To deal or not to deal, that is the question...

Foreword

While Africa's geological appeal for frontier oil and gas exploration will remain strong relative to other regions (one quarter of the new reserves discovered worldwide in the past decade are African), the early 2020 oil price crash will have significant and long-lasting impacts on upstream activity within the continent. Trends that were set in motion after the 2014 oil price collapse are likely to be exacerbated.

We will discuss the African upstream trends observed over the last decade - providing some insight into the evolving strategies of regionally grouped companies and attempting to make sense of these in the context of the most recent crash. We will also look at exploration activity over the same period with the view to drawing insights from the 2014 crash and applying those to the current environment and outlook.

A drama in three acts

Three distinct periods are defined within the scope of this article, driven by crashes in the oil price:

A) Pre-2014 crash

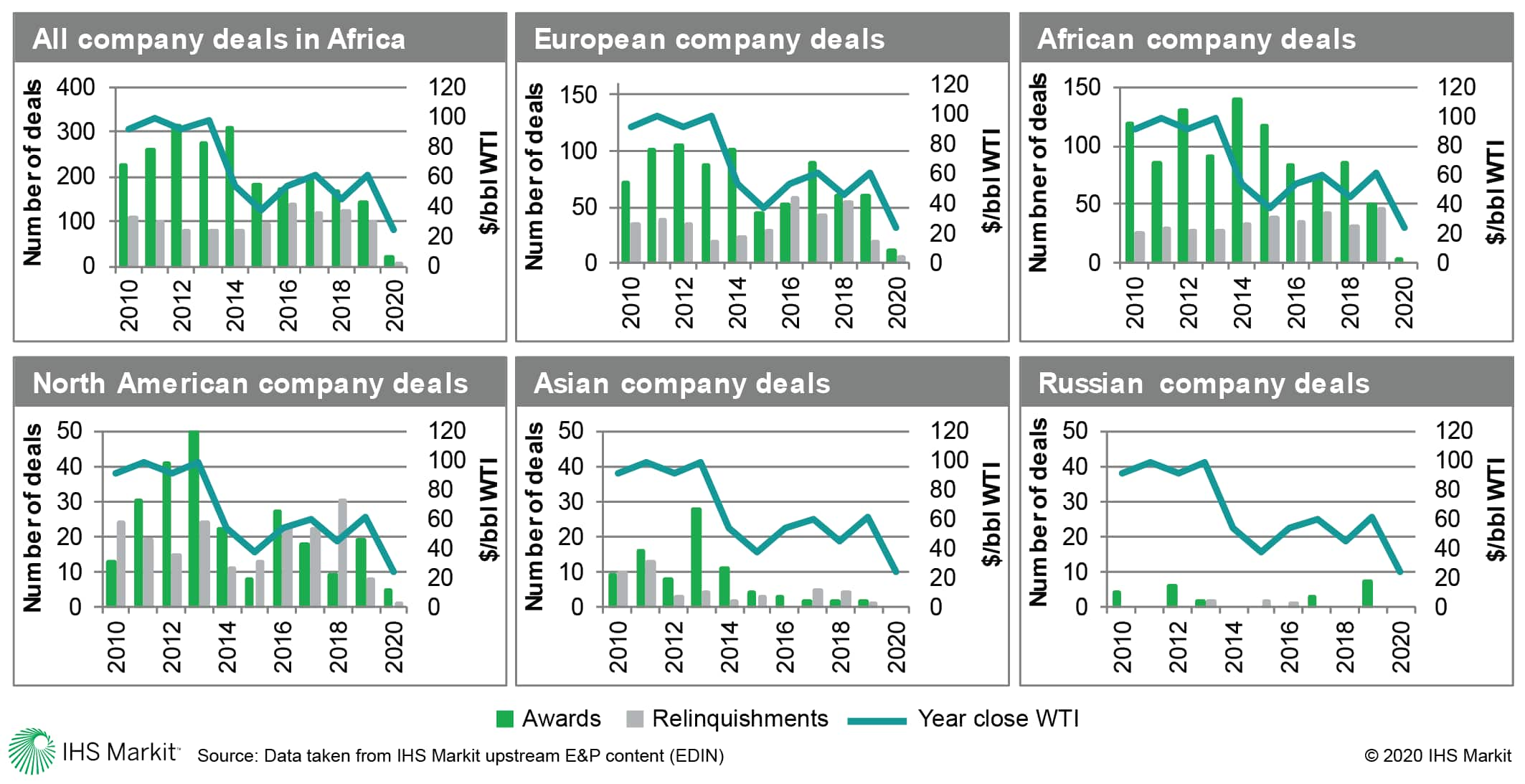

Between 2010 and 2014, oil was trading in the region of USD 100/bbl and Africa was attracting significant interest from large European, North American and Asian oil and gas companies. The continent also presented numerous opportunities for smaller independents and African companies allowing for the expansion of acreage holdings. On average, some 300 entries or awards were taking place annually while there was a downward trend in terms of relinquishments (less than 80 annually at the end of the period).

B) Post-2014 crash to Pre-2020 crash

The dramatic decline in the oil price from mid-2014 to early 2016 had an equally severe impact on company deals and investment decisions in Africa. The number of new contracts awarded during the period almost halved; conversely the number of relinquishments significantly increased. To put this into context, 2016 was the only year in the last decade when more acreage was relinquished than awarded.

C) Post-2020 crash

The most recent oil shock was driven by the collapse of the OPEC - Russia Vienna Alliance and the COVID-19 pandemic, simultaneously creating a significant oil oversupply and a dramatic decline in demand. Explorers have already slashed discretionary spending, including dramatic reductions to exploration budgets. These cuts in turn will lead to commitments being reneged on and/or block relinquishments, as opposed to entering successive exploration periods and the resulting commitments. Although it is early days, it seems likely that many of the strategies exploited during the period after the 2014 crash will be redeployed - slashing of exploration budgets, deferrals of commitments when possible or withdrawals from exploration acreage and divestments.

