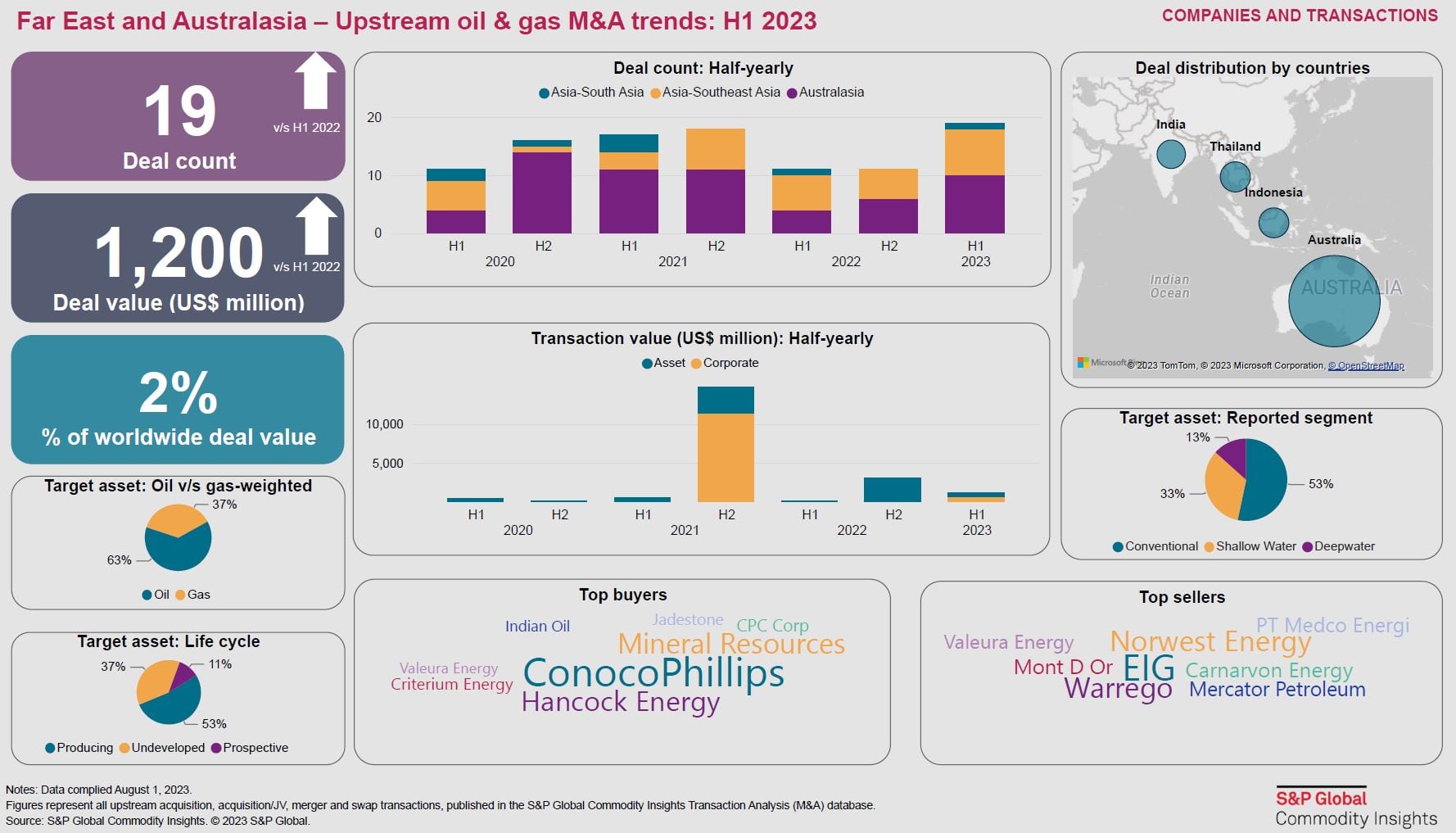

Far East and Australasia – Upstream oil & gas M&A trends: H1 2023

In the first half of 2023, there has been a surge in upstream oil & gas M&A activity in the Far East and Australasia region. This surge is primarily attributed to companies' increasing interest in acquiring low-carbon gas assets as the energy transition accelerates. Major energy companies such as BP, Shell, TotalEnergies, and ConocoPhillips have been actively realigning their LNG portfolios in the region, where they acted as both buyers and sellers. Eni's recent acquisition of Neptune's global upstream portfolio, which includes gas and LNG assets in Indonesia and Australia, supports the company's target to increase the share of gas production to 60% by 2030. Current elevated commodity prices, consolidation of gas assets, and the entry of new players with aggressive M&A strategies are expected to sustain the regional deal flow.

Learn more about our research and insight capabilities through our Companies & Transactions Service.

***

Want to learn more on this topic and access similar reports? Try free access to the Upstream Demo Hub to explore selected energy research, analysis, and insights, in one integrated platform.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.