Equatorial Guinea's Gas Mega Hub Ignites West Africa's LNG Potential

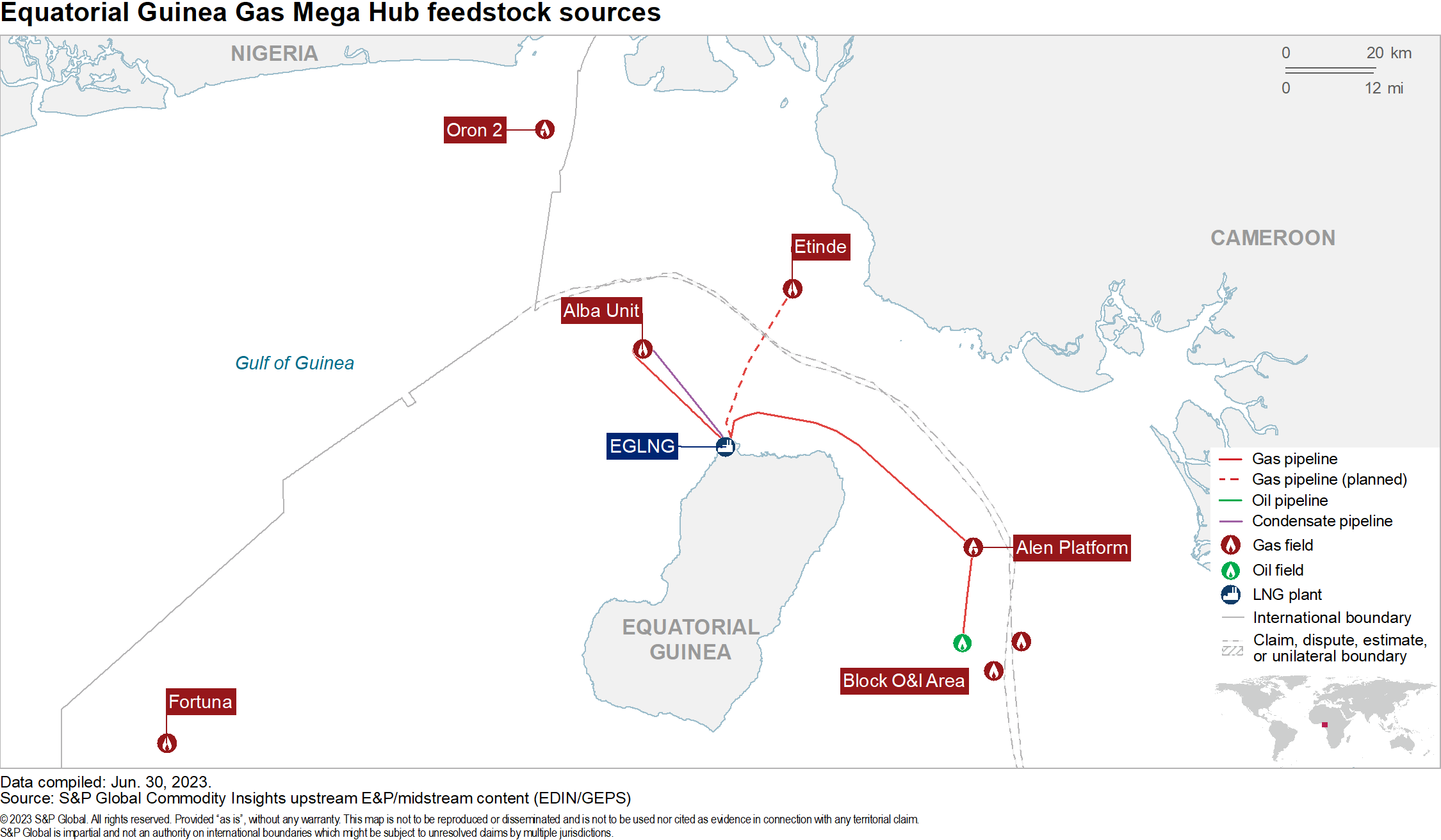

Equatorial Guinea could be a major hotspot for LNG within West Africa following the recent agreement between the Equatorial Guinea government, Marathon Oil Corporation (Marathon Oil) and Chevron's Noble Energy E.G. Ltd to move ahead with the development of the Gas Mega Hub (GMH). The Heads of Agreement (HOA) aims to extend and maximize gas feedstock for the terminal through the development of more fields in the region and within the neighboring countries.

