Economic instabilities and coronavirus (COVID-19) impact pose risks to Pakistan power demand growth and investments

Pakistan's GDP growth slowed in 2019 (July 2018-June 2019) hitting an eight-year low of 3.4%. The growth slowed as a result of a sharp weakening of domestic demand and tightening of fiscal and monetary policy to address the structural issues and keep the twin deficits (fiscal and current account deficits) in check. <span/>Besides that, the industrial slowdown, deteriorating business sentiment and circular debt were also major contributors to the GDP growth decline. Amid the economic crisis, in July 2019 Pakistan received a bailout package of about $6 billion from the International Monetary Fund (IMF). The program provides much-needed financial support to Pakistan in exchange for the implementation of fiscal and structural reforms. The government has expedited the economic reforms for fiscal consolidation in order to receive continued support from the IMF.

Besides that, economies globally are currently dealing with the shock of coronavirus (COVID-19) pandemic, and the Pakistani markets, especially the imports and exports markets, have started to feel the impact. IHS Markit expects Pakistan's GDP growth will hit an all-time low of negative 2.5% in 2020. However, economic growth is expected to recover in 2021 and grow at about 2.6%.

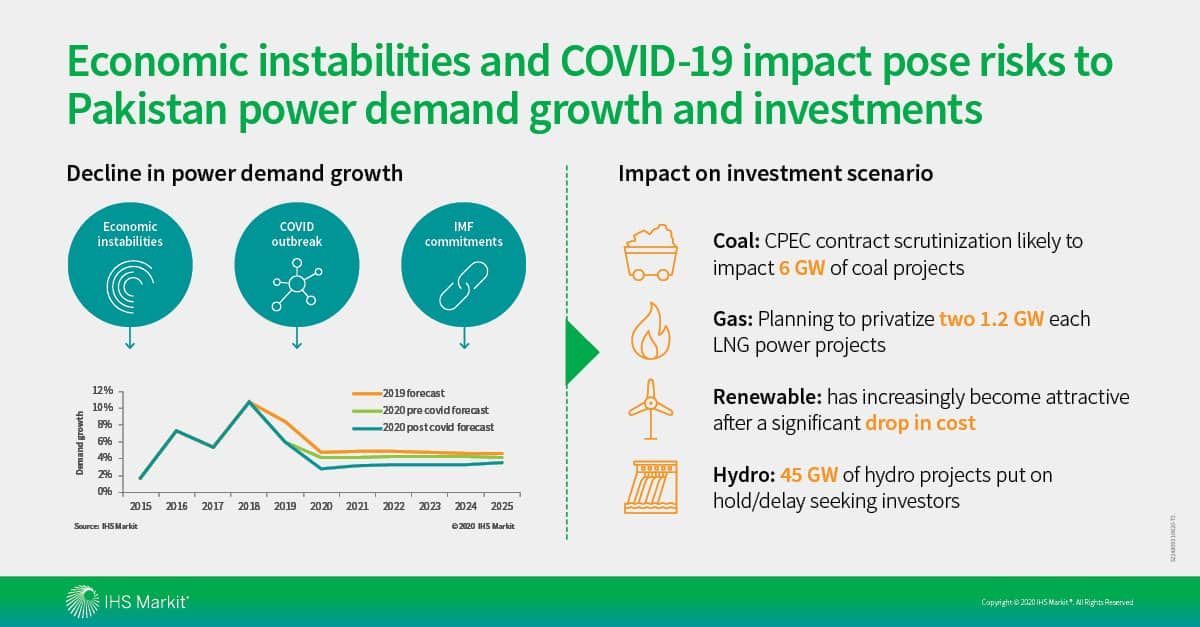

Figure 1: Economic instabilities and COVID-19 impact pose risks

to Pakistan power demand growth and investments.

With the rising domestic economic challenges, deteriorating investor confidence, global economic recession, and suspension of planned infrastructure projects, <span/>2020 power demand in Pakistan is expected to grow by 2.8% against the pre-COVID-19 outlook of 4.1%. Despite the poor outlook for power demand growth in 2020, IHS Markit expects demand to recover slightly and grow at an average of about 3.2% during 2020-25. However, the recovery in demand is dependent on the government's efforts to address the ongoing financial issues and on its determination in implementing the power sector reforms.

A slowdown in economic activity and power demand is expected to be the major driver of slippages in the pipeline capacity. Further, the situation is expected to worsen with the removal of the existing industrial subsidy and the implementation of additional surcharge on the industrial tariff as directed by IMF guidelines. Hence, Pakistan is expected to place more emphasis on demand-side management programs and structural reforms of distribution companies (DISCOMs) than on the generation capacity augmentation plan. About 14.1 GW of power capacity is under construction, while another about 37.2 GW of capacity are in various stages of planning. The government is prioritizing hydropower plants for the long term to reduce dependence on fossils fuel imports while investing in coal projects in the short term to address power shortage issues. However, existing economic challenges and policy uncertainty is jeopardizing the country's fuel diversification plan, and this could lead to delays or suspension in pipeline power capacity.

Learn more about our power demand research in South and Southeast Asia.

Saurabh Kumar is senior research analyst at IHS Markit.

Posted 08 July 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.