Guyana’s updated fiscal terms could lead to reduced yet competitive returns

Guyana, from stagnant to world-class in record time

In 2015, after holding the Stabroek block for over a decade, ExxonMobil discovered the giant Liza field which would later trigger a large exploratory campaign that resulted in more than 30 successful discoveries. These discoveries add up to a substantial 7 Billion boe (barrels of oil equivalent) of hydrocarbons in place, according to S&P Global EDIN database.

Exploration success increased significantly in 2022 with a total of 10 discoveries, 9 of which were made in the Stabroek Area by ExxonMobil and partners. The first commercial discovery outside the Stabroek Area was made in the Corentyne block, the Kawa 1, by CGX Energy and partner.

Four years after discovery, the Liza project came online through the floating, production, storage, and offloading (FPSO) vessel, Liza Destiny. This represented a major milestone for the country and has attracted the attention of other operators interested in business opportunities in the novel oil province. In 2022, a second FPSO began operations, boosting daily oil production rates to over 390,000 bo/d, as per Guyana's Ministry of Natural Resources (MNR) reporting. Production is expected to increase in the near future with four additional FPSOs operated by ExxonMobil in the Stabroek Area.

Betting on the anticipated success of the Guyana basin, the government launched the First Licensing Round for Offshore Oil and Gas Exploration and Production in December 2022. A total of 14 blocks were offered, 11 in shallow water and 3 remaining in ultra-deepwater. Blocks range in size from 1,000 to 3,000 sq km and are open to qualified local companies and international oil companies (IOCs) for bidding. The competitive bidding round process was expected to close with the submission of bids on 14th April 2023. However this process has been postponed as the government is yet to finalize the petroleum activities' bill needed prior to announcing contract awards.

Fiscal comparisons against other Latin American players

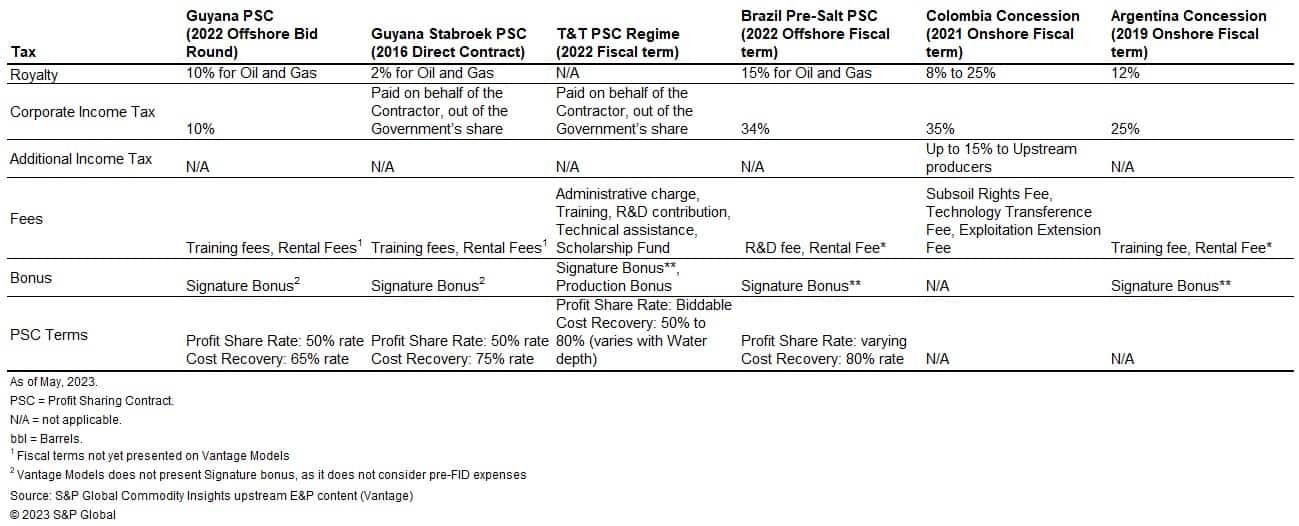

The 'in draft' Guyana fiscal regime[1] features terms that are similar to its Latin American peers. Namely the introduction of corporate income tax payable by investors and royalty rates more in line with the region's major producers.

Even though the new Guyana Bid round terms are less attractive when compared to Stabroek Contract terms, the new fiscal regime does not include additional income taxes, like the one recently introduced by Colombia, or add new fees.