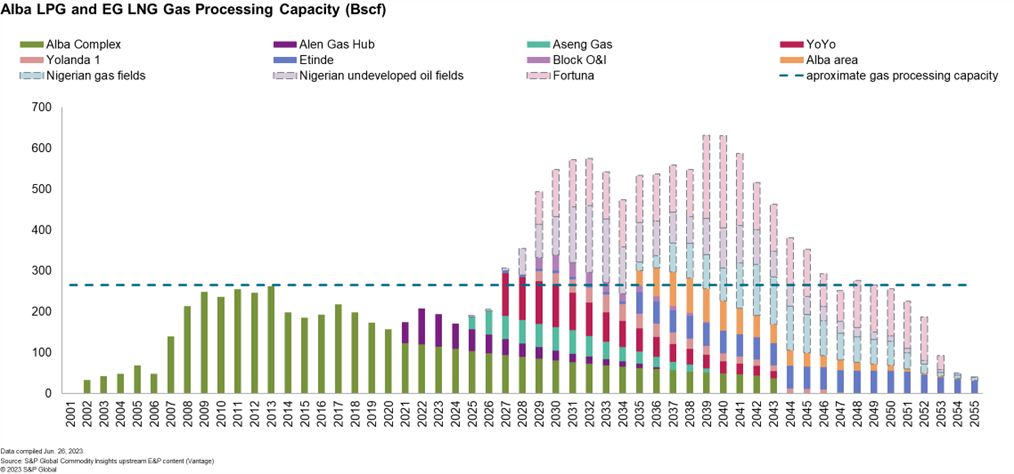

Phase I of this project was successfully completed in February 2021 with the start-up of the Alen gas monetization project, which aimed to send gas from the Alen field to the Punta Europa facility via a newly built 70km-long pipeline with a capacity of 950 million cubic feet of natural gas per day (MMcf/d). The Alen field had been producing condensate since 2013, while gas was reinjected to maintain reservoir pressure. Currently, gas is processed through the existing Punta Europa facilities, from where it is further sold to the European and global LNG markets. The Alen gas monetization project has been a key step forward in maximizing development of existing and future regional gas resources and can facilitate the commercialization of further gas resources in proximity to the Alen facility.

