FERC’s proposed interconnection reforms provide hope for growing renewable project backlog

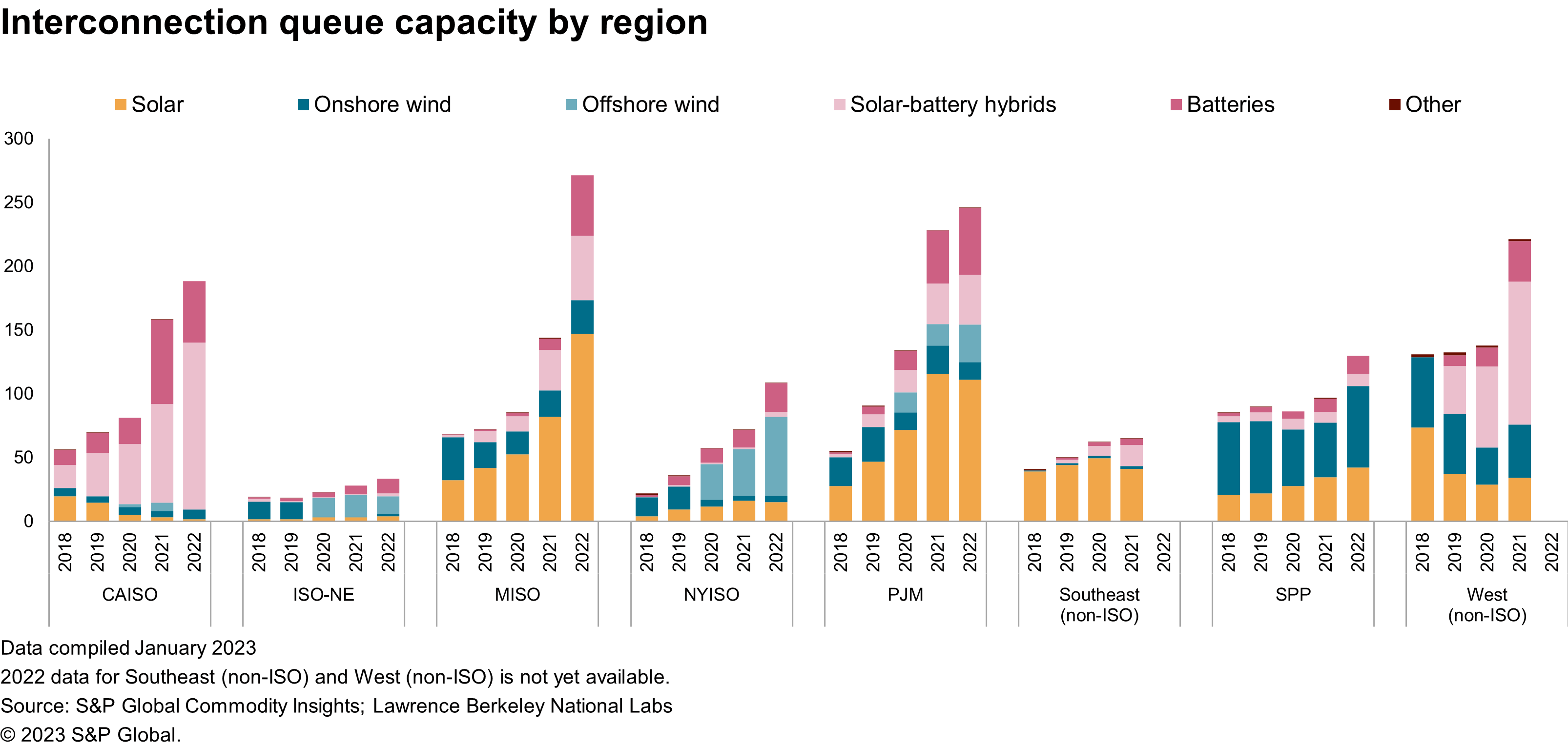

Interconnection queues across the United States are facing a growing backlog of requests as transmission providers struggle with the throughput of existing projects in the queue, coupled with the sheer volume of new renewable projects entering the queue seeking to interconnect. The backlog has grown sharply in the past few years and could get worse as new tax credits for renewables in the Inflation Reduction Act further energize the market for clean energy. In a bid to improve processes and alleviate the backlog, the Federal Energy Regulatory Commission (FERC) issued a Notice of Proposed Rulemaking (NOPR) on interconnection queue reform in June 2022.

FERC's proposals in the NOPR fall into four buckets: the implementation of a "first-ready, first-served cluster study process," process changes aimed at increasing project throughput, financial levers to spur accountability and performance improvements, and reforms to account for technology advancements. While the level of support varies for individual proposals, stakeholders generally agree that the current process is ready for a change and have provided constructive and creative feedback to the NOPR.

One of FERC's headliner changes is the transition to a "first-ready, first-served" cluster study approach from a "first-come, first-served" serial approach in use today. The shift would prioritize study order based on project readiness rather than order of entry into the queue, and process projects in "clusters" to reduce the number of individual studies. Given that this approach is already widely viewed as an industry best practice and is in use today by several independent system operators (ISOs) and utilities, we expect this reform to go through.

A second major issue that FERC seeks to address is reducing the number of "speculative" projects that enter the queue. Partially driven by developers submitting multiple interconnection proposals to find the least cost location to interconnect and supported by the relatively low cost of filing, these "speculative" projects can clog the queue and trigger delays if they eventually drop out of the queue. FERC approaches the speculative project issue from a few different angles: increased commitments from developers and increased information access pre-queue, among others.

On the developer sides, FERC proposes increased financial commitments and proof of commercial readiness to enter and remain in the queue. Most stakeholders are in favor of increased financial commitments from developers, but it's less certain if we will see increased commercial readiness requirements implemented given strong opposition from developers and discourse on what constitutes as appropriate readiness.

On the transmission provider side, FERC proposes that more transmission capacity and congestion data be available to potential customers in advance of entering the queue. This could empower customers to estimate their project's system impacts before entering the queue. Though most stakeholders agreed in principle with supplying more information pre-queue, there is some pushback among transmission providers regarding customers' overreliance on the data, extra work of keeping the data current, and security threats. Despite these concerns, increased transmission information transparency appears likely in some form.

Other issues addressed by FERC, which we cover in depth in a recent report on the topic, include: the removal of the "reasonable efforts standard" and implementation firmer study deadlines for transmission providers, the standardization of affected systems studies, how to incorporate technological advancements into the study process, and updated cost sharing and allocation guidelines among interconnection customers.

An interconnection queue that can get viable renewable projects online quickly and efficiently is increasingly vital as the US trends towards decarbonization. The June 2022 NOPR represents one of several efforts by FERC to comprehensively reform the transmission planning, interconnection, and cost allocation processes to ready the grid for a future with more and more diverse types of resources. If reforms are implemented as we expect, the interconnection process will see major changes for both transmission providers and developers alike.

Learn more about our global power and renewables research.

Annie Gutierrez, research analyst, focuses on solar, storage, and western power market fundamentals as part of the Gas, Power, and Climate Solutions team at S&P Global Commodity Insights.

Sam Huntington, associate director with the Gas, Power, and Climate Solutions team at S&P Global Commodity Insights, focuses on energy storage and power market fundamentals.

Posted 24 March 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.