Overall, Guyana managed to maintain its attractiveness in the region compared to other Profit Sharing Contracts (PSC) although now it is slightly less attractive compared to the Trinidad and Tobago PSC.

Summary of fiscal terms from major Latin American O&G

producers

Economic valuation of a hypothetical project under new fiscal model proposal

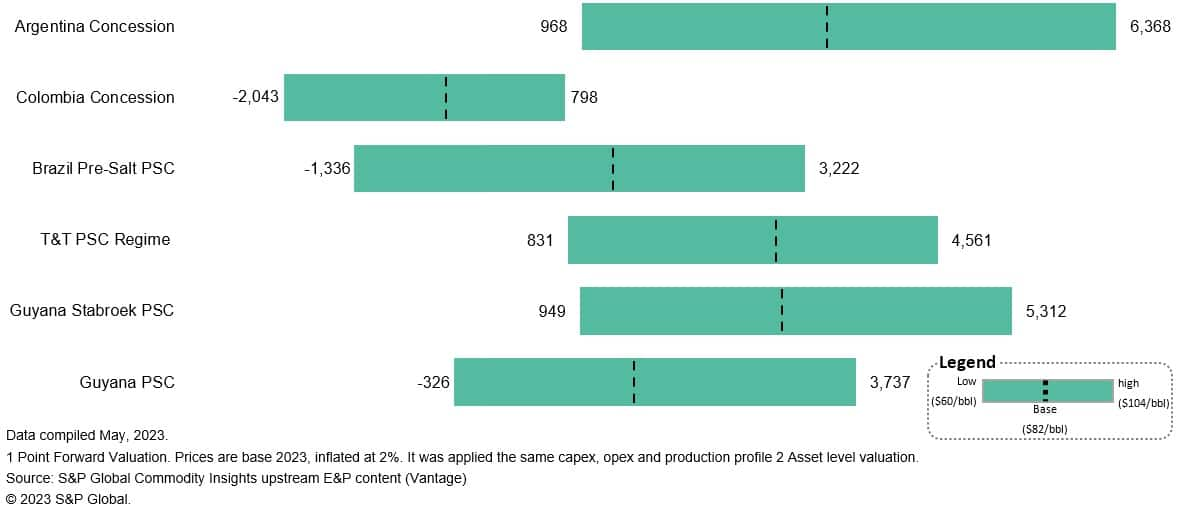

To showcase the impact of Guyana's proposed fiscal terms, a hypothetical project was assessed using fiscal terms from various countries in Latin America. In this analysis, the after-tax net present value (AT NPV) was analyzed at different oil prices, based on S&P Global Vantage's three oil price scenarios of USD 60/bbl, USD 82/bbl and USD 104/bbl (real terms 2023), adjusted for oil quality and escalated at 2% every year. The total cost considered was USD 54/boe (USD 27/boe for development costs) in nominal terms for a 500 MMboe sized asset.

The previous 2016 Stabroek fiscal terms are undoubtedly beneficial to international oil companies (IOC), opening the opportunity for foreign investors to an attractive landscape for exploration and appraisal of the undeveloped offshore Guyana basin.

Now that potential has been proven and production is already being marketed, the government is looking to improve its revenue by offering an updated PSA model for future blocks where higher taxes are paid and government take is increased by approximately 10%.

Ater Tax NPV @ 10% of hypothetical project per country

The Guyana Stabroek contract term is among one of the most competitive Profit Sharing Contract arrangements in the region, due in part to low royalty rates and no income tax payable. Although the proposed terms would represent a reduction in AT NPV of 36% at a base oil price, the hypothetical project remains competitive when compared to other fiscal terms analyzed in the region.

The relatively high-cost profile, especially on the capex side, can have a material impact in a low-price scenario, as seen in the low case where most PSCs returns become negative, including the Guyana new fiscal terms, as it reduces the Profit Oil/Gas earning potential in the early stages of the development.

These results could vary once the definitive version of the model contracts are released.

[1] Pending updates on the Petroleum Act and Amendment of Corporate Tax Act.

Solutions

For more information regarding well, field & basin summaries, please refer to EDIN

For more information regarding asset evaluation, portfolio view, fiscal terms, and production forecasts, please refer to Vantage

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.