Global Power and Renewables Research Highlights, January 2023: COP27 pledges, carbon markets, and energy transition efforts and challenges

The following provides a brief overview of selected reports in the Global Power and Renewables service from January 2023. Learn more about our Global Power and Renewables Service and the reports featured in this post.

The year 2022 was tumultuous, with complex geopolitical tensions, volatile supply chains, and the urgent need for rapid cuts in global emissions. This was also a busy year for carbon markets, with more countries and corporations alike embracing various forms of market-based mechanisms. The 27th Conference of the Parties (COP27) closed last November, repeating the "phasedown of coal" phrase featured at the 26th Conference of the Parties (COP26) in Glasgow, Scotland. Meanwhile, renewables are growing worldwide, and questions on maintaining grid reliability and energy security have arisen.

The following reports showcase the impacts of the COP27 climate talks, carbon markets, and global energy transition efforts and challenges.

COP27 pledges and carbon markets

COP27 was held in Egypt last November as the "implementation COP" tasked with delivering the emission reduction commitments made in Paris and Glasgow. Many countries are under pressure to deepen their climate ambitions.

Upon closer examination, however, COP 27: Limited impact for Europe finds that the climate conference falls short of its ambition. While countries like Turkey, India, and Indonesia announced their intentions to decarbonize faster, the conference did not result in a commitment to phase down the use of oil and gas, mirroring the call in 2021 in Glasgow to phase down unabated coal plants. European countries that have preexisting clear paths to decarbonize by 2050 are unaffected by the climate talks at COP27. One breakthrough of the conference was the creation of a fund to compensate vulnerable countries affected by climate disasters. Its impact is unclear at this stage as all the details have yet to be discussed; they will be agreed on at the next climate conference, the 28th Conference of the Parties (COP28), in Dubai, United Arab Emirates. Clients can view the detailed discussion here.

Another long-standing aim of the climate talks is to create a global carbon market allowing emission reductions to be traded globally. Discussions at COP27 suggest that the framework may instead allow credits of varying environmental quality, which would lead to multiple price points as is the case today and stand in the way of a liquid voluntary carbon market and a credible price reference.

