Asia-Pacific Regional Integrated Service Research Highlights: Fourth quarter 2023

In the fourth quarter of 2023, 19 new insight papers have been published in the S&P Global Commodity Insights Asia Pacific Integrated service, apart from the regular updated reports. This research highlight summarized the key impact papers and provided an overview the market signposts in Q4. A link to a select set of reports is provided below.

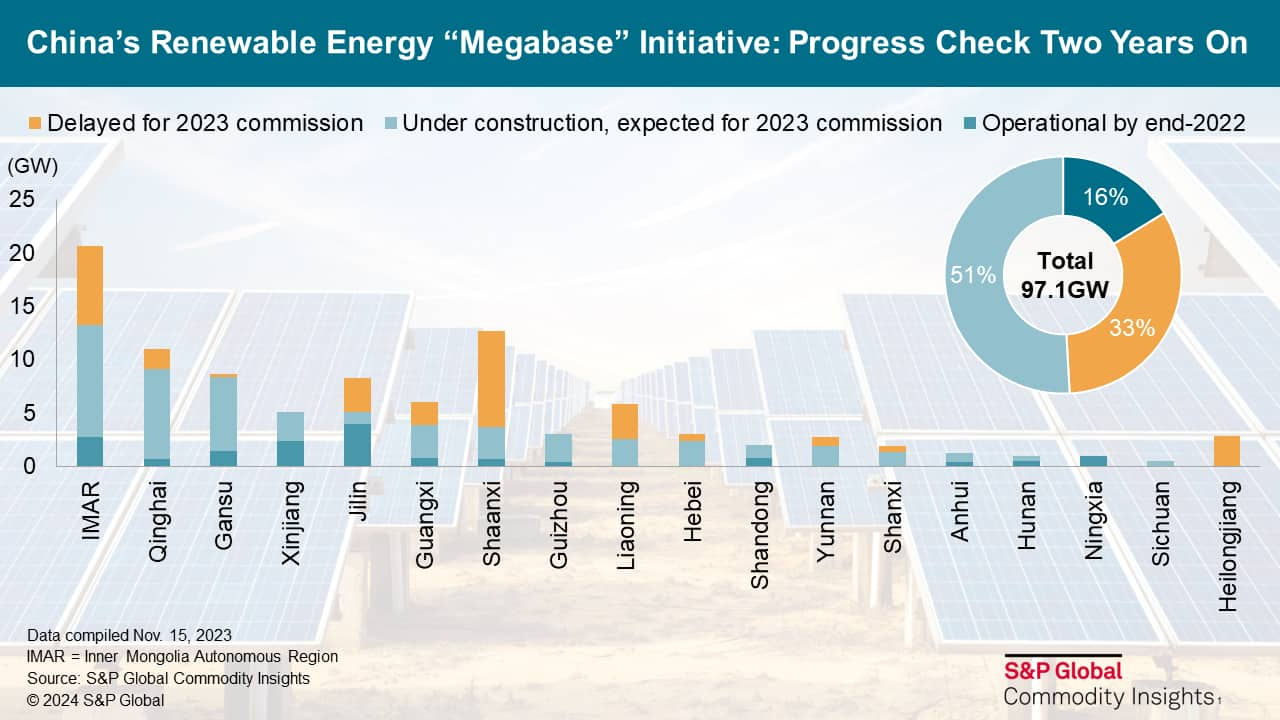

The graphic of the quarter is selected from "Renewable megabase development in China: 2 years after kickoff", showing progress of the 1st batch of these renewable projects in China.

Renewable megabase development in China: 2 years after kickoff

It has been two years since President Xi Jinping announced the development of about 100 GW of wind and solar to kick-start the national renewable megabase initiative in China. Two-thirds, or 65.3 GW, of the projects in the first batch can be grid commissioned within two years. The top-down planning mechanism favored such a development pace. Developers backed by state-owned enterprises (SOEs) contributed 45.8 GW, or 70% of the total expected capacity additions within the first two years of megabases development. Despite the coordinative efforts, roadblocks have delayed the remaining 32 GW of projects from the originally planned schedule.

At the same time, land-use disputes and related administrative approvals will rely on better top-down coordination as new batches of projects flux in. Transmission capacity issues, however, are expected to persist throughout the 14th Five-Year Plan period when new-build renewables far outpace transmission network development. There are 5.53 GW of projects that have obtained the necessary approvals but are too late to catch the end-2023 commission timeline; these are expected online in 2024.

Megabase new-build wind and solar can deliver more cost-competitive clean energy despite higher capital investments. In receiving-load regions such as Shandong, Henan, Hubei and Zhejiang, landing costs of solar or wind from megabases can be on average 16% or 10% cheaper, respectively, than local renewables new build, or 22% cheaper than local operating coal.

Read more here.

Japan's Hydrogen Strategy: Strategy overview and the latest on support schemes

Japan's Hydrogen Strategy, published in June 2023, shifts the focus from domestic consumption to industrial strategy through exporting hydrogen-related technologies. In December 2023, the Ministry of Economy, Trade and Industry (METI) provided more details on planned policy support with an interim draft for two support schemes, the price gap support scheme and the infrastructure build-out support scheme.

The strategy identifies nine areas where the global market size is significant, and Japan has a technological advantage. Technologies in these areas are underpinned by the government funded research.The strategy's demand targets are 3 million metric tons (MMt) in 2030, 12 MMt in 2040 and 20 MMt in 2050. Japan defines carbon intensity for "low-carbon" as a 70% emission reduction from natural gas.

