Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 28, 2023

Reshaping E&P Activity Areas in Italy – New Framework Explained

Hydrocarbon exploration in Italy began in the 1860s and thrived during the 20th century. Contrastingly, since the early 1990s, exploration activity sharply decreased with the last four exploratory wells drilled in 2017. Yet, despite this significant decline, the remaining hydrocarbon potential is believed to be substantial for the domestic market (2P remaining reserves of 1.5 billion barrels of oil and 3.8 trillion cubic feet of gas).

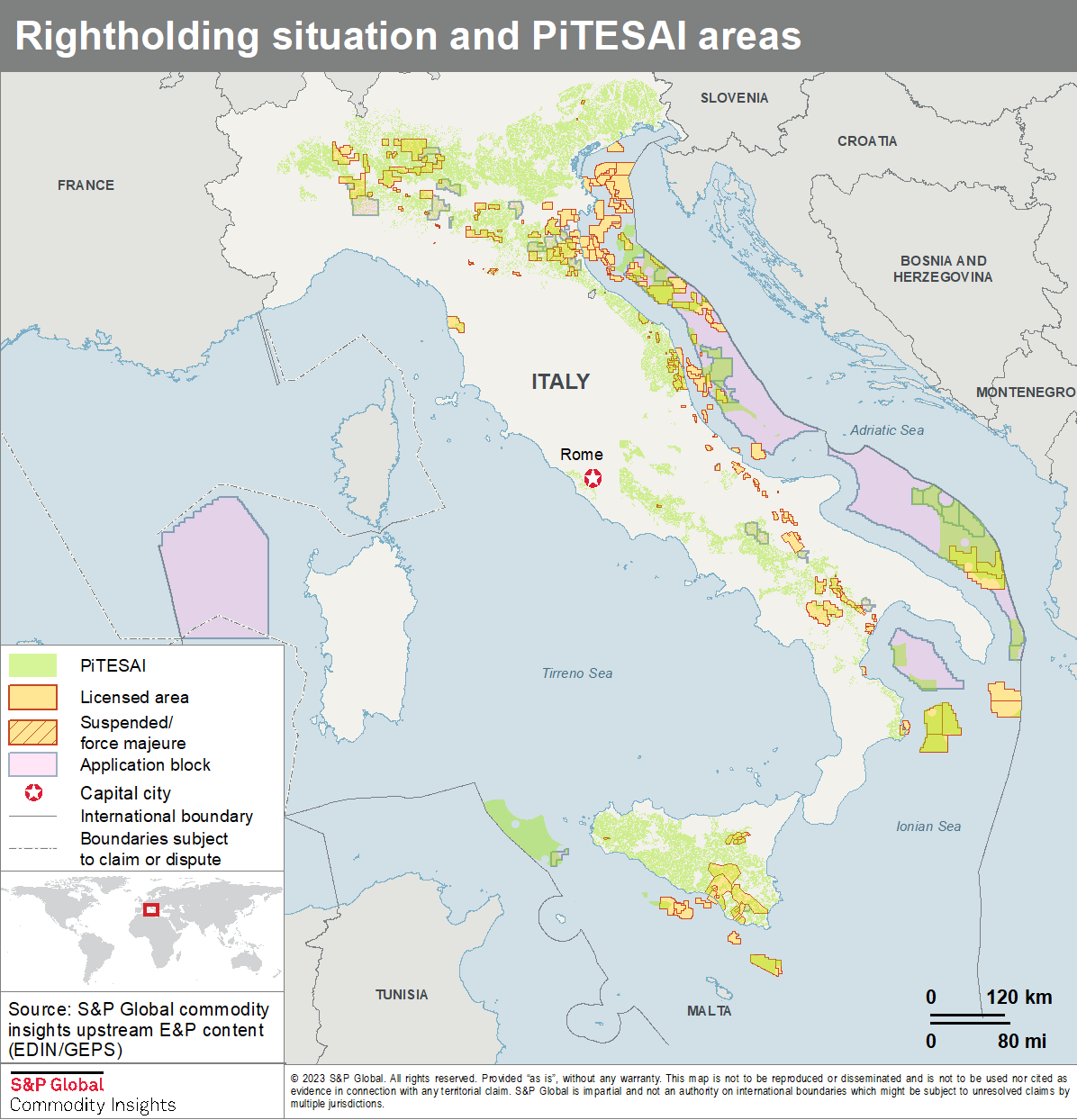

Notwithstanding this optimistic potential, profound policy changes juddered the petroleum industry in early 2019 when a moratorium on hydrocarbon prospection and exploration was introduced by the government. The moratorium was enacted to allocate the time needed to redefine the country's E&P activity areas. A plan formalized by a special-purpose law: Piano per laTransizione Energetica Sostenibile delle Aree Idonee or PiTESAI (Fig. 1) designed to comply with environmental and social sustainability goals and to reduce Italy's hydrocarbon footprint.

