Energy storage among key strategies for renewable integration in India

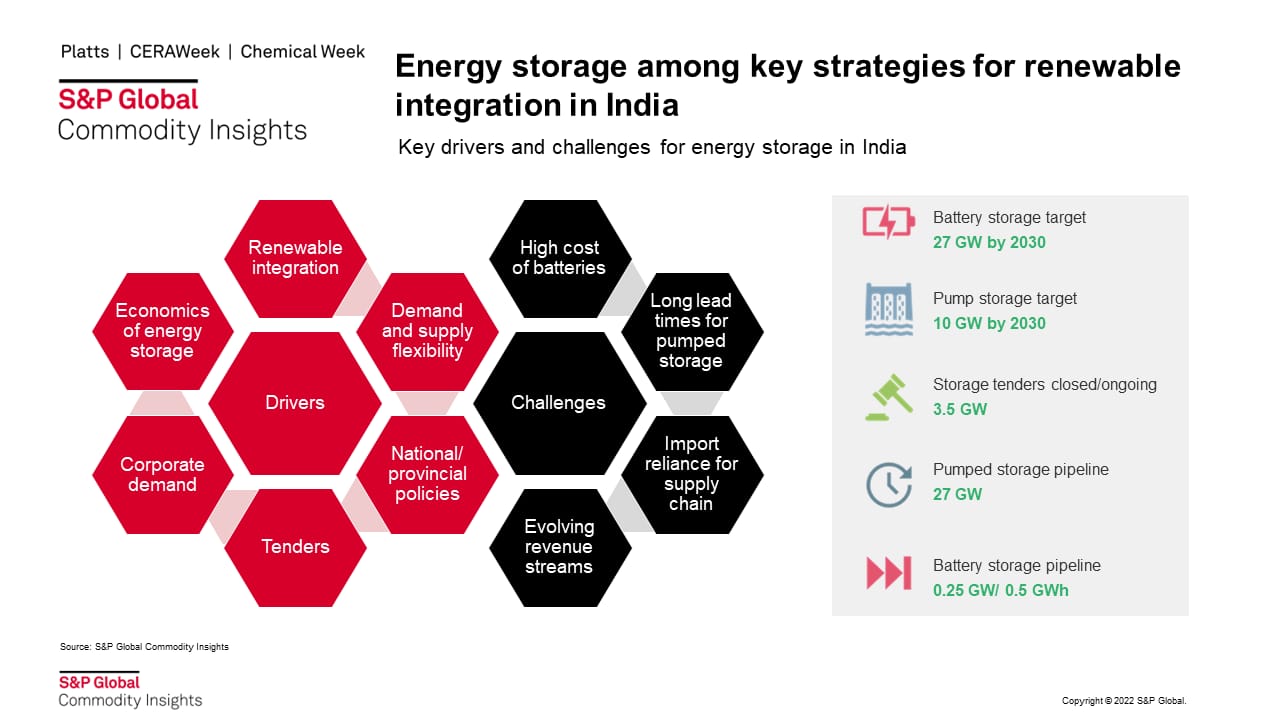

More than 80% of the new capacity additions until 2050 in India's power sector are expected to come from wind and solar energy sources with high seasonal as well as daily variability. High seasonal and daily variability in supply due to the intermittent nature of wind and solar is driving the policies at national and state levels to firm up renewable supply, build operational reserves, and improve system flexibility by building energy storage.

In the short term, policy focus is on operationalizing pumped storage projects (PSP) which are under construction and in late stages of development to build operational reserves. On the other hand, battery energy storage systems (BESS) pipeline is also being built through competitive tenders where execution timelines could vary between 1 to 1.5 years. Battery storage projects are expected to build further with more upcoming tenders for standalone as well as collocated projects requested by SECI and other state utilities including Gujarat, Maharashtra, Karnataka, Kerala, and Uttar Pradesh.

In the short-term, PSP capacity is expected to dominate the energy storage additions driven by better economics, resource potential, and local capabilities. But in the long-term BESS additions are expected to outgrow PSP by 2030. Batteries growth will be supported by the falling capex requirement and competitive pricing in tenders.

There is a pipeline of over 30 GW pumped storage and battery storage projects across multiple states in India. While the majority of the pumped storage pipeline is driven by state governments, private investments by companies including Greenko Group and JSW Energy have strengthened the pipeline further with a mix of state and corporate consumers. Private investment in the energy storage segment is currently led by renewable developers and diversified utilities expanding to tap this emerging sector.

Most of the current tenders for storage are hybrid in nature with collocated renewables with storage requirements to meet peak demand or provide firm renewable supply including round-the-clock supply. While standalone storage tariff (at about $120/MWh) is more than double the tariffs in the collocated tenders (under $ 50/MWh), these projects offer different applications and value to the system and remain competitive with other sources of flexibility.

As per S&P Global estimates, in an optimistic case project returns of up to 12% can be achieved for a standalone battery project in India, but these estimates are very sensitive to the initial investment requirement, augmentation cycles, duration of the contract and available revenue streams. At present, long-term PPAs are the safest bet for earning sustainable revenues. While in the longer term when daily variability in wholesale prices increases due to higher solar in the generation mix, it will create opportunities for arbitrage revenues as well.

Learn more about our global power and renewables research.

Ankita Chauhan is a principal analyst on the Asia Pacific Gas, Power, and Climate Solutions team at S&P Global Commodity Insights.

Posted 19 December 2022

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.