Regional company strategies adjusting to global market trajectories

Since 2010, company strategies have shown a strong correlation to the region of incorporation. Looking at the entire 10-year study period, awards have been dominated by companies headquartered in Europe and Africa. IOCs like BP, Eni, Equinor and Total entered numerous agreements in West Africa and Shell's takeover of BG Group, for example, allowed it access to significant acreage offshore East Africa. This trend was not restricted to majors. Independents like Tullow Oil, Afren (prior to the 2014 crash and its ultimate bankruptcy) and Chariot expanded footprints. North American and Asian companies were active in the region particularly within the Pre-2014 crash period and again towards the end of the Post-2014 crash to Pre-2020 crash period. US-based Anadarko and Kosmos Energy were two of the most active players, particularly in West Africa.

Figure 1:Graphical illustration of contracts awards

(in green) versus relinquishments (in grey) in Africa. The top left

graph gives the overall African trend. The five successive charts

provide a more granular view based on groups of companies with

similar regional provenance. Scales vary in order to optimise both

readability and comparison.

The 2014 oil crisis not only restrained investment, but it expedited divestment programmes. This was particularly evident within mature areas like the Niger Delta - the ultimate beneficiaries being indigenous companies. In 2015, awards to European companies dropped significantly while African companies achieved their second-best year in terms of awards, as indicated on Figure 1, despite this occurring during the worst of the oil price collapse.

North American players sequentially increased acreage positions in Africa prior to the 2014 oil crash. It is during this period that we saw the likes of Anadarko, Chevron and ExxonMobil actively exploring Liberia, Sierra Leone or Cote d'Ivoire, and ConocoPhillips or Cobalt following suit in Angola. The strategy changed significantly post 2014, when US-based companies greatly accelerated withdrawals - relinquishing more licences than they moved into. This trend continued until 2019 when sentiment seemed to have shifted back to Africa and frontier exploration.