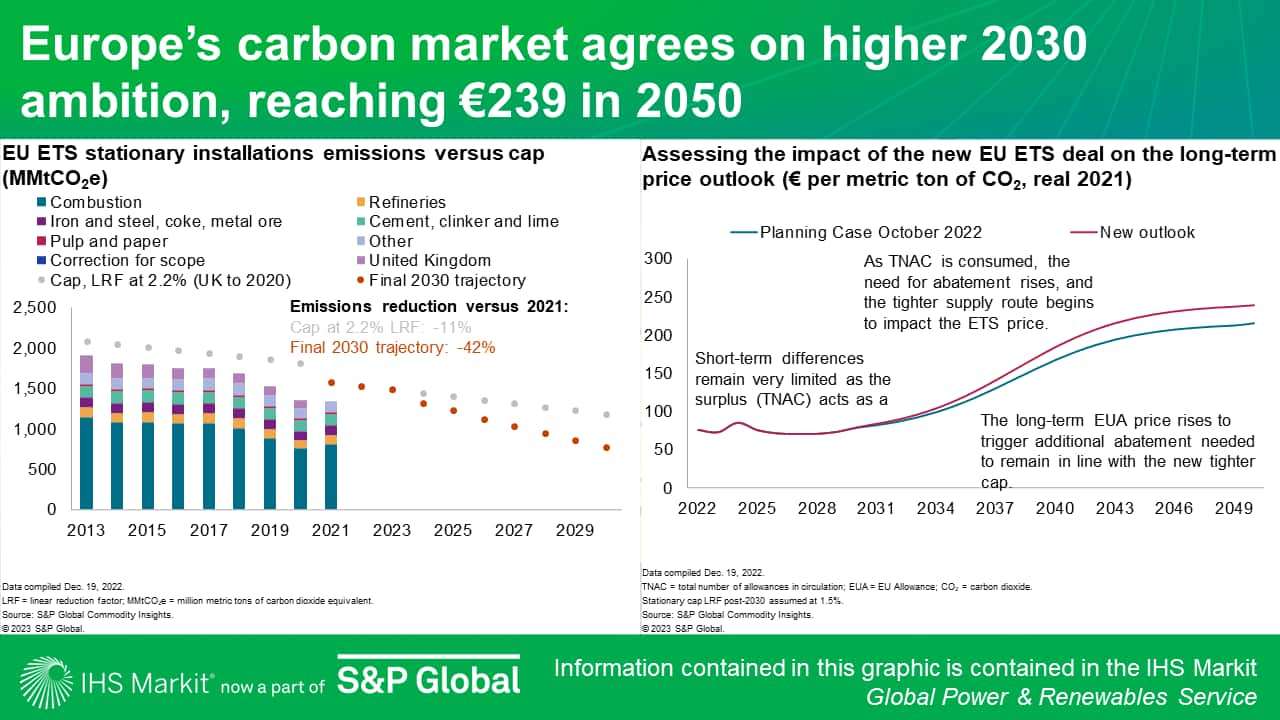

Meanwhile, efforts to boost regional carbon markets continued. According to Europe's carbon market agrees on higher 2030 ambition, on 18 December 2022 the European Union agreed in trialogue discussions, including representatives from the European Parliament, Council, and Commission, on a path forward for the European Emissions Trading System (ETS) to 2030. In line with our expectation, the European Union agreed on a significant market ambition increase to reach 62% emissions reduction by 2030 by tightening supply. The high level of allowances in the market currently means that the price outlook is unchanged to 2030. Post-2030, the carbon price outlook is higher than it was previously, reaching €100 per metric ton in 2034, €184 in 2040, and €239 in 2050 (real 2021). Clients can view the detailed discussion here.

China also plans to tighten its carbon allowance in the newly launched national ETS in the recently released allowance allocation plan for the second ETS compliance cycle. According to China's ETS update: Free allowances tightened, although total cost remains limited, free allowances that are based on emission-intensity benchmarks will be tightened for thermal generators compared with the first compliance cycle, but the seemingly significant tightening mainly serves to wipe out the allowance surplus in the previous cycle. Despite the generous allocation of allowances, the tightening benchmarks will expose inefficient generators to higher carbon cost penalties. This indicates a strong policy push for efficiency improvements or accelerated retirement of those generators.

Energy transition efforts and hurdles

With much of the world battling through an energy supply crunch and global supply chain disruptions in 2022, despite growing and ongoing decarbonization efforts, many challenges on the road to the energy transition are starting to emerge globally.

One challenge to the energy transition in the past year with recent turmoil in the supply and logistics chain is the increased costs of all renewable technologies, calling an end to the spectacular drop in renewables costs over the past decades. Yet, the recent increases are almost anecdotal compared with historical cost declines for these technologies, according to the client insight, The cost of renewables will continue to fall—this is why: Long-term cost drivers for solar, wind, and energy storage. Cost reductions for renewables will resume sooner than later, driving the ongoing transformation of the power sector.

In Europe, offshore wind's installed capacity will surge from 31 GW today to 450 GW by 2050, according toProspects for offshore wind, Europe's energy transition trump card. Despite strong growth prospects, several concerns are identified. The current supply chain is not designed to deliver Europe's ambitions in the short term. And current low prices or even negative bidding in auctions are not sustainable for profit. In France, offshore wind development has had a slow start with 0.5 GW of installed capacity, but the target is 40 GW of offshore wind capacity by 2050; offshore wind plants will not be viable without economic support until the 2040s, according to Strong offshore wind perspectives in France.

Markets in Africa and the Middle East have great potential for low-carbon hydrogen supply. While funding is still limited, a handful of countries in the region have recently passed long-term national hydrogen plans with quantitative targets, according to Low-carbon hydrogen ambitions in Africa and the Middle East: An overview. S&P Global Commodity Insights estimates green hydrogen production in Africa and the Middle East will require more than 400 GW of additional renewables capacity by 2050, on top of nondedicated renewables additions supplying electricity to the grid in 2050.

