Walking the tightrope of the Brazilian offshore wind development

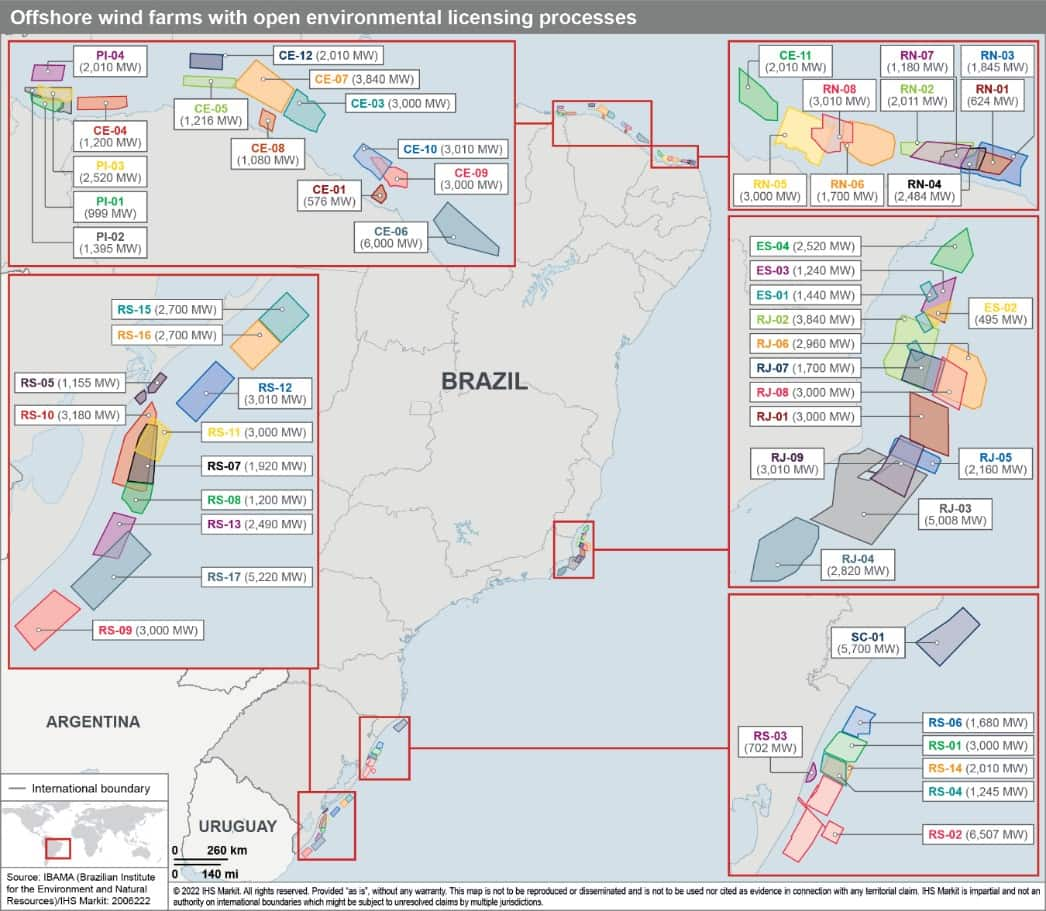

With nearly 7,500 km of coastline and significant offshore wind resources delivering capacity factors over 60%, Brazil has the potential to become a key global offshore wind benchmark, attracting large renewables developers and major oil and gas companies that can offset their carbon footprint. A growing interest in offshore wind has led to a surge in environmental license requests, totaling over 176 GW in requests for an average capacity of 2.7 GW per project.

Despite general optimism, offshore wind is one of the most capital-intensive and technically complex technologies among renewable energy alternatives in the future Brazilian power generation portfolio. The largest under development 15 MW offshore wind turbine, which is expected to be commercially available in 2025, will have three 115 m long blades weighing nearly 65 tonnes, more than the weight of a modern heavy battle tank. With a swept area exceeding 40,000 m2, one such wind turbine is capable of generating enough electricity to power 20,000 homes. The installation of these giant units is particularly challenging, as the nacelles must be lifted over 150m to be mounted on masts in extreme weather conditions. Considering that each blade (of a tan's weight) has a tip speed superior to 350 km/h, and can be subjected to winds above 70 km/h (20 m/s) is possible to conceive the huge challenge of designing and building such a machine.

