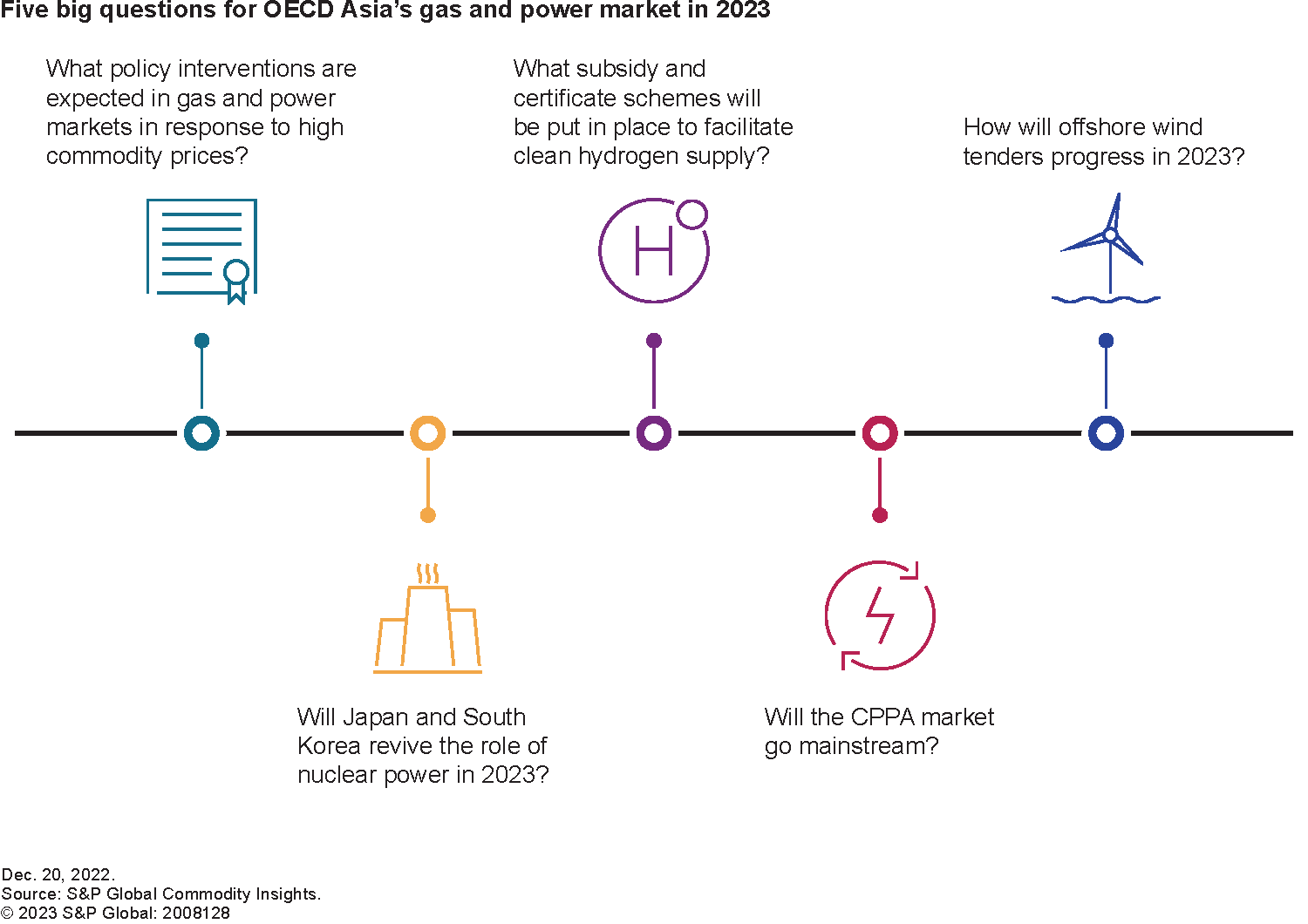

Five big questions for OECD Asia’s gas and power market in 2023

The year 2022 was full of unexpected market events in the already tight energy market, triggered by the war in Ukraine. Soaring import fuel prices drove up wholesale gas and power prices in many Asian markets to unprecedented levels, which in turn prompted utilities and retailers to mull a steeper hike in retail tariffs to protect their bottom lines. Emergency measures such as a wholesale electricity price cap had to be taken to protect those hit by rising fuel prices.

All these events were unthinkable—the extent to which global energy supply crunch would have such far-reaching ramifications across the energy system was unforeseeable at the beginning of 2022. Will there be more energy market disruptions in 2023? Will the energy transition, which had to take a back seat, be back on the agenda?

As we enter 2023, the S&P Global Asia Gas, Power, and

Climate Solutions team lays out five big questions that are

expected to shape the discussions around the gas and power market

in Australia, Japan, and South Korea.

What policy interventions are expected in gas and power markets in response to high commodity prices?

