Five key questions for national oil companies in 2023

National oil companies (NOCs) comprise a range of petroleum resource holders and resource seekers. This group features companies with significant resources at home and other companies that must pursue these resources abroad to meet domestic oil and gas demand. Within this peer group, the one thing that NOCs have in common is state ownership. The 25 NOCs that fall under the coverage of S&P Global Commodity Insights differ in terms of their proved reserves base, production capacity, economic importance to the state, contributions to domestic budgets, and autonomy from their host governments. In a recently published report, we presented five key questions for NOCs that will guide their strategies as well as our research agenda for 2023.

1. Is geographic portfolio concentration a risk or a safeguard? Most NOCs are national in nature, with a high concentration of their reserves and production located within their borders. Dominance at home—where the company operates most of its country's oil and gas reserves—gives that NOC added leverage relative to peers. However, this also tends to come with more responsibilities, including extra taxes, local employment obligations, and a requirement to subsidize energy prices. For NOCs based in resource-deprived countries, they could face pressure from the state to venture abroad to satisfy domestic energy needs.

2. Do reserves-to-production (R/P) ratios still matter? For decades, R/P ratios have been used as an important industry metric for measuring a company's ability to sustain its current performance and grow its business. For NOCs with high ratios, untapped oil and gas reserves were viewed as the company's "bank" for the future. However, with governments and NOCs seeking to reduce their carbon footprints to combat climate change, a higher ratio is no longer a measure of long-term success but could indicate which NOCs could get stuck with stranded assets that do not get developed and remain underground.

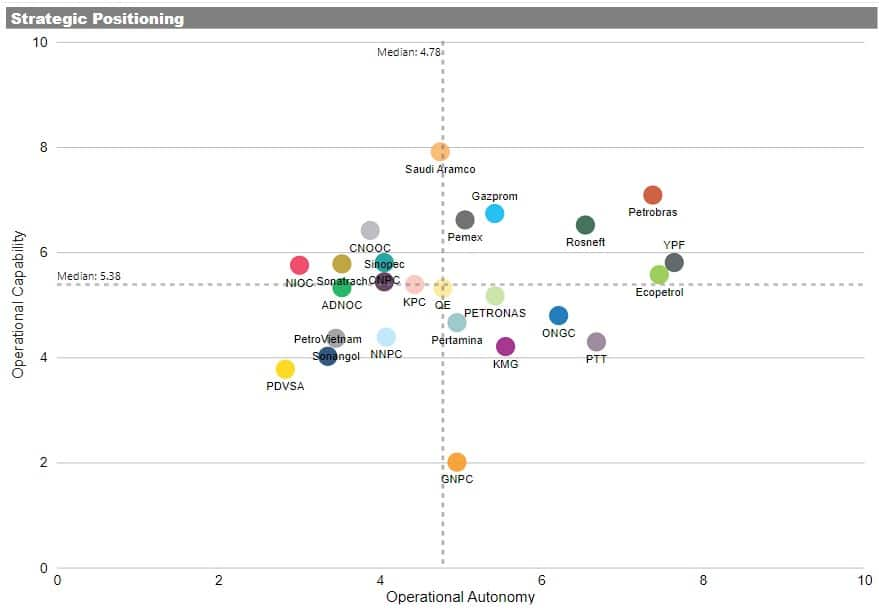

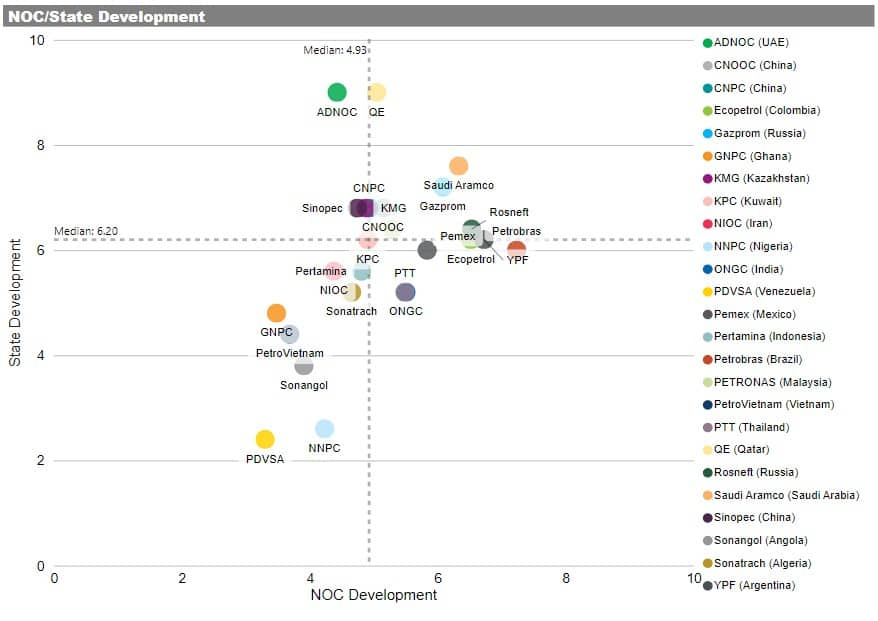

3. With accelerated monetization now a primary goal, where are the partnership opportunities? Growing concerns about climate change are prompting governments to accelerate resource monetization. In this regard, operational capability will be a key determinant of each NOC's ability to strike the balance between petroleum monetization and climate protection. NOCs with higher operational capabilities will have more scope to operate oil and gas projects successfully on their own while those with fewer operational capabilities will be more reliant on external partners and investor friendly domestic conditions to monetize resources.

4. Will NOCs take a more definitive step into the low-carbon sector? Many NOCs have a state mandate to focus on the domestic petroleum sector or go abroad in the event that resources at home are scarce. Yet, as climate concerns have moved to the forefront, some governments are tasking NOCs with new responsibilities to invest in alternative, low-carbon energy sources. While exploration and production are likely to remain their core function, some NOCs are taking steps to invest in other energy sources as a part of strategic diversification. This pressure can be more acute for resource-strained NOCs or those who have a higher share of external financing.

5. What are NOCs doing to green their operations? Even those NOCs that are determined to keep their focus on the petroleum sector are having to adapt to new realities as pressure grows for them to address climate change. NOCs are increasingly taking steps to decarbonize their existing activities and ensure that they maintain "social license" to operate in the oil and gas sphere. This includes significant investments to "green" their operations, from reducing carbon intensity from production, to cutting methane emissions, to electrifying offshore operations—all of which improve operational efficiencies and reduce carbon footprints.

Material for this post is taken from the full report, entitled "Five key questions for national oil companies in 2023", which is available to clients of S&P Global Commodity Insights—Upstream Companies & Transactions. The report contains an in-depth analysis of these questions, additional graphics, as well as region-specific insights.

For an in-depth assessment of financial and operational capabilities across the 25 NOCs in our coverage, see the S&P Global Commodity Insights NOC Benchmarking Tool. For an in-depth operational assessment of reserves, exploration, and strategic partners across the 25 NOCs in our coverage, see the S&P Global Commodity Insights NOC Operations Dashboard. These dashboards are only available to clients of S&P Global Commodity Insights—Upstream Companies & Transactions.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.