A portion of the ¥20 trillion ($133 billion) Green Transformation bond will reward first-movers who supply hydrogen. An interim draft for the support schemes discussed in December 2023 clarified scope, eligibility, timeline and assessment criteria. Applications for the support scheme will open in the summer of 2024, with decisions to be made by the end of the year. The total package size was not revealed.

Indonesia's 'cap-and-trade-and-tax' carbon pricing scheme: A light touch on the power market

Indonesia has established a comprehensive carbon pricing framework as part of its key efforts to achieve climate ambitions. As the country's largest emission source, coal-fired power plants (CFPPs) are the natural priority and chief targets of carbon pricing initiatives.

Indonesia will charge CFPPs for their emissions through a hybrid "cap-and-trade-and-tax" mechanism, incorporating both the emissions trading scheme (ETS) and carbon taxes. CFPPs that emit above their caps will need to cover their excess emissions through emissions trading or paying taxes.

Indonesia's ETS is an intensity-based trading system that rewards higher efficiency. Trading will likely start in early 2024, first involving CFPPs connected to PT Perusahaan Listrik Negara (PLN) grids.

The carbon tax will essentially be a levy on excess emissions not settled through the ETS. Since the carbon tax rate is stipulated to be higher than or equivalent to the ETS allowance prices, CFPPs will always prefer to cover their excess emissions with cheaper ETS allowances before paying taxes. However, delays to the tax implementation will undermine the overall effectiveness of Indonesia's carbon pricing policies as the ETS by itself does not pose compliant requirements on CFPPs to fully settle their deficits within the ETS.

Moreover, the carbon pricing scheme will only leave a light touch on the power market. The relatively loose intensity caps, the multi-benchmark design and the delayed implementation of carbon taxes will only pose a minimal carbon cost burden on CFPPs. In addition, the regulated and subsidized nature of Indonesia's power market, coupled with contractual constraints of long-term power purchase agreements (PPAs), will limit the passthrough of carbon prices and hamper them from mobilizing wider structural change.

South Korean clean hydrogen auction plan: Updates from the KPX briefing session

On Nov. 29, 2023, the Korea Power Exchange (KPX) organized a public briefing session on the clean hydrogen auction market, sharing some changes to the draft clean hydrogen auction plan announced on March 28, 2023.

The KPX presented some changes in the auction design to cater to specific demands from the industry and clarified some operation rules. Although still at draft stage, some notable changes in the auction scheme include fuel cost indexation which will be allowed for clean hydrogen design during the initial stage (see slide 4 for more details). The introduction of fuel cost indexation, which was only available for general (unabated) hydrogen auction, aims to address concerns of potential bidders on price volatility and associated risk allocation between hydrogen/ammonia suppliers and buyers.

The maximum output of each power generator will be capped to align with the country's greenhouse gas emission reduction target in 2030. The portion of hydrogen electricity generation exceeding the maximum output will not be able to receive contract-for-difference (CFD) payment. Emissions intensity of gas-fired power plants with high-efficiency or historical emissions of each plant prior to clean hydrogen/ammonia blending is considered as a reference to set the maximum allowable emissions per plant.

Some requirements for winning bidders will be eased due to constraints on building infrastructure required to export and import hydrogen in a short time frame. For instance, the obligation to meet the annual production target will be exempted for up to one year after commercial operation, meaning that CFD payment will be made in the first year of operation regardless of whether the target is met.

India's leading renewable companies in 2023

India has more than 126 GW of renewable capacity installed by mid-2023 and the largest 10 companies constitute about a third of these operational assets. Adani Green Energy is the largest renewable asset developer as of June 2023 with 8,317 MW of operational assets closely followed by ReNew with 8,296 MW of online capacity. These two players alone constitute about 40% of the total assets of the top10 renewable developers.

India's largest 10 renewable developers own and operate about 42 GW of assets, of which majority 90% constitutes of solar photovoltaic (PV) and onshore wind. India has more than 126 GW of renewable capacity installed by mid-2023, and the largest 10 companies constitute about a third of these operational assets.

The total pipeline projects of the largest 10 companies constitute about 57% of the total renewable pipeline in India, indicating an increasing consolidation of capacity among large portfolio owners.

Majority of the leading independent power producers (IPPs) are of local origin. Overseas financial institutions are targeting corporate shareholding in these companies as a strategy to invest in renewable assets while keeping market and construction risk low.

Several IPPs have announced plans to set up energy storage projects and venture into manufacturing for solar PV to reduce supply risks, as well as green electricity and green hydrogen production for commercial and industrial (C&I) consumers.

Additional Insights and Strategic Reports published in fourth quarter 2023

- Asia-Pacific renewable corporate power purchase agreement — Q3 2023

- China's gas market in the 2023-24 winter season: Significant weather-driven heating demand variation

- Waking up to offshore wind in India

- China moves to zonal tariff for interprovincial gas transmission pipelines

- South Korea's thermal gap will shrink for H1 2024

- Vietnam leans on coal amid rapid power demand growth for October 2023

- Singapore's return of its gas aggregator model

- Eni's Indonesia gas discovery may be a catalyst to revive Bontang LNG production

If you are interested in learning more about our Asia-Pacific gas, power and renewables coverage, please click here.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.