Many countries have experienced unprecedented policy interventions in gas and power markets since 2022. A price cap on wholesale power prices, loosening of restrictions on raising retail power tariffs, export restrictions on spot LNG, and so on—all these measures were out of the question just three years ago, but now stand at the center of policy discussions. With the current supply crunch expected to persist for a few more years, and the end of the war in Ukraine nowhere in sight, S&P Global Commodity Insights expects crude oil price and LNG price to remain elevated in 2023. The Brent price could remain close to $100/bbl, more than double the 2020 level, while the Asia LNG spot price is forecast to stay elevated than the pre-pandemic level. These high commodity prices may continue to weigh on gas and electricity consumers in 2023, while incentivizing exporters to capitalize on the high premium in the international market at the expense of domestic consumers.

Will the elevated fuel prices spur governments to take extra measures in 2023 to improve energy security and ease the financial burdens of utilities, retailers, and consumers?

Will Japan and South Korea revive the role of nuclear power in 2023?

Following years of debate over the contentious issue of its safety, nuclear energy made a dramatic comeback in Japan and South Korea. Japan is looking into restart seven reactors from the summer of 2023 onward, extending the economic life of existing plants after the government halted operation of all nuclear plants following the Fukushima nuclear disaster in 2011. The administration of South Korea's new president Yoon Suk-yeol reversed the previous administration's nuclear phaseout plan and plans to add two nuclear reactors (2.8 GW) in addition to three under construction (4.2 GW). Prioritizing nuclear energy could bring about far-reaching benefits to the energy market; LNG and coal import will be reduced, which could bring down the wholesale power price and alleviate the government's burden of raising retail tariffs. Moreover, nuclear energy as almost emissions-free source could help countries to curb their emissions, as Japan and South Korea are under pressure to achieve their NDC commitments.

As high fuel import prices continue to weigh on the economy, will the pro-nuclear policies contribute to energy security, affordability, and sustainability in 2023 as expected?

What subsidy and certificate schemes will be put in place to facilitate clean hydrogen supply?

Hydrogen stands at the center for hitting the net-zero target in Japan and South Korea. Both countries combined have the potential to make up 10% of the world's hydrogen consumption in 2050 based on S&P Global Commodity Insights forecasts, with 70-90% of hydrogen imported from other markets where it can be produced at a lower cost. Australia, on the other hand, is set to become a major clean hydrogen export hub, thanks to its cost competitiveness in solar and wind power generation, hydrogen technologies, land availability, and their proximity to demand centers in Asia. Nevertheless, the current delivered cost of clean hydrogen remains at a significant premium to that of grey hydrogen, causing concerns over whether the massive investment needed to build a global hydrogen value chain could be attracted at scale.

To expedite the pace of hydrogen economy development, a colossal amount of subsidies for hydrogen supply as well as the certificate scheme that defines a type of clean hydrogen will be needed. Most importantly, exporters and importers need a common framework that tracks and verifies carbon content of hydrogen being traded, so that only those within the given emissions threshold are actively promoted. Will we see more regulatory development coordinated across markets to boost production and consumption of clean hydrogen in 2023?

Will the CPPA market go mainstream?

The CPPA market gained momentum in 2022, and two-thirds of companies that announced 100% renewable targets are headquartered in Asia Pacific. Japan and South Korea now rank second and fourth place, respectively, among global RE100 members in terms of headquarter location. In terms of the market size in OECD Asia, Australia is the leading the way with more than 1,900 MW new contracted capacity signed for clean energy procurement last year, followed by Japan with 450 MW solar and wind procurement contracts.

A few drivers underpin the recent growth of the CPPA market. Companies like Apple's call on their global supply chains to decarbonize by as early as 2030 are spurring more Asia-based suppliers to search for cleaner power options. Utilities and retailers also look to pass through skyrocketing fuel prices onto consumers by raising retail tariffs (both regulated rates and market-based tariff in the case of Australia), making CPPA more cost competitive. Nevertheless, a few challenges such as grid availability and permitting issues could undermine the availability of new renewables supply in 2023.

How will offshore wind tenders progress in 2023?

In OECD Asia, offshore wind is emerging as an alternative source that could decarbonize the power sector and contribute to achieving NDC targets. Japan and South Korea set an ambitious installation target of 10 GW and 12 GW by 2030, respectively, and have completed initial rounds of auctions to select the first generation of offshore wind projects. Australia's new prime minister Anthony Albanese has pledged to make Australia a "renewable superpower," supported by the declaration of the first offshore development zone in December 2022 with additional zones expected to be announced in 2023.

Despite increasing momentum in this nascent sector, the industry faces various challenges including supply chain constraints, rising supply costs, local content requirements, and lack of clear market design. Japan's first auction round in December 2021 was met with fierce criticism from foreign investors as consortiums led by Mitsubishi swept up all three projects offered, leading to a re-evaluation of the auction design. In South Korea's first auction round in November 2022, only one offshore wind project with 99 MW capacity—Jeonnam 1, jointly developed by Copenhagen Infrastructure Partners and SK E&S—was awarded, far short of the 1.5 GW of annual installation needed to meet the government's target.

As we head into 2023, the regulatory framework needed to foster supply chain and new rounds of offshore wind projects—bidder selection criteria, marine spatial planning, grid connection rules, and so on—will shape the prospect for this nascent industry.

For more information on this research and the service it comes from, please visit the Asia Pacific Regional Integrated Service page.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.