Russia-China gas cooperation potential: Multiple options on the table

After experiencing a decline in 2022, Chinese gas demand has resumed its growth trajectory in the first five months of 2023 and is expected to increase by almost 300 Bcm in the next two decades. Chinese companies have been signing a series of new LNG term contracts, but LNG is not the only option for new gas imports for China. Now that pipeline exports to Europe have fallen significantly, Russia has been actively engaging China on new pipeline gas projects in addition to the two existing contracts —38-Bcm/y through Power of Siberia (POS)-1 and 10-Bcm/y from the Far East.

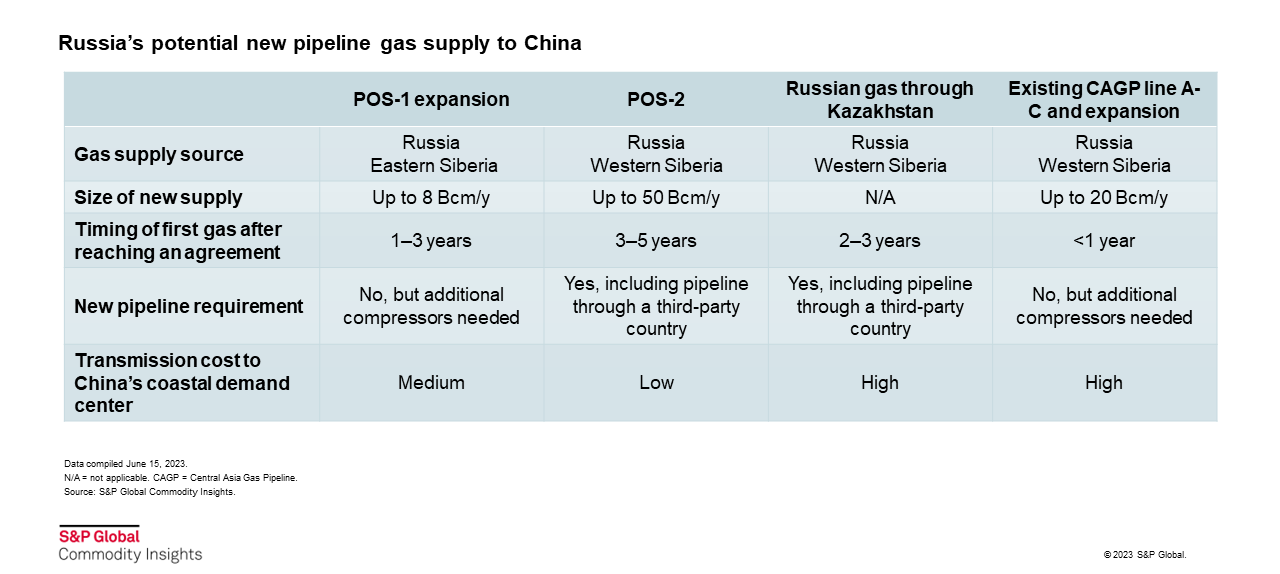

The POS-2 pipeline project, up to 50 Bcm/y capacity sourcing from Western Siberia, has been under negotiation before the Russia-Ukraine conflict to diversify gas exports from Russia. Now, China becomes an even more strategic market. Following Chinese President Xi Jinping's visit to Russia in March 2023, the Russian government announced that almost all aspects of the POS-2 agreement have already been agreed upon with no confirmation from China. Construction of long-distance pipelines on both the Russian and Chinese sides is still required, even when a supply agreement is reached (see Figure 1).

In March 2023, Russia proposed two new pipeline routes through Central Asia to supply gas from its existing gas fields in Western Siberia to China. The first option involves the entry of Russian piped gas into northeastern Kazakhstan, delivering some gas to Kazakh consumers, along with an extension to the Kazakh-China border. Alternatively, the proposal suggests reversing the flow in one of the pipeline strings in the Central Asia-Center (CAC) pipeline system to transport gas to Uzbekistan and then moving some of the southward-flowing Russian volumes through to the existing Central Asia Gas Pipeline (CAGP).[1] However, no specific details have been released on these proposals.

From the initial proposal to the finalization of a commercial agreement, reaching a consensus has always been a challenging process. Furthermore, even if the landed price of Russian gas at the Chinese border is comparable to that of POS-1, the new entry point(s) at the China-Kazakhstan border means significantly higher transmission costs within China to bring gas to the coastal demand centers. In addition, the existing CAGP has limited spare capacity.

China also has an alternative pipeline supply option sourcing additional gas from Turkmenistan's Galkynysh gas field through the CAGP Line D. This pipeline, with a designed annual capacity of up to 30 Bcm, takes a different route compared to the existing A-C lines, passing through Uzbekistan, Tajikistan, and Kyrgyzstan to reach China. Although Chinese President Xi announced initiatives to expedite the progress of Line D during the China-Central Asia Summit in May 2023, no formal agreement has been signed yet. The development of Line D has faced challenges, including price negotiations and technical difficulties, leading to the project's intermittent construction.

China's long-term gas demand growth is promising, requiring new gas supply including imports. Both LNG and imported pipeline gas play crucial roles in China's supply mix. Based on China's gas supply security consideration, a general rule of thumb is for import dependency to remain at 50% or less, with imports split between pipeline and LNG. That means China will need roughly 50 Bcm of pipeline imports by 2040 in addition to existing agreements, and it is highly unlikely that all pipeline supply options under discussion will reach commercial stage. Each new supply option from Russia comes with a different timeline, supply volumes and pipeline construction requirement within Chinese borders. If China decides to accelerate a new pipeline import commitment, its appetite for LNG could be significantly reduced, with repercussions on the global market.

Learn more about our APAC energy research.

Tianshi Huang is an Associate Director covering Greater China's gas and LNG markets.

Jenny Yang is a Senior Director covering Greater China's gas and LNG markets.

Anna Galtsova is a Senior Director covering European and Eurasian gas markets.

Paulina Mirenkova is a Director covering Central Asian oil and gas markets.

Posted 30 June 2023

[1] CAGP currently consists of three lines — A, B and C — that run from Turkmenistan, Uzbekistan and Kazakhstan to China.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.