The proposed fiscal changes were approved, even though Italy is heavily reliant on natural gas to produce electricity. At present, the country supplies 10% of its gas demands while importing approximately 60 Bcm/annum. This reliance on imports has become a significant issue due to the current gas supply imbalance in Europe introduced by Russia's invasion of Ukraine in 2022.

PiTESAI

The moratorium was implemented by the government in February 2019 for a period of up to 24 months. The legislative change halted the procedures for granting new exploration permits and exploration activity on the existing permits.

During this time, the government enacted a series of regulations affecting the key legal aspects of the hydrocarbon market resulting in the publication of the new zones suitable for E&P activity. In the operational sense, the government completely redrafted the country's E&P areas applying a set of criteria that involved licensing history, previous successful hydrocarbon operations, existing limitations offshore (e.g., 12-nautical mile rule), geological (substantial hydrocarbon potential), administrative, environmental, social, and economic benchmarks affecting all valid contracts.

By drafting the new areas suitable for future E&P activities (PiTESAI), the government was required to accommodate the country's contractual criteria for both, the existing and future activity. The newly designated areas have practical implications on the processing of the existing and future applications, contracts, and E&P activities.

These new regulations came into force following the lifting of the extended 36 months-moratorium on all prospection and exploration of hydrocarbons in February 2022.

Effects of the PiTESAI

As drafted, the PiTESAI affected most of the country's 58 exploration permits, 88 exploration permit applications, and 178 exploitation concessions valid in early 2022. Based on the new regulations, it is expected that 60% of the area covered by valid permits will no longer comply with the PiTESAI stipulations. Furthermore, over 90% of the applications will likely be affected, namely the ones in the Adriatic Sea located mostly outside of the PiTESAI area (Fig. 1).

It is possible that the government will cancel the 21 exploration permits located outside and several others partially within the PiTESAI area since the operators may not be interested in retaining them due to the area being geologically compromised. Regarding concessions, even prior to the installation of the PiTESAI, due to the hike in concession fees in mid-2019, the operators started requesting area reductions of production concessions to reduce costs.

Current Situation

Even though energy self-sufficiency may not be possible through the exploitation of fossil fuels alone, Italy could reduce its dependence on imports if it prioritizes its gas resources. In September 2022, the Association of Companies Active in the Natural Sector or Assorisorse published a study showcasing the essential role of domestic gas exploitation in the country. If production is optimized and the development of new projects is fast-tracked, Italy could potentially double its domestic production by 2025. However, this increase of production requires modifications to the PiTESAI regulations that currently prevent the development of numerous projects (e.g., North Adriatic gas discoveries). If the government fails to modify the existing conditions of the PiTESAI, it is predicted that gas production in Italy will decline to less than 1 Bcm by 2027 with the possibility of coming to an end in the early 2030's.

Outlook for the Future

The newly installed government led by Georgia Meloni faces major challenges ahead - how to deal with the current energy crisis and how to effectively adjust the PiTESAI. The plan drafted by the bloc involves the increase of renewable and nuclear energy generating capacities while intensifying exploitation of existing gas reserves. Therefore, the Adriatic region has now been included in the plan to double domestic production to 6 Bcm/annum. However, as the opposition to fossil fuels within the parliament remains high, it is difficult to speculate if these initiatives will move forward.

Unless significant adjustments are made to the PiTESAI, exploration and production activity in the country will continue to decline and dependence on imports will increase. A sustainable energy industry could be achieved if Italy prioritizes the exploitation of its natural resources, increases the share of renewable energy in the energy-generating mix, and diversifies energy imports. The role of natural gas should not be undermined as it assists to reach energy security, decrease dependence on third party countries, and transition to carbon neutrality.

Figure 1.- Map of Italy

displaying PiTESAI areas and the contractual situation of the

country as of February 2022 (enactment of the PiTESAI).

Figure 1.- Map of Italy

displaying PiTESAI areas and the contractual situation of the

country as of February 2022 (enactment of the PiTESAI).

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2freshaping-ep-activity-areas-in-italy-new-framework-explained.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2freshaping-ep-activity-areas-in-italy-new-framework-explained.html&text=Reshaping+E%26P+Activity+Areas+in+Italy+%e2%80%93+New+Framework+Explained+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2freshaping-ep-activity-areas-in-italy-new-framework-explained.html","enabled":true},{"name":"email","url":"?subject=Reshaping E&P Activity Areas in Italy – New Framework Explained | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2freshaping-ep-activity-areas-in-italy-new-framework-explained.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Reshaping+E%26P+Activity+Areas+in+Italy+%e2%80%93+New+Framework+Explained+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2freshaping-ep-activity-areas-in-italy-new-framework-explained.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}