Brazil's onshore wind market is well-developed, but the supply chain is relatively limited to a few companies, with a single national turbine supplier with a small market share. The local supply chain also includes a few blade manufacturing facilities, suppliers of specific components for the wind turbines, and wind tower manufacturers. The expectations around the jump-start of a comprehensive supply chain for offshore wind, including offshore foundations and installation, remain challenging to reconcile with the onshore wind experience. Let's throw a glimpse of light on this subject.

The monopile is the cheapest and unanimously chosen foundation choice for the low water depths in the regions under licensing. This hollow cylindrical structure nowadays can exceed 3,000 tons, is heavier than a large FPSO processing module, be as long as a soccer field, and have the diameter of the field's central circle.

The manufacturing of this heavy structure starts with special rolling machines that transform plain steel tick plates into cylindrical rings that are welded together. The wider and longer the steel plate, the better, because less welding will be required. There are no places in Brazil able to roll plates, as tick as used in large monopiles, into such large diameter rings and weld them together. Furthermore, the local best steelmakers cannot make tick plates in dimensions as big as their international peers, which means more welding and manhours for construction. Investments in new monopile factories recently build suggest a payback of the investment, considering customary international financing conditions, profit margins, and infrastructure, after the construction of about 1,000 foundations. With the demand projected for Brazil alone, a single local factory supplying all projects will not pay itself before 2050.

The handling of such heavy pieces during manufacturing and later transportation and storage can easily cause damage by deformations. Thus, as close the construction site is to the offloading base, the better, which makes the Brazilian construction yards and ports the best candidates for installing new factories. But as those investments will be long term and after the oil downturn together the 2015 corruption mitigation measures in Petrobras have thrown several local yards near bankruptcy the battered Brazilian industrials got high-risk aversion.

After the manufacturing, the installation of such huge structures in the sea requires lifting vessels with large crane capacity and a Thor's-like hammer, and there are just a few in the world with busy schedules. For the turbine erection, the direct way is to hire one of the few offshore purpose-built wind turbine installation vessels. With a very large deck area, they can accommodate several wind turbines on each trip. Can be used instead, several combinations of crane barges or jack-up barges, cargo barges, several tugboats or OSVs, and an AHTS. These kinds of vessels are more available but have a much larger weather downtime, time spent in port operations, and logistic needs, which can increase threefold the turbine installation time without making it any cheaper.

But someone can argue that instead of using the cheaper and most efficient technological choice, local developers decide to use jackets to shorten the development cycle or to increase local content. They are lighter in weight and use more of the regular grades of steel (which can be sourced from Brazilian suppliers) and can be built in any existing offshore construction yard or shipyard. Jackets, however, are labor-intensive for construction and demand complex sea installation. Design comparisons show that for water depth below 40 m, the option for jackets can increase the LCOE significantly. Maybe worse is that a regularly sized monopile factory can deliver 200 complete foundations per year, while all Brazilian construction yards together cannot match this output of jackets. The wind farm developers will be forced to hire several different yards simultaneously and wait longer, overstretching their ability to carefully manage the EPC and sacrificing scale savings.

Offshore installation management can be one of the few beneficial synergies with the oil and gas supply chain. The average wind project under licensing will require 110 wind turbines, with the handling of almost 600 thousand tons of material (the weight of the topsides of 13 large pre-salt FPSOs). While one vessel will be installing a foundation, nearby there will be others installing the nacelle, at the side of the other putting the blades. At a short distance, a cable lay vessel will be handling hundreds of km of electric cables between the machines. Up to 10 vessels can be working inside a 2 km edge square area with other smaller supply and tugboats hurrying up between them. All materials and people must be in place with perfect timing to avoid vessels and crews IDLE but charging expensive day rates anyway. Petrobras with its contractors have mastered the planning and logistics of large offshore works and their expertise would be fundamental to the success of the first projects.

Because the Brazilian industry is not well suited to wind offshore, adapting the projects to satisfy local content ambitions right away is risky. The adoption of local content policies can be a double-edged sword, as it could create new jobs, but also limit the market's ability to take advantage of the most efficient and cost-effective power supply options already available in the country.

Considering the challenges faced by the offshore wind technology in the country, S&P Global Commodity Insights forecasts 15 GW of capacity additions in the next decades, driven mainly by new policies that aim to support projects through dedicated auctions for the power sector and also new initiatives to promote the development of a green hydrogen market.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.