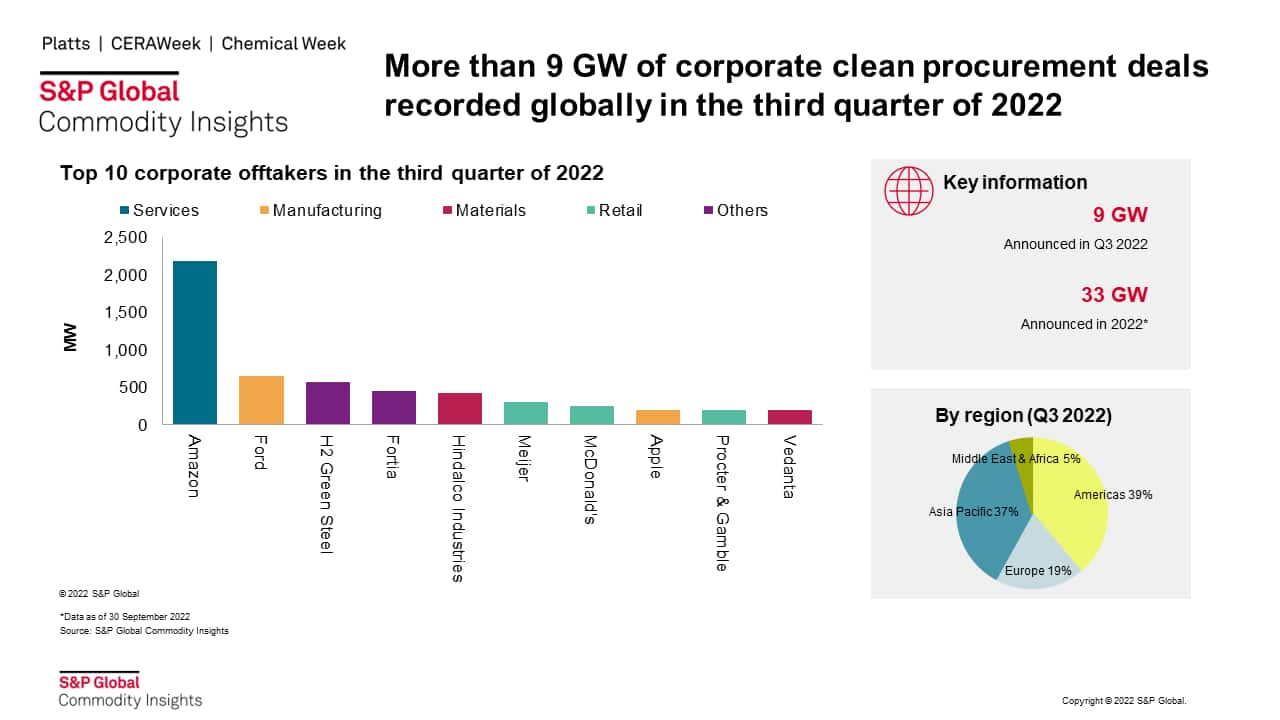

Global corporate clean energy procurement deals of 33 GW announced in the first three quarters of 2022

Corporate clean energy procurement (CEP) continues to rise. The total corporate power purchase agreements (PPAs) closed in first three quarters of 2022 stand at 33 GW surpassing the total volume recorded in 2021 by 7%. In the third quarter of 2022 alone, more than 9 GW of new contracts were announced. The contracted capacity was down by 17% compared to the previous quarter (Q2'22), however, was year-on-year higher by 77%. North America constitutes about 40% of the global corporate PPAs in Q3'22, closely followed by Asia Pacific at about 37%. A total of 347 corporate deals were recorded in Q3'22 across 30 different markets globally, with United States, India, and Taiwan among the three largest markets with two thirds of the total contracted capacity.

In Q3'22, about 3.6 GW of capacity was contracted in the United States with three fourths of the PPA capacity by the services and manufacturing sectors. Amazon is the leading buyer with 1.7 GW contracts announced across seven states in both regulated and deregulated markets in the third quarter. Amazon also emerged as the largest corporate renewable consumer globally with more than 2 GW of new contracts recorded in Q3'22 taking the total contracted volume by the services company in the first three quarters of 2022 to nearly 5 GW. As of 2021, Amazon has achieved 85% share of its procurement through renewables and is on its way to achieve 100% renewable procurement target globally by 2025.

India recorded 1.7 GW of corporate renewable contracts in Q3 2022. Materials and services companies together accounted for more than 70% of the CEP deals announced in this period. While among the largest corporate PPAs announced is the 400 MW hybrid wind-solar deal between renewable IPP Greenko and materials company Hindalco Industries Limited. Amazon also recorded its first utility-scale renewable procurement in India during this quarter with three contracts announced with total capacity of 420 MW.

The second largest offtaker of renewable PPAs globally in the third quarter was automobile manufacturer Ford. The contracted capacity included a 650 MW solar with DTE Energy through a green power purchase program MIGreenPower in the United States. This purchase has put Ford 10 years ahead of its 2035 carbon-neutral schedule.

More and more companies are announcing 100% renewable procurement targets. 70% of the companies announcing such targets are headquartered in Asia Pacific and about half of them are in the manufacturing sector. While liberalized electricity markets are dominated by virtual PPAs, regulated markets enter direct PPAs, together making 65% of the contracts in Q3 2022.

Besides, regulatory reforms in Asia Pacific markets lead the way in enabling corporate PPAs. Among these markets include:

- Australia, which passed legislation to increase its national emission reduction targets,

- Japan introduced a stimulus plan for decarbonization projects,

- India centralized open access application process which would reduce administrative challenges and delays, and

- South Korea reduced the threshold to participate in the corporate PPA markets

To learn more about our corporate renewable procurement research, visit our Clean Energy Procurement page.

Ankita Chauhan is an associate director at S&P Global Commodity Insights, focuses on renewable energy research for South Asian markets and global clean energy procurement.

Posted on 20 December 2022

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.