As Europe’s PPA market continues to expand, how will PPA prices evolve?

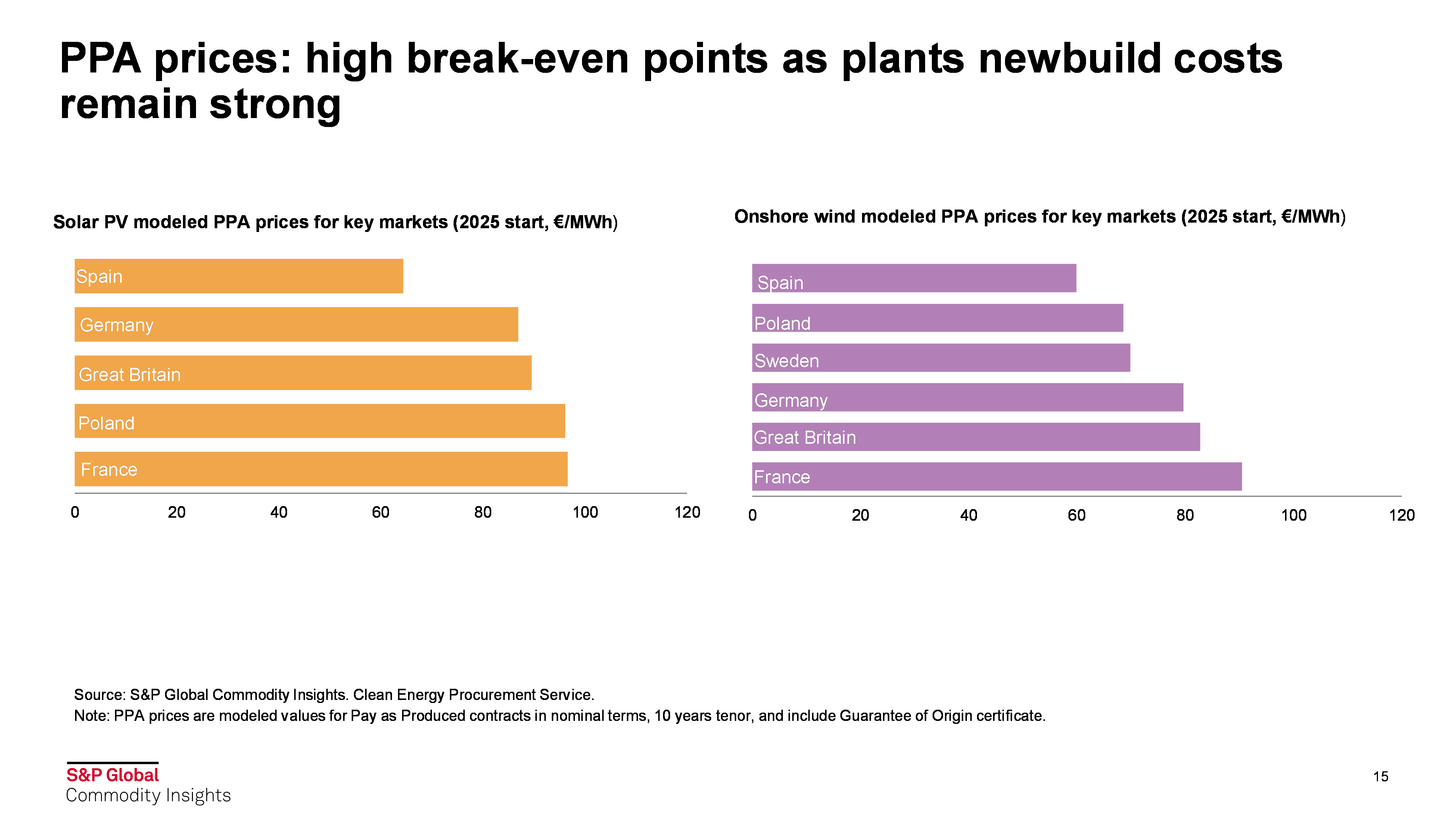

While power prices have now returned to levels closer to pre-Russian/Ukraine war, large uncertainties remain around pricing renewables in the longer term. Some of the inflationary pressures to build new plants are abating, but newbuild costs are still somewhat mirroring the cost escalations and supply bottlenecks of the last 24 months, which will have an impact on the way the market prices long-term PPAs. Based on a recently developed model, S&P Global Commodity Insights believes 10-year solar and onshore wind PPAs starting in 2025 in Spain would be priced fairly in the low euro 60/MWh, while in Germany both technologies would need PPA prices around 80-85/MWh to enable prevailing renewables plants to recover newbuild costs, operating costs, and financing costs.

Factors impacting solar PV PPAs: Capture prices, capacity factors, and contract durations key assumptions.

In addition to the underlying costs for project development, a number of additional parameters could impact PPA prices; clearly the modelling assumptions have an impact on the PPA valuation. Major factors include:

- Wholesale power prices and capture rates. This is a central assumption as renewables assets have a lifetime of 25-30 years, which is longer than a typical PPA. Hence the assumptions around the revenues post-PPA have an impact on the PPA evaluation.

- Capacity factors are clearly a large driver of price variations across PPAs and markets. This is particularly the case in Germany, given the large divergence in solar resources across the country, with locations in Southern Germany at a premium versus the average. For Germany, a 10% change in capacity factor assumptions lead to a 15% change in the modelled PPA prices.

- PPA durations have also a key impact, as the revenue cannibalization risks are more pronounced in the longer term, for the merchant tail post-PPA.

- We see the PPA share of the solar PV plant to be an important factor only in select markets. In Spain, our models show that the lower the PPA share of the power plant, the higher the PPA price should be as more capacity is left unhedged and exposed to potentially lower revenues from the spot market.

- Other factors, such as discount rate or the debt ratio of the project, have been considered, but have a more limited impact on the PPA price in our modelling results.

Solar PV PPA prices and wholesale spot capture prices: Wide spreads likely to persist

With surging renewables capacity and lagging system flexibility, the trajectory and volatility of wholesale capture prices remain highly uncertain. Our modelled PPA prices are generally above the forecasted capture prices, with the divergences being particularly large for solar. As shown by recent developments in spot prices, record solar PV generation deflated hourly prices around midday, moving well below zero and impacting income of full merchant solar PV plants, unlike wind plants, whose capture prices have been more supported.

This confirms our idea that unhedged revenues of solar PV plants face large downside risks, but this might be an opportunity for corporate offtakers that have appetite for a larger exposure to wholesale markets. These large spreads between PPA prices and spot capture prices pose some questions on whether PPAs for standing alone solar PV plants could continue to take off in Europe.

PPA prices set to decline substantially in the next couple of years as costs pressure abate

The other question is how PPA prices might evolve in the future. While PPA prices are influenced indirectly by the development in wholesale power prices and capture rates, the development in newbuild costs has also an impact in our modelling work. We believe cost pressures will abate over time. Solar PV is the most interesting technology as we see the potential for larger declines in CAPEX within the next five years or so, which more than offset less attractive resources at the margin. This could mean that solar PPA starting up in 2026 could be dropping more substantially from current levels. Our model shows a 12 euro/MWh decline for solar PPAs starting in 2026 versus PPAs starting a year earlier. As a result, offtakers may want to wait to lock into long-term deals in the next couple of years, to take advantage of declining prices.

You can learn more about our PPA pricing insights from our Clean Energy Procurement service.

Bruno Brunetti, based in London, UK, is Head of Low-carbon Electricity Analytics at S&P Global Commodity Insights.

Posted 30 June 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.