Traditionally, Asian and Russian companies have been underrepresented in the African upstream landscape. This started to change in the early 2010s when these groups were awarded contracts in Ethiopia, Cote d'Ivoire and Egypt. However, after the 2014 oil price crash, a divergence in this trend is observed. Asian companies pulled back primarily from West Africa whereas Russian companies progressively augmented their positions. In 2016, Rosneft partnered with Eni and BP in the gas giant Zohr. In Congo, Gazprom moved into two onshore licences later to be replaced by Lukoil which in turn acquired additional offshore acreage in 2019. More recently was the move by Lukoil to acquire the undeveloped deep-water gas giant Fortuna in Equatorial Guinea. Further Russian investment is expected in this country, in addition to a commitment to invest in South Africa's upstream industry.

To deal or not to deal? That is the questionfor 2020-2021

In late 2019 and early 2020, both authors were optimistic regarding the continued revival of African Upstream activity. With oil prices seemingly stable at around USD 60/bbl and expected to remain relatively consistent, explorers were again looking at frontier basins. However, at the time of writing (mid-April 2020), the industry was in the grip of a crisis driven by a demand crash related to the COVID-19 pandemic. The net result is that almost without exception, company mergers and acquisitions that were expected to be concluded within the next 12 to 18 months are facing significant risk - a key issue being valuations at current prices. In addition, drastic cost reductions in upstream budgets, will put further downward pressure. That said, we are likely to see a few opportunistic acquisitions.

Perhaps one of the biggest challenges within the near term will be for companies looking to divest producing assets, finding buyers that are willing and able to offer fair value will be difficult. In response, several companies have already mentioned delaying divestments until market conditions improve. Conversely, relinquishments and or cancellations of exploration acreage is likely to accelerate, particularly if entering successive exploration periods triggers substantial commitments. One strategy that operators have employed thus far is to evoke Force Majeure as a means to extend current exploration periods and push back commitments. Several examples in Libya and Cameroon are already known of, and many more throughout Africa are expected.

Within this trying context, ExxonMobil hopes to finalise the sale of the giant Zafiro oil field in 2020, offshore Equatorial Guinea. Potential buyers include US-based Marathon Oil, Russian Lukoil or GazpromNeft, or Chinese Sinopec that would partner with Nigerian Waltersmith Petroman Oil. However, the current market uncertainty may make concluding the sale difficult indeed. Based on an USD 60/bbl oil price, the project had a net present value of about 1.4 billion; but at USD 30/bbl it is barely economic. In Nigeria, several majors are also looking to pursue divestment programs, including Chevron, Total and ExxonMobil.

In North Africa, Shell is looking to divest its Egyptian assets in the Western Desert. Dana Gas has also decided to market its producing assets within the Nile Delta and the Gulf of Suez to focus on Kurdistan, but the company has put off the sale due to current market conditions. In Chad, ExxonMobil, Petronas and Glencore plan to sell producing assets, while in Algeria, BHP, CNOOC, Petrovietnam and smaller players are trying to divest development/production acreage.

Smaller companies with less robust balance sheets are expected to face significant headwinds. Tullow Oil - one of Africa's greatest explorers - mentioned it may not be possible to continue operating this year unless economic conditions improve. It is worth remembering the collapse of Afren in 2015 was attributed at least in part to the 2014 oil price crash. Chariot Oil and Gas recently introduced a significant change in strategy - essentially a move away from a high-impact explorer to a Moroccan gas producer. The transition will be accompanied by portfolio streamlining, which will likely result in the offloading of exploration acreage. This pullback in frontier exploration has already been implemented by Kosmos Energy. The decision was taken before the 2020 oil price crash but would have been almost inevitable within the current environment. The company plans to reduce exposure to offshore Mauritania/Senegal, with gas end-users, utilities and supermajors identified as potential buyers.