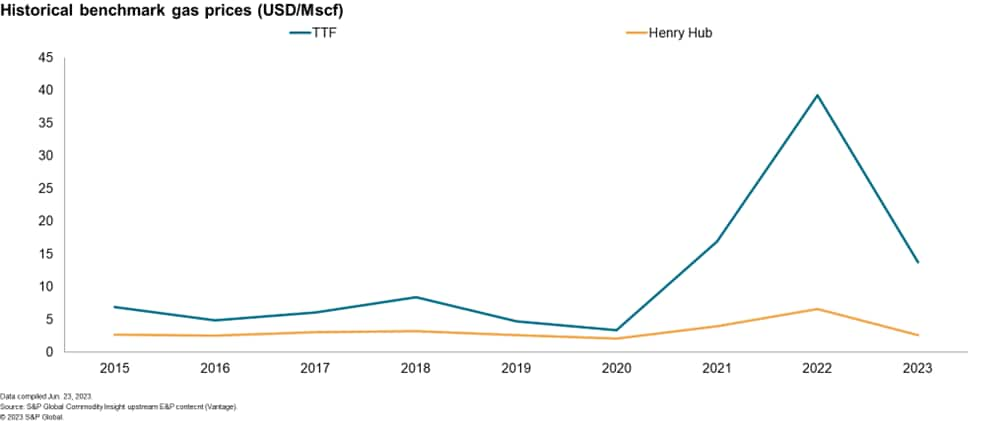

Phase II consists of a change of contractual terms for the Alba gas

field, which has been the main source of feedstock gas to Punta

Europe since 1991. Currently the Alba LNG is sold under contractual

terms linked primarily to the Henry Hub index. However, following

the expiry of this contract at the end of 2023, Alba gas volumes

will be processed under new contractual terms linked to the TTF

index. Marathon expects the new contract to improve the company's

earnings and cash flow, because of the recent and expected higher

gas prices (graph 1) due to the sanctions imposed by the European

Union to Russian gas imports and the consequent increased LNG

demand. The improved cashflow will provide Marathon Oil the funding

to further develop the Gas Mega Hub (GMH). Moreover, the company is

also evaluating at least two infill drilling opportunities to

improve and maintain the Alba production performance, that has been

declining on average at a rate between 8% and 10% year on year.

Phase III of GMH will focus on the commercialization of gas from

the Aseng field, which has been producing oil since 2011 with gas

injection for pressure maintenance. It is estimated that there will

still be spare processing capacity at the Punta Europa facility to

accommodate production coming from the Aseng field, which is

expected to be connected to the EG LNG via a tie-back to the Alen

production platform.

A recently signed bilateral treaty on cross-border oil and gas

developments between Equatorial Guinea and Cameroon opens up an

opportunity to further expand the possibilities for gas

commercialization within the region and further extend the life of

the terminal. This bilateral agreement aims to accelerate the

development of Chevron's Yoyo-Yolanda project, situated on the

border between Equatorial Guinea and Cameroon. The joint

development would involve a subsea tieback to the Alen platform

from where gas will be exported to the EG LNG via the existing

pipeline.

The Etinde gas field offshore Cameroon could be another candidate

to supply feedstock gas to the EG LNG plant. The field was

discovered in 2019 but has since remained undeveloped partly due to

the complex geological structures and high-pressure reservoirs, as

well as due to the commercial and regulatory issues impacted by

COVID-19 and recently, due to the sanctions that were imposed on

Russian Lukoil. Should the Etinde gas field be included in the

bilateral treaty, the partners might finally go ahead with a Final

Investment Decision (FID) via the EG LNG plant which gives

potentially lower development risks, lower initial investment cost

and potentially a shorter timetable compared to the initial

development plan that included a Floating Liquified Natural Gas

(FLNG) facility. Operatorship change from New Age to Perenco is

still pending, but once completed, it is expected to accelerate

development planning activities.

Apart from the plans to import gas from Cameroon, Nigeria can also

provide gas feedstock to the GMH. A memorandum of understanding

(MOU) signed between Nigeria and Equatorial Guinea in early 2022,

could allow the commercialization of Nigerian untapped resources

located in the proximity of the border via an offshore gas pipeline

to the EG Alba facilities, which will provide access to the Punta

Europa LNG terminal. The signature of this MOU could accelerate the

development of unexploited gas fields such as Oron 2 (discovered in

1975), as well as open the possibility to commercialize gas from

other oil fields located at a tie-back distance from Alba.

Combined, the gas reserves of these fields are estimated to be in

the range of at least 3 Tscf.

Finally, the Fortuna gas field which is estimated to hold up to 2

Tscf of natural gas, located in Block EG-27, has remained stranded

for almost 10 years. Ophir Energy and Lukoil, the two past

operators, haven't managed to finalize a development plan. The

previous FDP included an FLNG, however the government leaned

towards a scenario of a 150 km long tieback to the Punta Europa

facility, which could cause both technical and financial challenges

due to the distant field location. According to the authorities,

negotiations for a new operator are ongoing.

Other sources of potential gas supply for the EG LNG plant could be

the fields located in the blocks, adjacent to the Alba unit.

Combined, these fields are estimated to hold around 700 Bscf of gas

resources, which could be developed simultaneously as a tie-back to

the existing Alba facilities provided the projects are technically

and economically viable.

***

Want to access more upstream content? Visit S&P EDIN & Vantage.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.