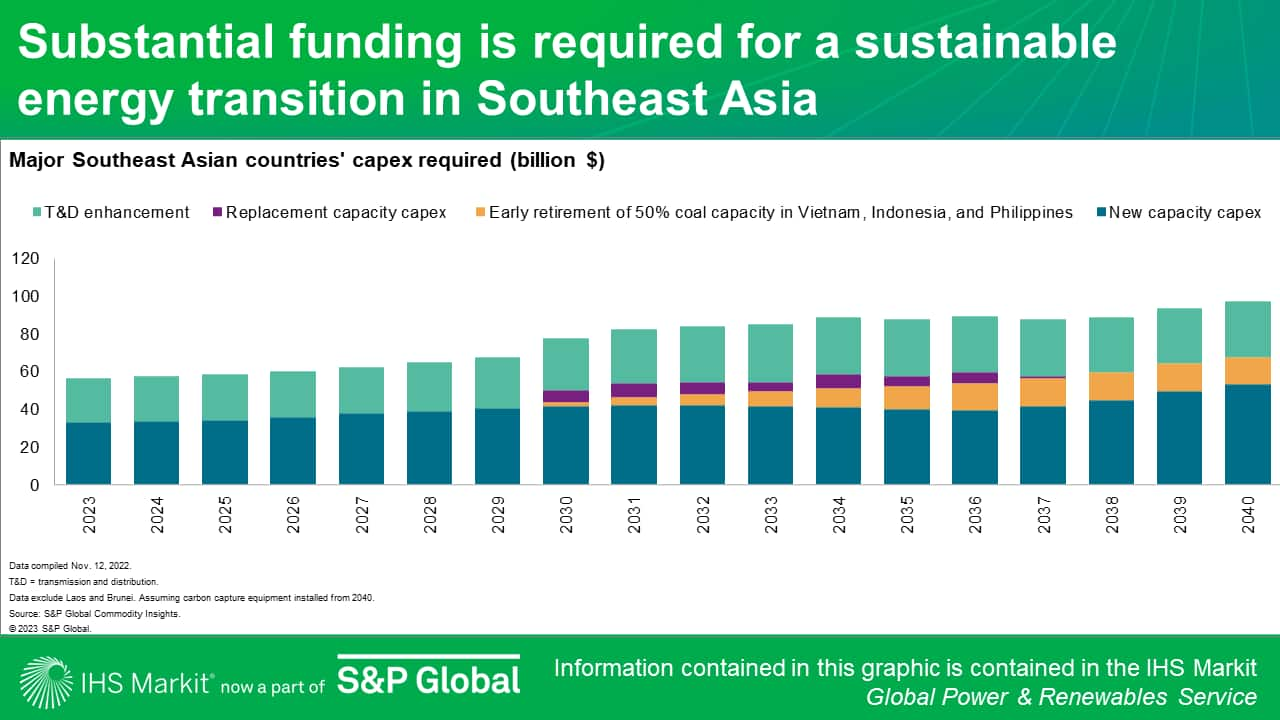

In Southeast Asia, governments are facing a balancing act between the energy transition and power price affordability. According to Balancing affordability and the power sector energy transition in Southeast Asia, countries in the region have mostly regulated electricity prices at a lower level stably to support economic growth in the past decade, but transition paths including replacing coal power with renewables and other innovative low-carbon technologies are prohibitively costly, leaving huge financial burdens on utilities and national budgets. (This article is publicly available here.) To accelerate the energy transition sustainably, power market reform processes with innovative cost control and new payment funds from private participation are crucial to balance the rising prices and electricity affordability.

In Latin America, renewable growth is set to continue its strong momentum, according to Latin American Power Outlook: Southern Cone, December 2022. Despite the phaseout of transmission subsidies and growing participation in the thermal generation mix in Brazil, renewables will represent more than a third of the country's installed capacity by 2050. Nevertheless, challenges remain in capital cost, power grid limitations, and permitting. Chile's most recent auction, from August 2022, procured only 15% of the 5.25 TWh on tender and at a higher clearing price ($37.4/MWh) than in previous occasions.

In the United States, even with the global supply chain crisis that delayed project construction, renewable capacity additions driven by corporate procurement crested 11 GW in 2022, setting a new record, according to US corporate renewable procurement outlook. Through 2030, the corporate sector will account for about 20% of all new renewable capacity additions in the United States.

In Asia Pacific, renewable power procurement by corporations in the form of a corporate power purchase agreement (CPPA) has boomed in the past few years. According to the client insight Asia Pacific renewable corporate power purchase agreement—Third quarter 2022, total CPPA activity across Asia Pacific now sits at 2,154 deals, with an estimated total of 25.5 GW of renewable capacity being contracted by 137 corporations. This shows an increase of 256 deals and 3.4 GW from the previous quarter, demonstrating continual growth of the CPPA market into the second half of 2022. The service sector contributes the most in terms of contracted capacity, followed by the materials and manufacturing sectors.

In addition to power purchase agreements, international renewable energy certificates (I-RECs) have emerged as a popular and less complex way for global companies to source renewable electricity and address greenhouse gas emissions. According to State of I-REC markets, with special focus on Brazil, India, and Turkey, mainland China has led in the issuance of I-RECs but faces double-counting challenges owing to current market design; Brazil, Turkey, and India present the largest three markets outside mainland China for I-REC issuance, accounting for 45% of global I-REC issuance. In 2021, voluntary compliance fulfilled via I-RECs covered less than 1% of the total power consumption for those countries.

Globally, the need to improve energy security and system flexibility with higher renewable integration has also sparked growth in the energy storage market. According toResidential Energy Storage Report—Preliminary Version December 2022, there has been an accelerated consumer desire in the residential energy storage market owing to electricity price increases and energy security concerns. In India, energy storage growth is driven by policy targets and tenders to firm up renewable supply and improve system reliability. India will add battery energy storage systems (BESS) capacity of about 9 GW during 2022-30, while pumped storage plant (PSP) capacity will grow from 4.7 GW currently to over 8 GW by 2030, according Energy storage among key strategies for renewable integration in India. (This article is publicly available here.)

Learn more about our global power and renewables research.

Qingyang Liu is a research analyst for the Global Power and Renewables team at S&P Global Commodity Insights.

Posted on 31 January 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.