A time to be bold or a time to hold

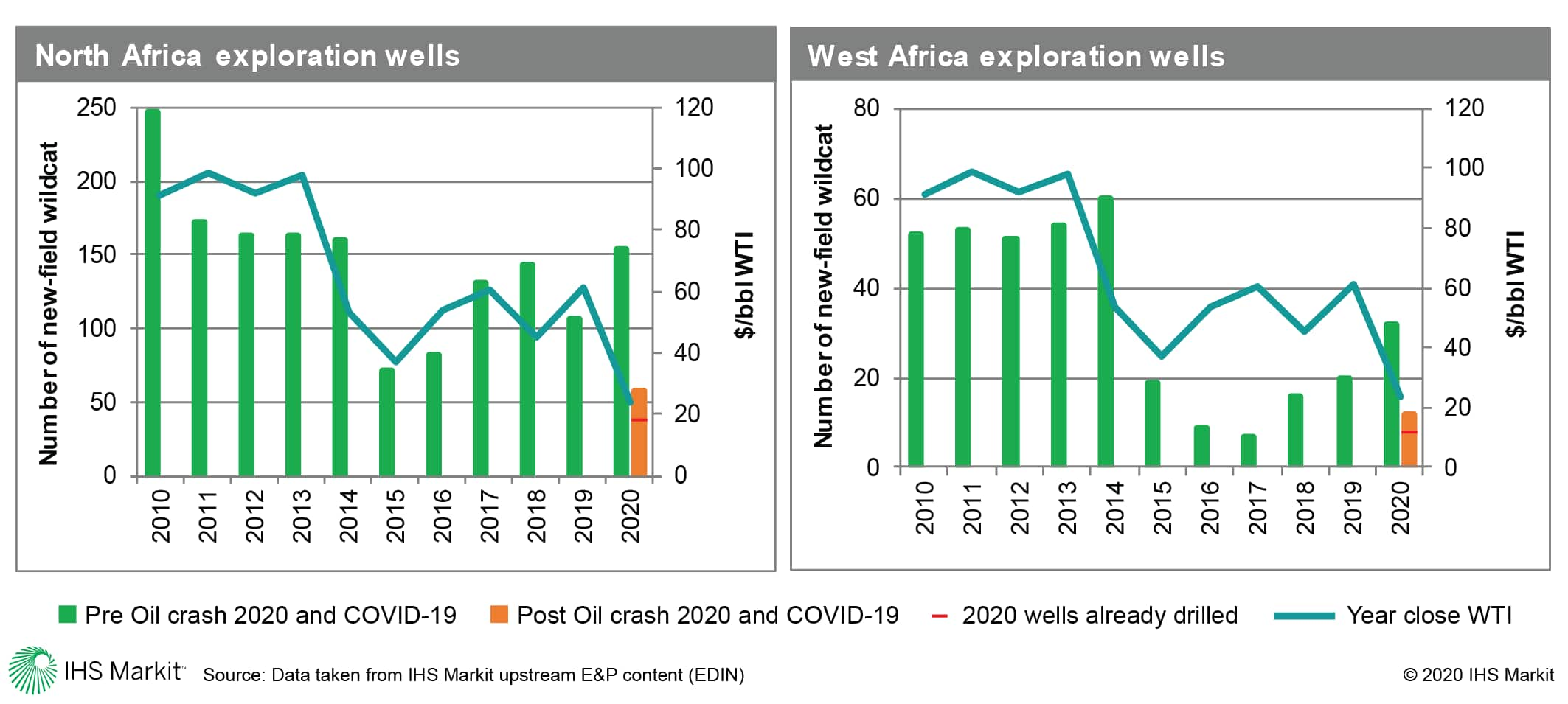

African exploration drilling activity provides additional insight into what might be expected in the years following the 2020 oil price crash. Broadly speaking, a pullback in exploration drilling in line with the oil price can be anticipated. But far more interesting is the likely response by sub-region, as illustrated in Figure 2.

