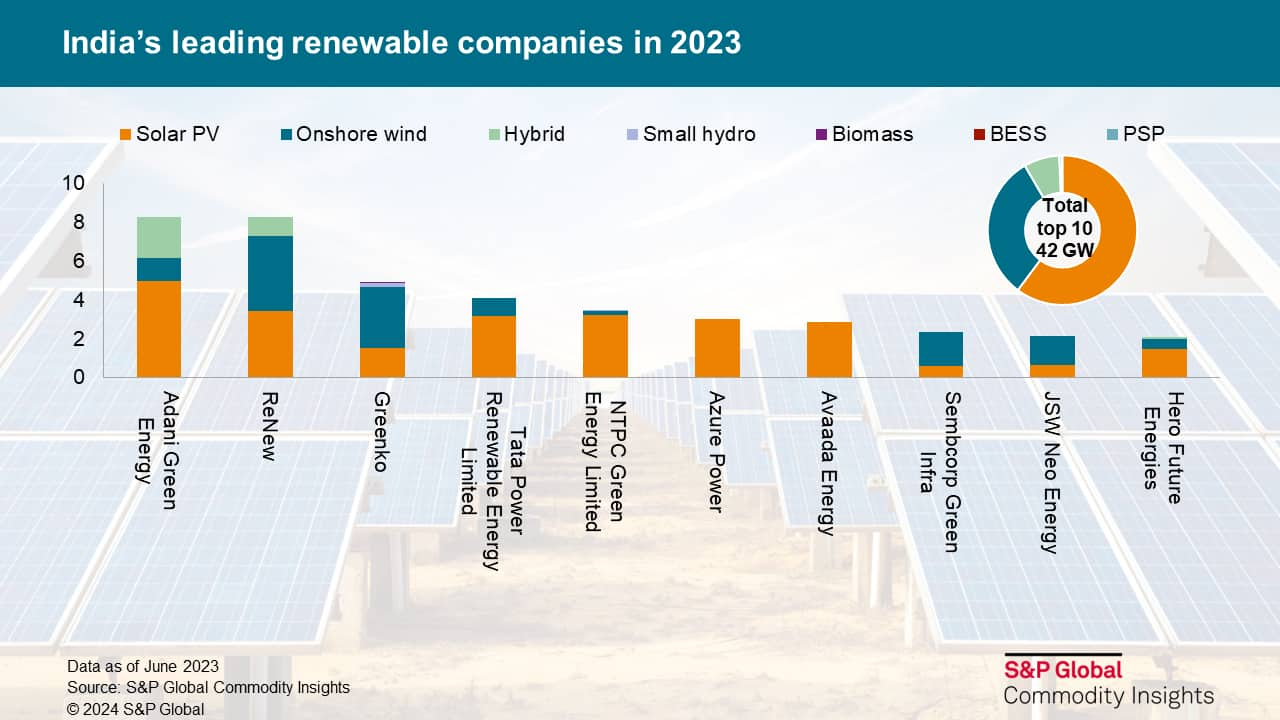

India’s leading renewable companies in 2023

India has more than 126 GW of renewable capacity installed by mid-2023 and the largest 10 companies constitute about a third of these operational assets. India's largest 10 renewable developers own and operate about 42 GW of assets, of which majority 90% constitutes of solar photovoltaic (PV) and onshore wind.

The total pipeline projects of the largest 10 companies constitute about 57% of the total renewable pipeline in India, indicating an increasing consolidation of capacity among large portfolio owners.

Competitive tenders have been the biggest driver for growing portfolios of the leading renewable players. Renewable companies, which have been consistently winning competitive tenders, have emerged as the largest portfolio owners in India. Local companies disproportionately represent the tender winning companies despite the 100% foreign direct investment in RES sector. It's in part due to high construction and counterparty risk, and in part due to very cost competitive tenders.

Majority of the leading independent power producers (IPPs) are of local origin. Overseas financial institutions are targeting corporate shareholding in these companies as a strategy to invest in renewable assets while keeping market and construction risk low. Adani Green Energy is the largest renewable asset developer as of June 2023 with 8.32 GW of online projects closely followed by ReNew with 8.29 GW of online capacity. These two players alone constitute about 40% of the total operational assets of the top 10 renewable developers.

More than half of the assets of the top 10 players are tied in long-term PPAs with stable counterparties. While about 15% of the PPAs are with high risk offtakers and remaining with moderate risk counterparties. Also, Majority of the companies have moderately distributed operational assets across different states. About 40% of the assets are distributed in 2 to 5 states and the rest are distributed across 9-13 states.

Diversification of business across renewable energy aligned project options including hybrid renewables, energy storage and green hydrogen is taking place. Several IPPs have announced plans to set up energy storage projects and venture into manufacturing for solar PV to reduce supply risks. The renewable companies are also planning to diversify from already commercially viable technologies including solar PV and onshore wind, and towards emerging areas including collocated RES with storage and stand-alone storage to capture the increasing demand for firm and dispatchable green power, as well as new demand areas such as C&I consumer demand for green electricity and green hydrogen production for commercial and industrial (C&I) consumers.

If you are interested in learning more about our Asia-Pacific gas, power and renewables coverage, please click here.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.