European power demand out of the frying pan and into the fire

2022 was an unprecedented year for power markets in Europe. Unusually high power prices drove tariffs to all-time record levels. The dependency of Europe on Russian gas became clear, as well as the importance of natural gas in setting power prices.

With rising retail and wholesale power prices, consumers of all sizes reduced power consumption. Some large industrials suspended production entirely, households lowered their thermostats, whilst towns across Europe turned lights directed at public buildings and monuments off and stopped heating public pools.

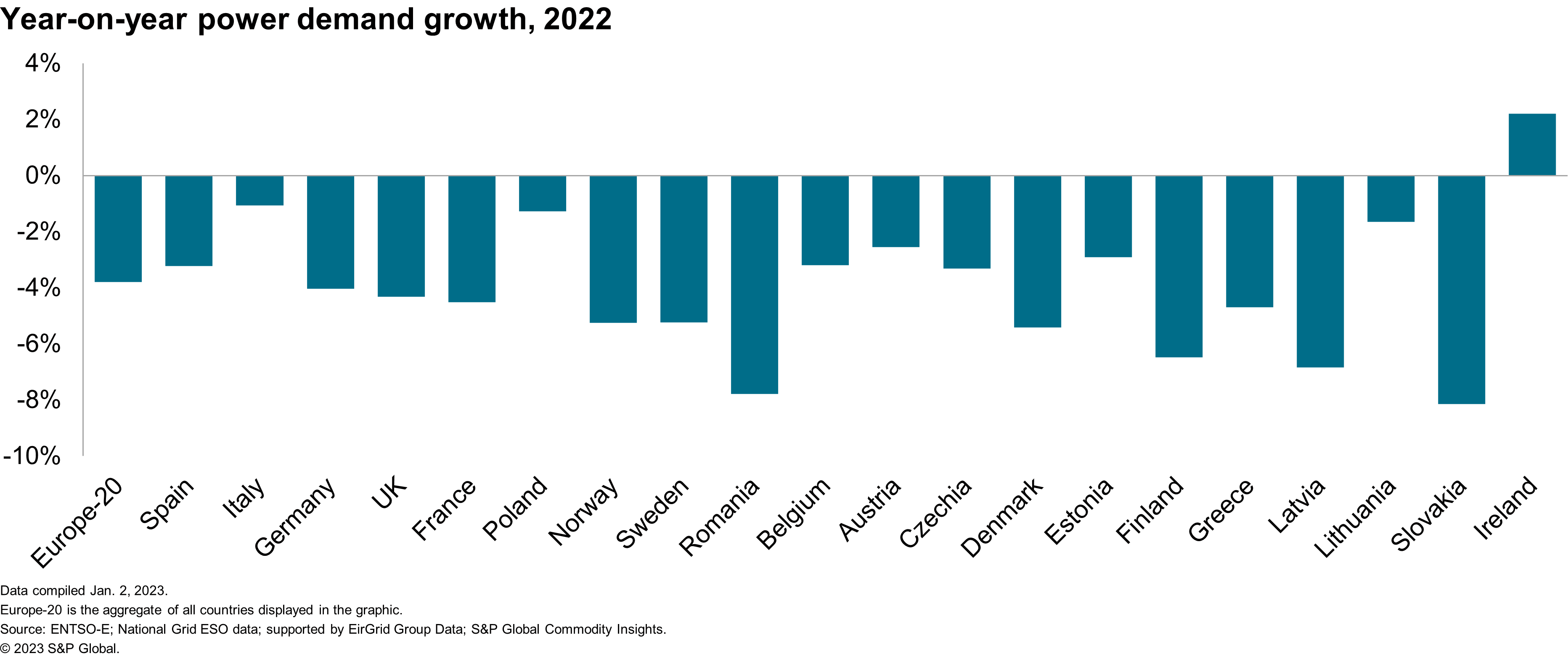

As a result, European power demand decreased by 4% year on year (see figure below). For some countries, 2022 demand was below 2020, a year previously regarded as a one-off extreme. The noticeable exception was Ireland, where power demand grew, driven largely by the expansion of data centers.

But what does this mean for 2023? The situation will most likely

get worse before it gets better: ongoing reliability concerns, high

retail prices, atypical weather and a weakening economic outlook

will all put pressure on demand throughout the year.

- Reliability concerns through the balance of the winter are expected keep prices strong and potentially very volatile which in turn will bring demand down. Where the new equilibrium between demand and supply lies and whether this ideal level is achievable given the security of supply issue further compounds the difficulties of knowing the future development of power prices.

- Another fundamental uncertainty is related to temperature and weather. Cold winters and warm summers drive demand up as it increases heating and cooling needs respectively. So far this winter, we have had both unusually cold and unusually mild weather at periods and demand has responded very much as expected. However, Europe is still consuming significantly less than before, even during cold spells.

- The state of the overall economy also plays a significant role. Uncertainty about the depth of any future recession feeds into uncertainty for the trajectory for power demand.

To assess how power demand could unfold for the coming year, we undertook a three-part analysis.

The first part looked at how 2022 demand developed, particularly towards the end of the year when the demand contraction became more pronounced. The second part looked at historical examples from similar periods where we saw rapidly increasing energy prices. Though not directly comparable, the early 1980s was a period when power demand veered off its trend primarily due to increased oil prices. The third part utilized price data and economics research on price elasticities* for power consumers.

Bringing these three analyses together, a further demand contraction of 5-10% y/y in 2023 remains well within the scope of probable outcomes. Combined with the 4% drop seen over 2022, European power demand could end 2023 close to 15% below 2021 levels in a worst-case scenario—far exceeding the target set by the European commission to bring power demand down by 10% from the pre-invasion level.

Demand reduction on this scale could have long-lasting impacts on the European power market. The return of industrial demand is dependent on companies being able to weather this storm and for production not to be permanently relocated in the process. The return of building demand could be quick if prices drop soon and previous behaviors return. Combined with increased installations of heat pumps across Europe in the wake of this, heating demand is likely to shift from gas to power further increasing growth rates. The pace of demand growth will be visible in the coming years.

*Price elasticities provide a measure of how a change in price corresponds to a change in demand.

For more information on this research and the service it comes from, please visit the European Gas, Power, Renewables and Cleantech Analysis service page.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.