the UK, Ireland and Australia and also works on the solar tracker market analysis.

Posted on 2 February 2024

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.