Figure 2:Exploration drilling activity in North Africa

(primarily onshore) versus West Africa (primarily offshore) over

the past decade (green bars), including a subjective estimate of

the expected exploration drilling in 2020 prior to the current

crisis and a likely reduction in 2020 (orange bars).

North African exploratory drilling is primarily onshore and is dominated by Egypt and Algeria. Within this region, the response to market fluctuations - both up and down - has been rapid. Exploratory activity showed a strong recovery from the 2015 lows to levels similar to those seen prior to the 2014 crash. This upward trend was expected to continue prior to the 2020 oil price crash.

The same cannot be said for Sub-Saharan Africa, in particular West Africa. Exploratory drilling in this region - at least in recent years - has been dominated by offshore drilling in increasingly deep waters. The oil industry has traditionally responded quickly to downturns, but the same is not true for its response to oil price recoveries. Typically, a 2 to 3-year delay can be expected before a year-on-year increase in exploratory drilling activity is observed.

The main reason for the divergence is related to the typical cost of an offshore versus onshore well, and the related development costs of offshore discoveries (no one wants to spend USD 50 - 150 million on an offshore exploratory drilling with no guarantee of field development, assuming the well is successful). Moreover, only a few companies have the financial and technical capacity to drill in deep waters. These tend to be the large independents or majors, which are very reactive when it comes to cutting discretionary spending in low oil price environments and less responsive to price recoveries.

Based on this, we expect a recovery in Saharan Africa drilling as soon as a recovery in the oil price takes place. However, in Sub-Saharan Africa a post-2022 recovery is likely if prices recover this year. It is worth noting that there is another factor that could skew this: commitment wells. In 2015, there were more wells drilled within the Kwanza Basin (Angola) than one might expect. Majors didn't have many options to cancel or delay these as they were contractual commitments and the penalties for not drilling were similar to the cost of drilling.

Round-up

As one might expect, the oil price has a significant influence on company strategies. Although the 2014-2015 drivers for the oil price collapse are not strictly the same as in 2020, useful inferences can still be made. A significant pullback in awards and increase in relinquishments is expected. Distinct trends related to company's region of incorporation are evident from historic data and these trends will likely persist. African and European companies have historically dominated the numbers of awards and or deals concluded on the continent and although a drop off in line with the oil price is expected, these groups will maintain a strong African focus. North American companies have in the past reacted rapidly and aggressively in reducing African exposure. Perhaps the most recent tentative trend is the increasing activity of Russian firms in Africa; it seems likely that this will continue and may indeed be facilitated by the recent crises.

While African governments did respond to the 2014 oil price crash, implementing tax incentives and legislation to stimulate upstream activity and improve the economics for selected projects, these measures came into place 3 to 4 years after the crash. This suggests that governments generally lack the ability to react rapidly, which does not bode well for the current crisis.

In the next 12 to 18 months - given the expected morose oil price environment - company deals involving producing assets are expected to face delays unless sellers are in a distressed position. Exploration acreage awards will likely plummet, and the number of relinquishments will rise. Explorers will hold acreage in the absence of pending commitments, while entering successive exploration periods which trigger near term commitments seems unlikely.

Exploratory drilling activity is expected to follow a similar trajectory to that of the 2014-2015 crash. Drilling will drop off significantly - possibly to less than a third of what was observed in 2019. Regionally, North African exploration drilling will respond similarly in line with the recovery. However, in Sub-Saharan Africa a recovery in drilling activity is not expected until 2022.

IHS Markit experts are available for consultation on the industries and subjects they specialize in. Meetings are virtual and can be tailored to focus on your areas of inquiry. Book in a consultation with Justin Cochrane.

Etienne Kolly is an associate director at IHS

Markit.

Justin Cochrane is an associate director at IHS

Markit.

Posted 09 July 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.